This Day in Legal History: Federal Minimum Wage Increase

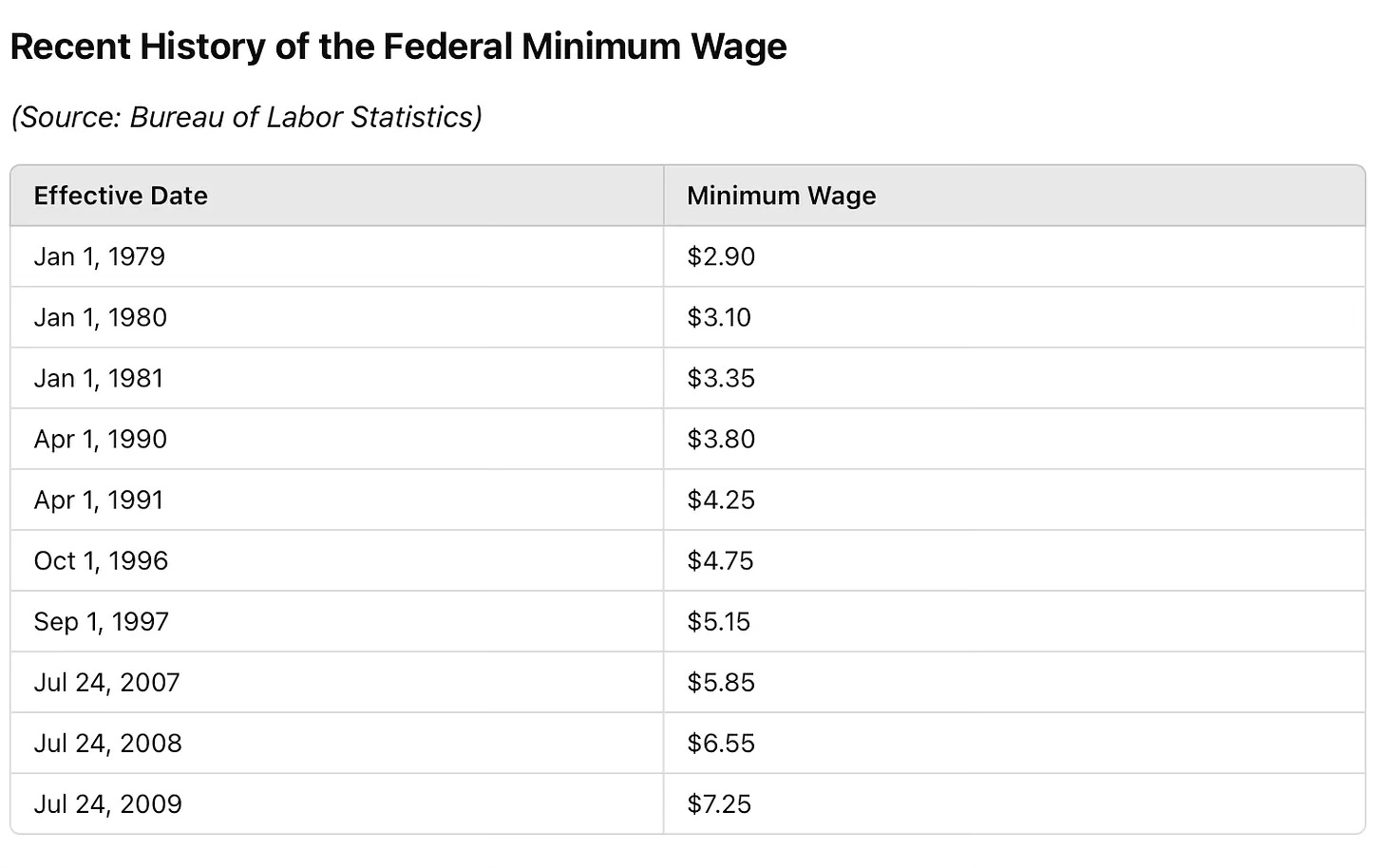

On this day in legal history, April 1, 1991, the federal minimum wage in the United States increased to $4.25 per hour. This followed an earlier increase on April 1, 1990, when the wage rose from $3.35 to $3.80 per hour. These back-to-back adjustments marked the first changes to the federal minimum wage since 1981, when it had been set at $3.35 under the Fair Labor Standards Act (FLSA). The 1990 and 1991 hikes were part of a broader legislative effort to address inflation and stagnating wages for low-income workers, especially in service industries.

The wage increase was included in the Minimum Wage Increase Act of 1989, signed into law by President George H. W. Bush. The law aimed to gradually raise wages while minimizing economic disruption for employers. Despite concerns from some business groups, the phased approach allowed companies time to adjust. Labor advocates, meanwhile, argued the increase was still insufficient for workers to meet basic living expenses, particularly in urban areas with high costs of living.

