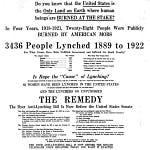

We have an important “this day in legal history” entry for today. On this day in 1954 the Supreme Court held, in Brown v. Board of Education, that racial segregation of children in public schools was unconstitutional. The case overturned the previous doctrine of “separate but equal” that had been established by Plessy v. Ferguson in 1896. The case was brought by Oliver Brown, whose daughter was denied entrance to a then-white school in Topeka, Kansas. The Court, led by Chief Justice Earl Warren, held that segregation violated the Equal Protection Clause of the Fourteenth Amendment, because separate facilities were inherently unequal. The decision paved the way for integration and was a major victory of the civil rights movement.

Briefly, without too much soapboxing, I think right thinking people everywhere would like to imagine the era of segregation as being a distant memory. An unfortunate period of history that is now so sufficiently obscured by time so as to render it devoid of the pain and damage it caused. It simply isn’t. I’m an “elder millennial,” whatever that means, born in 1985, 31 years after the decision in Brown was handed down. 31 years from 2023 was 1992 – the first Clinton administration. History it is, ancient history it is not.

The Internal Revenue Service (IRS) has submitted a report to Congress, as directed by the Inflation Reduction Act, evaluating the feasibility of a Direct File option for taxpayers. Direct File is a free, voluntary electronic filing system run by the IRS. The report concludes that many taxpayers are interested in using such a tool and that the IRS has the technical capability to deliver a Direct File program. However, it also highlights the need for sustained budget investment and careful management of the program's operational complexity.

The report focuses on taxpayer opinions, cost, and feasibility, and includes an analysis conducted by an independent third party. It outlines the potential benefits and challenges associated with implementing a Direct File program. IRS Commissioner Danny Werfel states that the agency is committed to improving services for taxpayers and acknowledges the interest in an optional Direct File program.

In response to the Treasury Department's directive, the IRS will initiate a scaled Direct File pilot in the 2024 filing season to gather further information. This pilot aims to assess customer support, technology needs, and overcome potential operational challenges identified in the report. Specific details about the pilot will be announced in the future.

The IRS report relied on data from the agency's Taxpayer Experience Survey, which surveyed thousands of taxpayers, as well as an independent survey conducted by the MITRE Corporation. User research and usability testing using an internal prototype were also conducted to gain firsthand taxpayer perspectives. The report includes a separate independent analysis by New America and Professor Ariel Jurow Kleiman on the Direct File concept.

The IRS is looking forward to engaging with stakeholders in the upcoming months to discuss this important topic. Commissioner Danny Werfel's letter to Treasury Secretary Janet Yellen, accompanying the Direct File report, can be accessed for further information.

HILL TAX BRIEFING: IRS Launching Pilot of Its Own E-File Program

New documents from the US Court of Appeals for the Federal Circuit reveal that Judge Pauline Newman, the court's oldest and longest-serving member, must release her medical records as part of an investigation into her fitness to remain on the bench. Concerns have been raised about observed changes in her behavior, including difficulties with basic tasks, paranoia about being hacked or spied on, and engaging in nonsensical conversations. The court staff reported her agitation and described her behavior as bizarre. Two of her staff members resigned and requested no further contact with her. Judge Newman also failed a mandatory security compliance training and made inaccurate statements about the court's leadership.

The Federal Circuit panel ordered Judge Newman to undergo evaluations by a neurologist and neuropsychologist. They demanded that she respond to the committee's examination request and release records of her mental acuity, attention, memory, and other related areas of treatment within 30 days. Judge Newman's request to transfer the judicial complaint to a different circuit was denied.

The New Civil Liberties Alliance is representing Judge Newman in her lawsuit. The NCLA is a public interest law firm ostensibly dedicated to fighting administrative state overreach. Prominent donors to the alliance include the surviving Koch brother, Charles Koch. Judge Newman's counsel has not yet responded to requests for comment.

‘Paranoid’ Incidents Necessitate Newman Exam, Fed. Cir. Says

Recent Supreme Court rulings have narrowed the scope of federal fraud statutes, raising concerns about ambiguity in their application. Over the past 15 years, decisions such as Skilling, McDonnell, Kelly, Percoco, and Ciminelli have rejected expansive interpretations of these laws. The court's concern is that prosecutors may use the statutes to impose federal ethical standards on state and local governments. Percoco v. United States limited the circumstances in which a private citizen might have a fiduciary duty to the public for "honest services" fraud, while Ciminelli v. United States rejected the "right-to-control" theory of wire fraud. These decisions are seen as steps toward limiting prosecutorial overreach.

