This Day in Legal History: Sirhan Sirhan Sentenced to Death

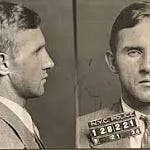

On this day in legal history, April 23, 1969, Sirhan Sirhan was sentenced to death for the assassination of Senator Robert F. Kennedy, a pivotal moment in American political and legal narratives. Sirhan, a 24-year-old Palestinian immigrant, was convicted of murdering Kennedy on June 5, 1968, at the Ambassador Hotel in Los Angeles, California, immediately following Kennedy's victory in the California Democratic presidential primary. Kennedy's assassination marked a profound loss, sending shockwaves across the nation and profoundly affecting its political landscape.

Sirhan's trial was a high-profile case, filled with emotional testimonies and global attention. Initially sentenced to death, Sirhan's sentence was later commuted to life imprisonment in 1972 following the California Supreme Court's decision to invalidate all pending death sentences imposed prior to 1972 due to the unconstitutionality of the death penalty statutes.

Over the years, Sirhan's case continued to evolve with numerous appeals and parole hearings. In 1998, his attorney, Larry Teeter, claimed that Sirhan did not commit the crime, suggesting that Sirhan was hypnotically programmed to fire shots as a diversion for the real assassin and was a victim of a larger conspiracy. Teeter's assertions fueled ongoing debates and conspiracy theories surrounding Kennedy's assassination, though they did not lead to a new trial or exoneration.

Despite these controversies, Sirhan has been denied parole multiple times, with the most recent denial occurring in March 2023. The parole board's decision underscored ongoing concerns about the severity of the crime and its impact on American society. Each hearing brought renewed attention to the complexities of the case, including arguments regarding Sirhan's remorse, rehabilitation efforts, and the enduring pain felt by the Kennedy family and their unequivocal opposition to his release.

Sirhan Sirhan's ongoing incarceration and the legal proceedings surrounding his case serve as a stark reminder of the lasting implications of political violence and the deep scars it leaves on a nation's collective memory. His story remains a significant chapter in the annals of American legal and political history, reflecting the tensions and traumas of a tumultuous era.

Energy Secretary Jennifer Granholm, as a key promoter of President Biden’s climate and economic initiatives, has been actively engaging with industry leaders and workers across the U.S., underscoring the administration’s commitment to fostering a clean energy transition that promises high-quality union jobs and rejuvenates manufacturing sectors. Her frequent visits to various energy-related sites and promotional events serve to illustrate the Department of Energy's extensive influence and its capacity to distribute substantial funding, derived mainly from the bipartisan infrastructure law of 2021 and the Inflation Reduction Act of 2022. Recently, Granholm used the setting of Butler Works, a steel plant in Pennsylvania, to emphasize the government’s efforts to sustain the steel industry, noting the plant's significant role in producing steel used nationwide.

Butler Works, operated by Cleveland Cliffs Inc., benefits directly from the Biden administration's policies, such as the newly established standards for energy-efficient transformers and substantial grant funding aimed at reducing emissions. Granholm's visit highlighted the broader industrial strategy to make domestic manufacturing more appealing and competitive globally. This strategy also seeks to reverse the offshoring trends that have historically weakened U.S. manufacturing, aiming to reclaim jobs and production capabilities lost to countries like China.

The timing of her visit aligns with a week of Earth Day-themed activities, emphasizing the administration's focus on enhancing the U.S. power grid and promoting local production of renewable energy components. This push towards revitalizing manufacturing in regions like Western Pennsylvania, a critical electoral battleground, is part of a larger effort to garner political support through economic revitalization. Cleveland-Cliffs, a major player in the steel industry, has been pivotal in this initiative, gearing up to meet the expected surge in demand for materials essential for a rapidly expanding U.S. power grid.