The minimum wage has long been a point of contention in U.S. labor policy, seen alternately as a lifeline for workers or a constraint on small businesses. While federal adjustments have been relatively infrequent, many states and municipalities have set higher local minimum wages. As of this writing, the last federal minimum wage increase occurred on July 24, 2009, when it rose to $7.25 per hour—where it remains today. This stagnation has reignited debates over the role of the federal government in ensuring a living wage. The April 1, 1991 increase remains a reminder of the complex balancing act between economic policy, labor rights, and legislative compromise.

The U.S. Supreme Court heard arguments in a case brought by the Catholic Charities Bureau, a nonprofit affiliated with the Diocese of Superior in Wisconsin, seeking an exemption from the state's unemployment insurance tax. The group, along with four of its subsidiaries, argued that being denied the exemption violates their First Amendment rights to religious freedom and church autonomy. While federal and state laws do allow religious organizations to opt out of unemployment insurance if they are “operated primarily for religious purposes,” Wisconsin determined the group’s services were primarily secular and charitable. The organizations involved provide support such as job training and care services for people with disabilities but do not require staff or clients to be religious.

During arguments, both conservative and liberal justices questioned whether Wisconsin's approach unfairly favored some religious organizations over others. Justices Elena Kagan and Neil Gorsuch expressed concerns about the state seemingly picking winners among religious groups. Catholic Charities contends their mission is rooted in faith, even if their services don’t explicitly promote religious doctrine. Wisconsin previously granted a similar exemption to one of their subsidiaries, prompting the current challenge.

Critics, including me, warn that granting the exemption could allow large religiously affiliated organizations, including major hospital systems, to bypass various regulations and potentially strip employees of benefits like unemployment insurance. A ruling is expected by the end of June. The Court is also set to hear another major case involving Catholic interests on April 30, regarding the proposed creation of a taxpayer-funded religious charter school in Oklahoma.

Yesterday, Nokia and Amazon announced they had resolved an international legal battle over alleged patent infringement related to video streaming and cloud computing technologies. The dispute centered on Nokia’s claims that Amazon improperly used its patented technology to power high-quality video on platforms like Prime Video and Twitch. Nokia had filed lawsuits in several jurisdictions, including the U.S., Germany, the UK, India, and the European Unified Patent Court.

Amazon, in turn, countersued in Delaware, accusing Nokia of infringing its cloud computing patents related to Amazon Web Services (AWS), including infrastructure and security technologies. A German court had previously ruled in Nokia’s favor, finding that Amazon had used its technology without proper licensing, though Amazon stated the decision wouldn’t affect its Prime Video users in Germany.

The companies have now signed a multi-year patent agreement, resolving all pending litigation under confidential terms. The agreement brings an end to multiple lawsuits and suggests ongoing cooperation between the two tech giants moving forward.

Amazon, Nokia settle international patent dispute | Reuters

The National Treasury Employees Union (NTEU), representing 150,000 federal employees, filed a lawsuit aiming to stop President Donald Trump from eliminating collective bargaining rights for a large segment of the federal workforce. The suit, filed in Washington, D.C. federal court, challenges an executive order Trump issued the previous week that exempted over a dozen federal agencies from having to negotiate with employee unions. The NTEU argues that the order violates federal labor laws and the U.S. Constitution.

Trump’s order was followed by legal action from eight federal agencies against multiple union affiliates, attempting to invalidate existing contracts. The administration claims the move is necessary for national security and to streamline agency operations, including the ability to discipline or terminate employees more easily, particularly amid budget cuts.

The NTEU counters that the national security rationale is a pretext, accusing Trump of using the order to pursue political goals and retaliate against unions that have opposed his policies. The union seeks a court ruling to block the order and prevent agencies from enforcing it, warning that the action would severely undermine federal workers' rights and job protections.

Union sues to block Trump from ending collective bargaining for many federal workers | Reuters

My column for Bloomberg this week looks at a well-meaning but flawed proposal in New York: a so-called “noise tax” aimed at reducing helicopter sound pollution. The bill would charge $50 per seat or $200 per flight for aircraft that exceed a fixed noise threshold, but it doesn’t actually tax sound. Instead, it taxes occupancy—a fundamental mismatch if the goal is to reduce the auditory burden on residents.

If noise is the harm, we should tax noise directly. A static decibel cutoff misses how sound actually impacts people—context matters. A helicopter flying over the harbor at noon is not the same as one hovering over a quiet park at 6 a.m., but under this bill, both would be taxed identically if they’re equally loud. Worse, there’s no incentive to alter flight paths or schedules to reduce disruption, nor any reward for operators who try to minimize their noise without hitting the “quiet” threshold.

A well-designed externality tax should reflect actual social harm and promote behavior that reduces it. Congestion pricing in New York does this well by varying fees based on time and place. France’s noise tax on planes is another good example—it charges more for louder aircraft flying at more sensitive times. New York’s bill, by contrast, is more of a symbolic luxury tax that may make air travel slightly pricier but won’t make the skies meaningfully quieter.

If the goal is truly to reduce noise, the city needs to tax decibels—not passengers.

New York’s helicopter noise tax misses the target