This Day in Legal History: Standard Oil Breaks Up

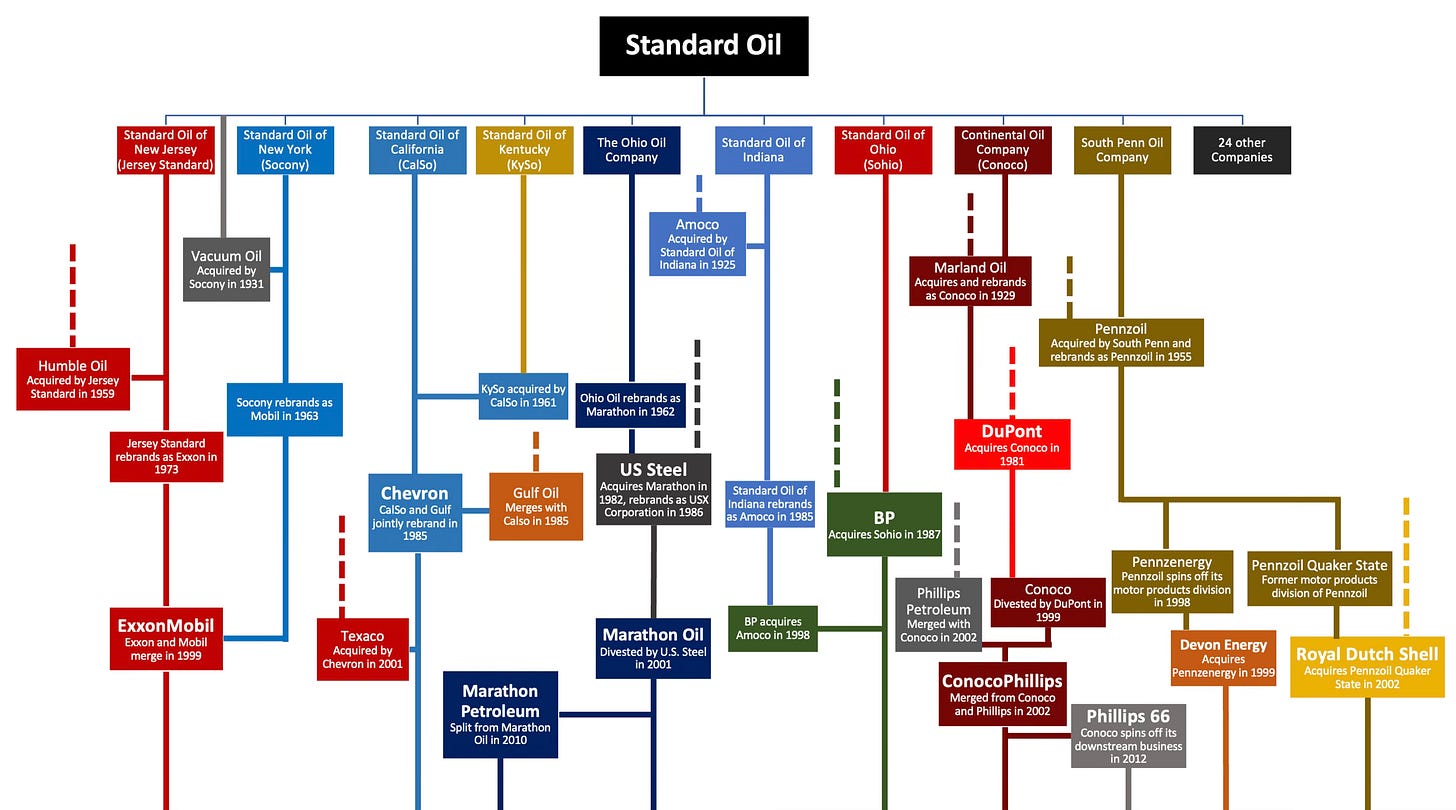

On May 15, 1911, the U.S. Supreme Court issued a landmark decision in Standard Oil Co. of New Jersey v. United States, finding that Standard Oil had violated the Sherman Antitrust Act by engaging in monopolistic practices. The Court unanimously ruled that Standard Oil’s dominance over the oil industry—achieved through aggressive acquisitions, predatory pricing, and exclusive agreements—constituted an illegal restraint of trade. As a remedy, the Court ordered the breakup of Standard Oil into 34 separate and independent companies, a dramatic reshaping of the American oil landscape. Among the entities created were companies that would later become industry giants in their own right, including Exxon, Mobil, Chevron, and Amoco.