However, despite these rulings, uncertainty remains regarding the potential applications of fraud statutes. Skilling narrowed the honest services wire fraud statute to bribery and kickback schemes, while McDonnell limited the definition of an "official act" subject to the law. Kelly held that political retribution schemes targeting toll lanes did not constitute wire and federal program fraud. Percoco and Ciminelli further refined the interpretation of the fraud statutes but left some issues unresolved.

Justice Neil M. Gorsuch, in a concurrence for Percoco, called on Congress to provide clarity in defining "honest services." The court expressed its responsibility in ensuring that the government does not exploit the statutes' broad reach. In Ciminelli, the court rejected the notion that "potentially valuable economic information" constitutes a traditional property interest under the wire fraud statute. The court highlighted that Congress did not explicitly include other intangible interests beyond "honest services" in the statutes.

Although the court has consistently narrowed the fraud statutes, many questions about their scope remain unanswered. Percoco and Ciminelli were fact-specific, and the definition of a traditional property interest has yet to be fully explored. The intent to inflict financial harm and the requirement of economic loss in property fraud cases are still being actively litigated in lower courts. The lack of clarity in the fraud statutes raises concerns about separation of powers, due process, and vagueness in their application. It is crucial that courts ensure that ordinary individuals have advance notice of what is prohibited under these criminal statutes. At the same time it is instructive to illustrate how even a concept such as fraud which at first blush may seem relatively straightforward can raise thorny legal questions.

SCOTUS Scales Back Fraud Statutes’ Reach, but Ambiguity Persists

Theranos founder Elizabeth Holmes and former CEO Ramesh "Sunny" Balwani have been ordered to pay $452 million in restitution to victims of the blood-testing startup's fraud. Holmes, who was convicted last year of misrepresenting Theranos' technology and finances, had also requested to remain out of prison while challenging her conviction but was denied by an appeals court. Judge Edward Davila, who oversaw Holmes' trial and sentencing, held both Holmes and Balwani equally responsible for the restitution amount, rejecting their argument that intervening events contributed to investors' losses. Holmes will now have to report to prison as a new date is set. Included among the investors that Holmes will need to make whole is none other than Rupert Murdoch – defrauding people is never defensible, but sometimes …

Theranos founder Holmes loses bid to stay out of prison, hit with huge restitution bill | Reuters

Law firm Proskauer Rose has been ordered by a Massachusetts judge to face trial in a $636 million legal malpractice case. The ruling by Suffolk County Superior Court Justice Kenneth Salinger allows a jury to determine whether the firm's alleged mishandling cost former client Robert Adelman his stake in a multi-billion dollar hedge fund. Adelman sued Proskauer in March 2020, claiming that attorneys from the firm included a provision in a partnership agreement that allowed the fund's manager to remove him. Adelman presented handwritten notes from a Proskauer partner that indicated a mistake in the agreement. Proskauer, represented by lawyers from Williams & Connolly, argued that it shouldn't be held responsible for the actions of Adelman's former colleague. The manager accused of ousting Adelman, is not involved in the lawsuit. A final pre-trial conference is scheduled for July 25.

Law firm Proskauer must face trial in $636 million legal malpractice case | Reuters

The Oakland Athletics baseball team is seeking to move to Las Vegas and is requesting hundreds of millions of dollars in taxpayer funds to finance the relocation. Critics argue that this is a bad tax deal for Las Vegas and Nevada, as it sets a precedent of using public money to benefit private sports team owners. Nevada's lower tax burden compared to California is cited as a positive aspect of the deal, but overall, there are few advantages. The Athletics have a relatively low payroll compared to other teams, so players would benefit little, comparatively, from the lack of income tax in Nevada. However, studies have shown that stadium building has limited positive economic effects, and the revenue generated from player salaries would not benefit Nevada due to the aforementioned absence of income tax. The revised funding plan reduces the amount sought from public funds, but it still puts a financial burden on taxpayers. Critics argue that public funding for sports stadiums would be better spent on projects that directly improve residents' quality of life. The deal also marks the end of the Oakland Coliseum, which is widely regarded as an unattractive venue by just about everyone save for perhaps the opossums that live in the walls.

Oakland A’s Move to Vegas Is Costly Gamble for Nevada Taxpayers