This Day in Legal History: Schecter Poultry Corp Decided

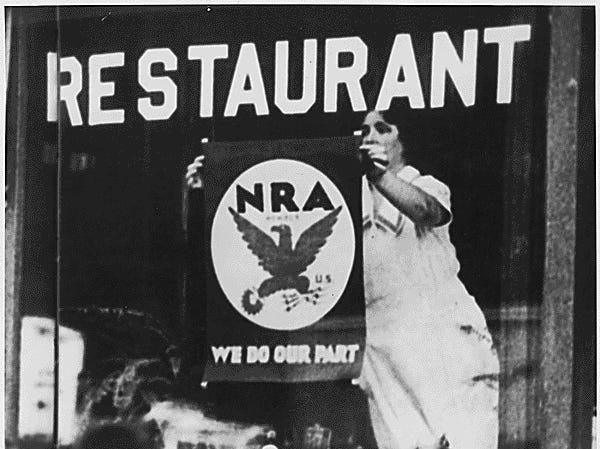

On May 27, 1935, the U.S. Supreme Court issued a landmark decision in A.L.A. Schechter Poultry Corp. v. United States, delivering a major blow to President Franklin D. Roosevelt’s New Deal. In a unanimous ruling, the Court struck down the National Industrial Recovery Act (NIRA), a cornerstone of Roosevelt’s economic recovery plan during the Great Depression. The case centered on the Schechter brothers, who ran a poultry business in Brooklyn and were charged with violating fair competition codes established under NIRA. The Court held that the NIRA unlawfully delegated legislative power to the executive branch without clear standards, violating the nondelegation doctrine.

The justices also found that the federal government had overreached its authority by regulating purely intrastate commerce. The Schechters’ business operated entirely within New York, and the Court concluded it had only an indirect effect on interstate commerce—placing it beyond Congress’s regulatory power under the Commerce Clause. Chief Justice Charles Evans Hughes, writing for the Court, emphasized the need for separation of powers and warned against unchecked executive authority.

This ruling sharply curtailed New Deal programs that relied on broad executive discretion and forced the Roosevelt administration to reconsider its legislative strategies. It also marked one of the last major uses of the nondelegation doctrine to invalidate federal legislation. While the doctrine has since faded in use, the decision remains a potent symbol of judicial limits on federal power. The Schechter case underscored the constitutional requirement that Congress, not the president, must make the laws, and that those laws must respect the boundaries of federalism.

The U.S. Supreme Court has temporarily blocked a lower court's order that would have required the Department of Government Efficiency (DOGE), created by President Trump and closely associated with Elon Musk, to turn over records and allow a top official, Amy Gleason, to testify. Chief Justice John Roberts granted the administrative stay without comment, giving the Court time to consider whether a longer pause is warranted. The case, brought by Citizens for Responsibility and Ethics in Washington (CREW), hinges on whether DOGE qualifies as a federal agency under the Freedom of Information Act (FOIA), which would subject it to transparency requirements.

The Trump administration argues DOGE is not covered by FOIA and has pushed back against efforts to obtain discovery—evidence and testimony—from the office. A federal judge had previously authorized limited discovery to help determine DOGE’s legal status, which led to the administration’s emergency appeal to the Supreme Court. The Justice Department claims this process threatens the separation of powers by exposing a presidential advisory body to scrutiny.

CREW contends the administration is trying to bypass judicial review and shield the office from public accountability. Though Elon Musk is seen as the public face of DOGE, the administration denies he holds any formal role. The Court’s intervention pauses imminent deadlines for DOGE to release records and participate in depositions, but a full ruling on the core legal question remains pending.

Supreme Court Pauses Order for DOGE Records and Testimony - Bloomberg

A federal judge has ordered the Trump administration to help a gay Guatemalan man, identified as O.C.G., return to the United States after he was wrongfully deported to Mexico. The man had fled Guatemala due to threats linked to his sexuality and was granted protection by an immigration judge. However, just two days after that ruling, U.S. officials mistakenly deported him to Mexico, where he had previously been raped and kidnapped.

U.S. District Judge Brian Murphy, based in Boston, issued the order after the Justice Department admitted it had no evidence that O.C.G. was ever asked about fears of being sent to Mexico, contradicting earlier claims. The judge called the situation a "horror" and emphasized that the man had been denied his constitutional right to due process. The case is part of a broader class action challenging the administration’s deportation practices, particularly efforts to send individuals to third countries without assessing safety concerns.

Murphy had already ruled that deportations under such conditions violated due process protections. The ruling also follows similar failures by the administration, including the wrongful deportation of another protected individual to El Salvador. O.C.G.’s legal team, now working on a return plan, said he chose to return to Guatemala and went into hiding after facing long asylum wait times in Mexico.

US judge orders Trump administration to facilitate return of Guatemalan deportee | Reuters

My column for Bloomberg this week dives into a deceptively boring topic that’s quietly poised to become a compliance headache: killing the penny. On the surface, it’s a monetary housekeeping item. But as I argue, the downstream effects—particularly for state sales tax systems—are anything but trivial.

The central problem isn’t emotional attachment to small coins. It’s rounding—specifically, how states choose to round transactions in a penny-free world. If states start rounding tax amounts instead of total amounts, or worse, do it differently depending on whether someone pays in cash or by card, they’re walking straight into a legal buzzsaw. The Internet Tax Freedom Act (ITFA) bars discriminatory treatment of electronic commerce. And no, that doesn’t only apply to online transactions—if digital payments consistently produce higher tax totals than cash ones, that’s arguably “discrimination,” and litigation will follow.

The fix? Simple enough: keep tax calculations exact to the penny, round only the total cash transaction due to the nearest nickel, and let the retailer absorb the difference. It’s not pain-free—retailers lose a few cents here, gain a few there—but it keeps digital systems intact and legal risk low. Rounding the tax itself may feel “efficient,” but it’s a compliance trap that opens states to lawsuits and chaos in point-of-sale systems designed for one-cent precision.

And that’s before we even get to the technical debt. E-commerce platforms, credit card processors, and small business systems have no concept of nickel rounding. Forcing them to adapt would mean software rewrites no one asked for—and in many cases, from vendors who no longer exist.

The upside here is policy gold: rounding only at the total level nudges more transactions toward cards and mobile payments, where amounts are exact and sales tax compliance is tighter. Fewer paper trails, fewer “zappers,” and fewer discrepancies in audit.

So yes, the penny is obsolete. But if states mishandle the transition, they’ll find out just how expensive abolishing it can be.