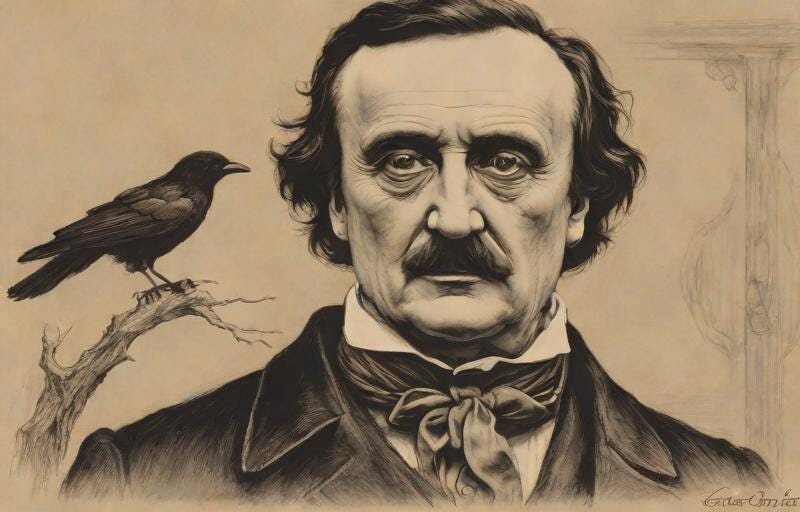

This Day in Legal History: The Raven is Published

On January 29, 1845, a significant event in literary history indirectly influenced the development of copyright law. Edgar Allan Poe's iconic poem, "The Raven," was published in the New York Evening Mirror. This moment, while primarily literary, holds substantial relevance in the context of copyright law and the protection of creative works.

"The Raven" quickly became a sensational hit, illustrating the immense commercial potential of literary works. However, Poe's financial gains from the poem were minimal, highlighting the inadequacies in the copyright system of the time. Poe's struggles with securing fair compensation for his works, including "The Raven," underscored the need for stronger legal protections for authors.

During Poe's era, copyright laws were still in their infancy, particularly in the United States. The lack of robust international copyright agreements meant that Poe's works were often republished abroad without his consent and without any royalties paid to him. This was a common plight for many authors of the time, leading to widespread calls for reform.

"The Raven's" popularity, coupled with Poe's public struggles for rightful earnings, played a role in stirring public and legislative awareness about the rights of authors. It highlighted the importance of legal frameworks that balance the interests of creators, publishers, and the public.

The plight of authors like Poe eventually contributed to the strengthening of copyright laws, both domestically and internationally. In the following decades, laws evolved to offer more comprehensive protection for intellectual property, ensuring that creators could reap the benefits of their work.

Significantly, Poe's experience foreshadowed the complexities of copyright in the age of mass reproduction and distribution. His challenges anticipated the modern dilemmas faced in a digital era where replication and dissemination of works are effortless and widespread.

In sum, while "The Raven" is primarily remembered as a masterpiece of poetry, its impact extends into the realm of legal history. Edgar Allan Poe's experiences with this poem contributed to the discourse on copyright law and the need for effective legal protections for intellectual property. His legacy, therefore, is not just literary, but also legal, underscoring the crucial relationship between creative works and the laws that safeguard them.

The U.S. Department of Justice (DOJ) is investigating the healthcare industry's use of AI in patient records, which influences doctors' treatment recommendations. This scrutiny arises from concerns about AI's role in potential anti-kickback and false claims violations. Investigators are probing pharmaceutical and digital health companies, examining the impact of AI on healthcare decisions. These investigations are still in early stages, with DOJ attorneys seeking information about AI algorithms and their effects on medical care.

The background of these probes can be traced to the 2020 criminal settlements with Purdue Pharma and Practice Fusion. They were penalized for creating AI-based alerts in electronic medical records (EMRs) that encouraged prescriptions of addictive painkillers. This case highlighted the risks of AI in healthcare, particularly when used unethically.

Current AI tools in healthcare can both improve diagnoses and be exploited for profit. DOJ's challenge lies in applying laws like the Anti-Kickback Statute and False Claims Act to AI's complex, automated nature. Prosecutors are exploring civil and criminal avenues, considering evidence like internal communications and the AI's impact on prescriptions. These investigations signal a growing focus on the legal responsibilities of companies using AI in healthcare.

DOJ’s Healthcare Probes of AI Tools Rooted in Purdue Pharma Case

Elite UK law firms, known as the Magic Circle, are losing the salary battle to US firms in London. These UK firms pay junior lawyers 35-40% less than the Cravath scale used by top US firms. UK firms' lower profits, due to increased competition and post-Brexit currency changes, hinder their ability to match US salaries. Since 2015, US firms have aggressively entered the UK market, especially in private equity work, often outbidding UK firms for talent. Kirkland & Ellis and Paul, Weiss are notable for hiring several partners in London.

This competition has led to about 370 associates leaving Magic Circle firms in the last year, with US firms benefiting. UK firms have responded by increasing associate salaries and introducing bonus schemes. However, they still struggle to close the pay gap with US firms. The Cravath scale, adopted by US firms in London, offers significantly higher salaries, with first-year associates earning around $225,000. The salary disparity and market conditions raise concerns about the sustainability of high associate salaries.

Elite UK Firms Are Losing London Salary Battle to US Invaders

Investors are concerned about Exxon Mobil's lawsuit against two shareholders for proposing a resolution on greenhouse gas emissions reduction, bypassing the U.S. Securities and Exchange Commission (SEC). Under Biden's SEC, it's become harder for companies to block shareholder resolutions, leading to a rise in such proposals. Exxon's lawsuit, which claims the resolution aims to diminish its fossil fuels business rather than increase shareholder value, is seen as potentially chilling for small investors. This action deviates from the norm where companies historically viewed the SEC as a fair arbiter for shareholder proposals.

The Exxon case is significant as it challenges the recent SEC policy change that makes it difficult for companies to argue against resolutions on the grounds of micromanagement. The number of shareholder resolutions has increased, with 889 proposals filed during the 2023 proxy season. If Exxon succeeds in court, it might encourage other companies to follow suit, bypassing the SEC.

This lawsuit comes amidst broader debates over the SEC's authority in enforcing shareholder proposals, with conservative courts possibly playing a role in the outcome. Exxon's approach is a departure from the standard practice of engaging with the SEC on such matters, and its success could reshape the landscape of shareholder activism, particularly in environmental and social governance issues.

Activist investors fret over Exxon Mobil's lawsuit bypassing US regulator | Reuters

Reddit Inc. is considering a valuation of at least $5 billion for its initial public offering (IPO), based on early feedback from potential investors. However, this figure is still tentative and dependent on the recovering IPO market. The social media company, known for its significant role in the meme-stock era, is potentially aiming for a listing as early as March. Despite these ambitions, private trades of Reddit's unlisted shares currently suggest a lower valuation, between $4.5 billion and $4.8 billion. These private share valuations, which are often lower due to their illiquidity, contrast with Reddit's peak valuation of $10 billion in 2021.

The fluctuating valuation reflects the broader downturn in the tech sector, where companies are valued lower in public markets compared to their peak private funding valuations. For instance, Instacart, once valued at $39 billion, debuted with a valuation of $9.9 billion and has since dropped to around $7.1 billion. Reddit's situation and potential IPO come at a time when tech IPOs are less lucrative than during the private funding boom of 2021. The company's decision and valuation are subject to ongoing deliberations and market conditions.

Reddit Advised to Target at Least $5 Billion Value in IPO (1)