A significant development for Butler Works came with the Department of Energy’s decision to modify an earlier proposal that would have phased out the production of a specific type of steel used in transformers, responding to industry pushback and bipartisan political pressure. This decision not only secures jobs at the plant but also addresses concerns about potential shortages in the utility sector, highlighting the administration’s receptiveness to industry feedback.

However, this regulatory decision has drawn criticism from energy efficiency advocates who argue that it compromises potential energy savings. Granholm defended the final rule as a balanced approach, illustrating a government process responsive to stakeholder input while striving to achieve both environmental and economic objectives. This incident underscores the complex interplay between advancing environmental goals and maintaining industrial viability in the face of evolving energy needs and political pressures.

Green Steel Jobs Multiply With Biden Energy Plan, Granholm Says

The U.S. Federal Trade Commission (FTC) is set to vote on a new rule that would nearly eliminate non-compete clauses, which restrict workers from moving between jobs within the same industry. This decision comes three years after President Joe Biden encouraged the FTC to curb such agreements, which currently impact about 20% of U.S. workers. The proposed rule has garnered support from major labor organizations and Democratic leaders from various states, emphasizing its potential to enhance job mobility and promote fair labor practices.

The Chamber of Commerce, the largest business lobby in the nation, has expressed strong opposition to the rule, planning to file a lawsuit immediately after the rule is officially released and voted upon. They argue that the rule is too expansive and could hinder companies from safeguarding their confidential information. Despite this opposition, the rule is likely to pass during the FTC meeting, with a predicted partisan split among the commissioners.

The FTC’s authority to enact this rule has been contested by the Chamber of Commerce, with their Chief Policy Officer claiming that the FTC lacks congressional approval to regulate aspects of competition in this manner. However, FTC Chair Lina Khan and other Democratic commissioners assert that they do possess the necessary authority, citing historical precedents where the FTC defined unfair competition practices.

This upcoming vote and the ensuing legal challenge by the Chamber highlight a significant clash between federal regulatory power and business interests, setting the stage for a pivotal legal and economic debate over the scope of non-compete agreements in the U.S. workforce.

FTC to Issue Non-Compete Ban as Chamber Lawsuit Looms

In New York, Justice Juan Merchan is set to rule on possible violations by former President Donald Trump of a gag order in his ongoing criminal hush money trial. This gag order restricts Trump from making public criticisms of witnesses and others involved in the case. Prosecutors have pointed out Trump’s recent derogatory comments about Stormy Daniels and Michael Cohen, who are both expected to testify, and his claims about jury bias as instances of violations. They have proposed a fine of $1,000 for each violation, while also highlighting the potential for harsher penalties, including jail time, if Trump continues to breach the order.

Trump, charged with falsifying business records to conceal a $130,000 payment to Daniels ahead of the 2016 election to prevent her from disclosing a purported encounter, has pleaded not guilty and denied the encounter occurred. Prosecutors argue that this payment was part of a broader scheme to suppress damaging information during the election campaign, labeling it as "election fraud."

During the trial, Trump’s defense has maintained his innocence, asserting that his actions were meant to protect his family and reputation, and accused Daniels of exploiting the situation for profit. Meanwhile, further testimony is expected from David Pecker, former publisher of the National Enquirer, regarding his involvement in a "catch and kill" strategy to aid Trump’s campaign by suppressing negative stories.

American Media, Pecker's company, admitted to paying for stories about Trump’s alleged affairs, including a substantial payment to Karen McDougal, which it never published. These actions were purportedly coordinated with Trump's campaign efforts.

The outcome of this trial, one of several criminal cases against Trump, could significantly impact his chances in the upcoming presidential election, where he is set to face Joe Biden. Polls indicate that a conviction could deter a significant portion of independent and Republican voters.

Judge to consider gag order violations in Trump hush money trial | Reuters

In my latest contribution in Forbes, I delve into the Biden administration's Fiscal Year 2025 budget proposal, which includes a pivotal excise tax on private space companies like SpaceX. This tax is primarily aimed at covering the logistical costs incurred by air traffic control during rocket launches, an increasingly frequent event given the surge in private satellite deployments over the past decade. This move isn't just about generating revenue; it's a strategic step towards addressing the burgeoning issue of low-Earth orbit congestion.