The decision was a defining moment in U.S. antitrust enforcement, signaling the federal government’s willingness to confront corporate consolidation. It aimed to restore competition and prevent the recurrence of monopolistic control in vital sectors of the economy. However, over the next century, many of the separated entities gradually reconsolidated. Notably, Exxon and Mobil merged in 1999 to form ExxonMobil, while Chevron absorbed both Gulf Oil and Texaco, and BP later acquired Amoco.

Today, a majority of the original 34 companies—or their direct successors—are now part of just a few massive corporations. This reconsolidation serves as a cautionary tale: without vigilant antitrust enforcement post-breakup, market dominance can re-emerge in new forms. The Standard Oil saga demonstrates not only the power of antitrust law but also its limitations if not actively maintained. It underscores that breaking up monopolies is only one step—the preservation of competition requires ongoing oversight.

The EPA announced it will weaken several Biden-era regulations on PFAS, or “forever chemicals,” in drinking water. Specifically, the agency plans to rescind enforceable limits on three types of PFAS—PFNA, PFHxS, and HFPO-DA (also known as GenX)—as well as on combinations of those and PFBS. At the same time, the EPA is giving water systems two extra years, until 2031, to comply with limits on PFOA and PFOS, the two most well-known and studied PFAS chemicals, citing the challenges especially for smaller and rural systems.

The original Biden administration rule had set an enforceable limit of 4 parts per trillion (ppt) for PFOA and PFOS and a non-enforceable goal of zero exposure due to their cancer and health risks. The EPA says it will revisit its regulatory decisions on the other PFAS types it is now rolling back. Administrator Lee Zeldin framed the delay as necessary flexibility while maintaining protections against the most harmful chemicals, but environmental groups like the Environmental Working Group blasted the move as a concession to industry that puts public health at risk. Some state-level regulators expressed caution and said more time is needed to evaluate the impact of rescinding the additional PFAS limits.

EPA Moves to Weaken Biden-era PFAS Limits for Drinking Water

U.S. Health Secretary Robert F. Kennedy Jr. appeared before Congress for the first time in his new role, facing bipartisan scrutiny over his department’s proposed 2026 budget, mass layoffs, and his response to a growing measles outbreak. Since taking office in February, Kennedy has overseen the dismissal of roughly 10,000 workers across major health agencies, aligning with broader Trump administration efforts to downsize the federal government. His budget plan calls for deep cuts, including $18 billion from the National Institutes of Health and $3.6 billion from the CDC.

Lawmakers questioned Kennedy’s controversial stance on vaccines—particularly during an outbreak that has resulted in over 1,000 infections and three deaths, largely among unvaccinated populations. Representative Rosa DeLauro accused Kennedy of promoting misinformation and endangering public health. Senator Bill Cassidy, who supported Kennedy’s confirmation based on promises to uphold vaccine access and collaborate with Congress, emphasized the need for transparency and reassurance amid sweeping departmental changes.

Kennedy defended the workforce reductions as a return to pre-COVID staffing levels and projected $1.8 billion in annual savings. Still, critics view the cuts as harmful to the country’s public health infrastructure. His personal conduct also drew scrutiny after posting photos of himself swimming in Rock Creek, a site banned for public use due to unsafe water conditions.

US health chief Kennedy faces lawmakers' questions on mass firings, measles | Reuters

A growing number of major U.S. companies are proposing to leave Delaware as their state of incorporation—a trend being called “Dexit”—following Elon Musk’s public fallout with Delaware courts. At least nine publicly traded companies, each valued over $1 billion, are preparing shareholder votes to move their legal homes, while five, including Tesla and Trump Media, have already relocated to states like Texas, Florida, and Nevada. The exodus is driven by concerns over Delaware’s increasingly strict scrutiny of deals involving controlling shareholders, highlighted by a 2024 court ruling voiding Musk’s $56 billion Tesla pay package.

Companies say Delaware’s legal environment has become unpredictable, especially for founder-led or insider-controlled firms. By contrast, states like Nevada and Texas offer looser standards and greater protection from shareholder litigation. For example, Nevada’s laws shield corporate boards under the business judgment rule unless there is fraud, while Delaware courts still require fairness and transparency in insider transactions.

In response, Delaware recently passed laws to limit judicial review of certain deals and curb shareholders’ access to corporate records, hoping to stem the corporate departures. Still, critics like legal scholars and corporate counsel argue that Delaware’s courts are now perceived as activist and uncertain, prompting companies to seek jurisdictions they believe offer more legal stability and control.

In Tesla’s wake, more big companies propose voting “Dexit" to depart Delaware | Reuters