This Day in Legal History: Republic of Ireland Act

On April 18, 1949, a significant transformation in Ireland's political and legal landscape occurred with the enactment of the Republic of Ireland Act. This pivotal legislation marked the culmination of Ireland's progressive move towards full sovereignty, severing the last formal ties with the British monarchy. Previously, the Executive Authority Act had designated the King of England as the head of state in Ireland, a symbolic vestige of the colonial relationship that had long influenced Irish governance.

The Republic of Ireland Act, passed by the Irish parliament, Dáil Éireann, in 1948, came into effect on Easter Monday, 1949, resonating symbolically with the 1916 Easter Rising, a key event in Ireland’s struggle for independence. By declaring Ireland a republic, the Act definitively removed the role of the British monarch in Irish affairs and also led to Ireland's exit from the British Commonwealth. This move was both a statement of national identity and a reflection of Ireland's desire for complete self-governance.

The Act also had profound implications for the legal system in Ireland. It entailed the establishment of a presidential office, replacing the governor-general, a representative of the crown. The first President of Ireland, Douglas Hyde, thus assumed a role that was more clearly defined in terms of national rather than imperial allegiance. Furthermore, the Act necessitated adjustments in the Irish constitution and prompted a series of legislative revisions to align national law with the newly affirmed republic status.

Internationally, the Republic of Ireland Act altered Ireland's position on the world stage, allowing it to establish and maintain foreign relations as a fully sovereign state. It represented a shift towards non-alignment and neutrality in international affairs, a stance that Ireland has maintained since.

The enactment of the Republic of Ireland Act was met with mixed reactions. While it was a moment of patriotic pride for many, symbolizing a definitive break from colonial rule, it also provoked concerns among unionists in Northern Ireland, exacerbating tensions that were already present.

Today, the Republic of Ireland Act remains a cornerstone of Irish constitutional law and a testament to Ireland's enduring commitment to self-determination and independence. Its anniversary serves as a reminder of the long and often tumultuous path to establishing a republic that stands as an equal on the international stage.

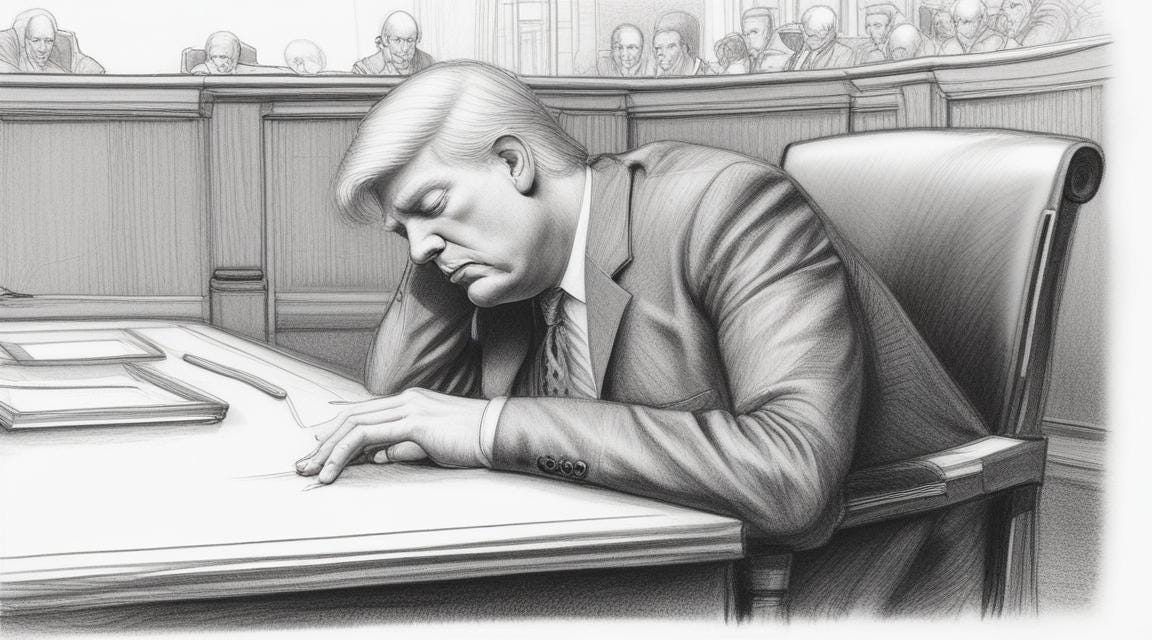

The criminal trial of former U.S. President Donald Trump in New York faced a significant development when a juror was excused after expressing feelings of intimidation due to her identity being partially exposed by the media. This incident highlights the intense scrutiny and pressures surrounding this high-profile case, which marks the first criminal trial of a former U.S. president. The judge, Justice Juan Merchan, took steps to protect jurors' anonymity and issued a partial gag order on Trump following his criticism of court officials and witnesses.