While this initial tax focuses on immediate air traffic control expenses, it paves the way for broader, more comprehensive space tax policies. The concept of a "space property tax" is introduced as a mechanism to internalize the external costs of satellite deployments. This tax would vary based on several factors including the size of the satellite, its operational lifespan, and its planned end-of-life disposal. The objective is to ensure that the costs associated with occupying space are fully accounted for and that satellite operators are motivated to utilize space responsibly and sustainably.

Drawing parallels with terrestrial property taxes, which discourage unproductive land use, a space property tax would similarly encourage satellite operators to optimize the productivity of their satellites and the space they occupy. Such a tax would not only cover the use of space but also contribute to a fund dedicated to addressing future space-related issues, including debris mitigation.

The global nature of space activities necessitates international cooperation and cohesive policymaking. The existing international agreements, such as the Outer Space Treaty, provide a foundational framework, but as satellite numbers grow, these policies will need to evolve. International collaboration will be crucial in creating a fair and effective space tax system, ensuring that all countries share the responsibilities and benefits of space utilization.

As we continue to explore and utilize space, we must learn from our historical treatment of Earth's resources. By adopting a proactive and sustainable approach to space exploration, we can prevent the overexploitation of this critical frontier. This shift is not just about compliance but about ensuring the long-term viability of space for future generations.

Forbes - Do We Need A Property Tax For Space?

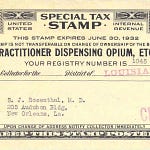

In my column this week, I explore an innovative approach to combating sales suppression through the introduction of a "Tax Lottery." This idea addresses the complexities introduced by remote cashiers and offshore payment processing, which are increasingly common in industries such as New York's restaurant sector. With remote cashiers based in distant locations like the Philippines, traditional auditing methods become challenging as tax authorities struggle to access accurate transaction logs.

The core issue here is the invisibility of remote transactions to local tax authorities, a problem exacerbated when transactions are processed offsite or even offshore. The difficulty in obtaining transaction records makes it easy for businesses to suppress sales tax, a potential boon to their profits but a serious threat to tax compliance.

To counter this, I propose a system where customers are incentivized to scan and submit their receipts immediately after purchases by entering a lottery. This could be integrated with existing state-run lotteries or through a separate prize fund created from the revenue gained from enhanced compliance. Such measures have been adopted in various countries with mixed results, yet they offer a promising solution to ensure transparency in transactions.

By encouraging consumers to maintain a "shadow record" of their purchases, we create an independent verification of sales transactions that tax authorities can rely on. This method effectively turns every customer into a potential auditor, drastically reducing the likelihood of sales suppression by business owners.

The success of such a system depends on the degree of sales suppression already occurring and the overall tax evasion culture within a state. While sophisticated evaders might still find ways around such measures, the general populace, driven by the incentive of potentially winning a prize, might become a formidable force in ensuring tax compliance.

Moreover, the Tax Lottery system leverages the fact that while businesses might risk suppressing some transactions, they cannot predict which transactions customers will choose to report via their receipts. This uncertainty forces businesses to record all transactions faithfully, lest they face the consequences of an audit triggered by customer-submitted data.

However, the effectiveness of this system hinges on balancing the penalties for non-compliance with the allure of the lottery rewards. The challenge lies in setting these parameters to optimize compliance without overwhelming businesses or consumers.

Ultimately, appealing to the financial interests of consumers could be a powerful strategy against the potential rise in fraud, especially as remote cashier systems become more prevalent. As tax authorities seek innovative solutions to modern challenges, the Tax Lottery presents a potentially transformative approach to ensuring transparency and compliance in an increasingly digital economy.

‘Tax Lottery’ Would Help Abate Remote Cashier Auditing Nightmare