The trial centers on allegations that Trump falsified business records to conceal hush money payments to porn star Stormy Daniels before the 2016 presidential election. Trump, who is concurrently facing three other criminal prosecutions, has pleaded not guilty to 34 felony counts in the Manhattan case. His legal team argues that no willful violations of the gag order have occurred, despite accusations from prosecutors of repeated breaches by Trump, particularly on social media.

The jury selection process reveals the polarized opinions about Trump, complicating the search for unbiased jurors in heavily Democratic Manhattan. The trial's outcome holds significant political stakes, with a Reuters/Ipsos poll indicating that a conviction could sway voters' opinions in the upcoming election. As the trial proceeds, the focus is on forming a complete jury, with opening statements anticipated next week if the jury is fully seated. The entire trial is expected to last six to eight weeks, potentially concluding before the November presidential election.

Trump hush money trial loses juror who felt intimidated, judge says | Reuters

A federal appeals court has ruled that U.S. Circuit Judge Don Willett does not need to recuse himself from a case involving a Consumer Financial Protection Bureau (CFPB) rule that caps credit card late fees, despite his son owning stock in Citigroup. The ruling came after concerns were raised about a potential conflict of interest given Citigroup's stake in the outcome of the case, as the company is significantly involved in the credit card industry and is a member of the groups challenging the CFPB's rule.

The issue surfaced when Politico reported on Willett's financial interest following a court decision he authored, which moved the case from Texas to Washington, D.C. In response, Willett disclosed that the contested stock was part of his son's education savings account, valued around $2,000. The Judicial Conference’s Committee on Codes of Conduct, after reviewing the matter, advised that the connection to Citigroup's performance in the stock market was too indirect to necessitate Willett’s recusal.

The committee's opinion, authored by U.S. District Judge Gerald McHugh, emphasized that the potential effect on Citigroup's stock was speculative and did not directly impact Willett’s impartiality in the case. The CFPB rule at the heart of the case seeks to limit what it terms "excessive" late fees charged by credit card issuers, which reportedly cost consumers approximately $12 billion annually. It mandates that issuers with over a million accounts can charge no more than $8 for late payments unless they justify higher fees. This significant reduction from the previously allowed fees aims to curb financial burdens on consumers. The legal battle continues as part of broader discussions about regulatory oversight and consumer rights within the financial sector.

US judge in credit card fee rule case doesn't have to recuse, panel says | Reuters

Corizon Health Inc., a distressed prison health-care company, has utilized a controversial bankruptcy strategy known as the Texas Two-Step, affecting inmates who face legal challenges due to limited access to resources. This maneuver involves spinning off liabilities to a new entity, Tehum Care Services Inc., which then filed for bankruptcy, impacting hundreds of inmates with pending personal injury claims. These inmates are now in a precarious position as they await Tehum’s decision on how to handle their claims, further complicated by their confinement and limited legal knowledge.

A recent judicial decision underscored the challenges faced by these inmates; a judge rejected a proposed $54 million settlement for medical malpractice claims, noting that it was unclear if the affected inmates were even aware of the settlement. This situation highlights the broader issue of inmates’ difficulty in accessing timely and accurate legal information, a problem exacerbated by their reliance on the prison’s mail system, which is notoriously slow and unreliable.

Additionally, the case brings attention to the broader implications of such bankruptcy strategies on the prison health-care sector. If Tehum’s strategy succeeds, it might set a precedent for other troubled medical providers to follow suit, potentially affecting more inmates. Critics argue that approving such settlements without proper consent from all parties involved is unfair and deprives inmates of their rights to seek further legal recourse.

The case also reflects the systemic issues within prison healthcare services, as other companies like Armor Health Management LLC and YesCare Corp face similar challenges with legal claims and financial instability. The ongoing legal battles and the potential setting of a precedent with Tehum’s bankruptcy case highlight the urgent need for reforms in how medical care and legal issues are handled in the prison system, ensuring fair treatment and access to justice for incarcerated individuals.

Prison Health Company Bankruptcy Poses Unique Hurdles to Inmates

A Texas federal jury has determined that Samsung Electronics must pay $142 million to G+ Communications for infringing on G+ patents related to 5G wireless technology used in Samsung's Galaxy smartphones. The jury specified the compensation amounts as $61 million for one patent and $81 million for another. This verdict follows a retrial on damages ordered by Chief U.S. District Judge Rodney Gilstrap, who questioned the clarity of the previous $67.5 million award given in January, debating whether it should be a lump sum or a running royalty.

The lawsuit was initiated by G+ in 2022, accusing Samsung of using its patented technology in 5G-capable Galaxy phones without obtaining the necessary licenses. G+ holds patents that have been recognized as essential for meeting international 5G standards. In defense, Samsung contested the validity of these patents and argued that G+ had not offered licensing terms that were fair and reasonable as required by standards organizations.

The case underscores ongoing legal battles over patent rights in the rapidly advancing field of 5G technology, highlighting the significant financial stakes involved. The outcome of this case could have broader implications for technology companies and the enforcement of standard-essential patents. This verdict marks a notable development in intellectual property law, especially concerning the telecommunications industry.

Samsung owes $142 mln in wireless patent case, jury says | Reuters