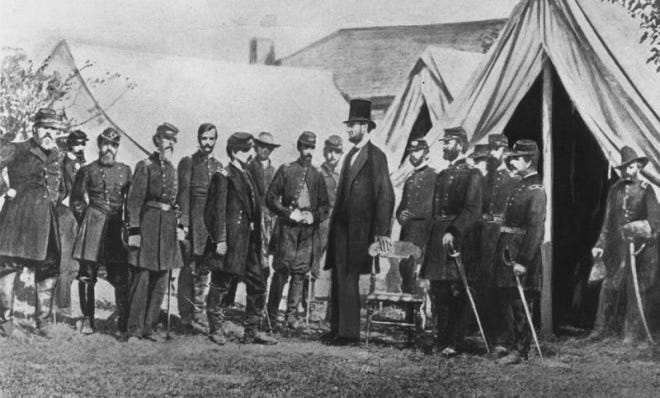

This Day in Legal History: Abraham Lincoln Passes First Income Tax

On July 1, 1862, amid the mounting costs of the Civil War, President Abraham Lincoln signed into law the nation's first true federal income tax under the Tax Act of 1862. This legislation imposed a 3% tax on annual incomes over $600 and a 5% tax on incomes exceeding $10,000—significant thresholds at the time. The tax was part of a broader revenue strategy that included an expansion of excise taxes and the creation of the Internal Revenue Office, the predecessor to today’s IRS. It marked a pivotal moment in U.S. legal history, as the federal government, for the first time, claimed broad authority to directly tax personal income.

Though innovative, compliance with the law was inconsistent, reflecting both limited administrative capacity and public resistance. The tax was designed to be progressive and temporary, aimed solely at funding the Union war effort. After the Civil War, political pressure mounted against its continuation, and public sentiment shifted toward limiting federal power in peacetime.

The law remained controversial until it was effectively struck down decades later. In 1895, the Supreme Court ruled in Pollock v. Farmers' Loan & Trust Co. that a similar federal income tax law was unconstitutional, declaring it a "direct tax" not properly apportioned among the states. This decision undermined the legal foundation of the 1862 tax, though it had long since lapsed. It wasn’t until the ratification of the 16th Amendment in 1913 that a permanent federal income tax regime was constitutionally authorized.

The U.S. Supreme Court recently issued several rulings that significantly reduced federal environmental protections, continuing a broader judicial trend. In one of the most consequential decisions, the Court curtailed the Environmental Protection Agency's (EPA) obligations under the National Environmental Policy Act (NEPA). This 8-0 ruling allows federal agencies to narrow the scope of environmental reviews, excluding indirect and future project impacts, which could expedite infrastructure projects like a proposed crude oil railway in Utah. Justice Brett Kavanaugh emphasized that courts must defer to agency discretion in such matters, reinforcing agency authority but limiting public scrutiny.

The Court also restricted EPA powers under the Clean Water Act in a 5-4 decision concerning a wastewater permit for San Francisco. The majority found the EPA's water quality requirements too vague, weakening enforcement capabilities and potentially harming water quality in affected areas. This decision strips the agency of a key tool used to maintain federally regulated waters' safety.

Additionally, the justices allowed fuel producers to challenge California’s stringent vehicle emissions standards in a 7-2 ruling, broadening legal standing for businesses in environmental litigation. These moves collectively signal a judicial shift favoring regulatory leniency and business interests over expansive environmental oversight.

US Supreme Court dealt blows to EPA and environmental protections | Reuters

Following a recent U.S. Supreme Court ruling that limits nationwide injunctions, two federal judges are expediting legal challenges to President Donald Trump’s executive order aimed at restricting birthright citizenship. The order, which takes effect July 27, denies automatic U.S. citizenship to children born on U.S. soil unless at least one parent is a citizen or lawful permanent resident. During hearings in Maryland and New Hampshire, a Department of Justice lawyer confirmed that no deportations of affected children will occur before the order becomes active.

Judges Deborah Boardman and Joseph LaPlante demanded written assurances from the government, and plaintiffs in both cases—immigrant rights advocates and pregnant non-citizens—pushed for immediate class-wide relief due to fears surrounding their children's legal status. The Supreme Court’s ruling last Friday did not validate Trump’s policy but did restrict judges from issuing broad injunctions that halt federal policies for the entire country, unless done through class action lawsuits. Justice Amy Coney Barrett's opinion suggested that class actions remain a viable path to broader judicial relief.

Trump’s administration argues that the 14th Amendment does not guarantee birthright citizenship, a position rejected by many lower courts. The Maryland judge scheduled a ruling after July 9, while a hearing in the New Hampshire case is set for July 10.

The Trump administration has appealed a federal judge’s decision that struck down an executive order targeting the law firm Perkins Coie, known for its past representation of Hillary Clinton and Democratic interests. The appeal, filed with the U.S. Court of Appeals for the D.C. Circuit, follows a May ruling by Judge Beryl Howell that permanently blocked the order, which aimed to bar Perkins Coie's clients from federal contracts and restrict the firm’s attorneys from accessing federal buildings.

Judge Howell condemned the order as an abuse of presidential power meant to punish political adversaries, stating that using government authority to settle personal scores is not a lawful use of executive power. Similar executive orders against three other law firms—WilmerHale, Jenner & Block, and Susman Godfrey—were also struck down by different judges in Washington. The Justice Department has not yet appealed those rulings.

Perkins Coie, along with the other firms, argued that the orders violated constitutional rights, including free speech, and were designed to intimidate attorneys from representing clients disfavored by Trump. The firm expressed confidence in presenting its case to the appeals court. Meanwhile, nine other firms have reportedly settled with the administration, offering nearly $1 billion in pro bono work and other terms to avoid being targeted.

Trump administration appeals blocking of executive order against law firm Perkins Coie | Reuters

My column for Bloomberg this week argues that the explosive growth of tax breaks for data centers—driven by the demands of artificial intelligence—is creating unsustainable losses for state budgets. While these facilities are essential for powering AI models, states are racing to hand out subsidies with little oversight or accountability. I point out that what began as modest tech incentives have ballooned into open-ended giveaways, with Texas’ projected tax losses surpassing $1 billion and Virginia now dedicating nearly half of its economic development incentives to data centers.

I argue that states should not abandon data center investment but must start demanding more in return. That means linking tax breaks to responsible energy use, such as locating facilities near stranded renewable power or requiring dry cooling and on-site energy storage. These measures would mitigate the strain on local water and power systems, especially since AI data centers use far more energy than traditional ones and often during peak demand hours.

The current model rewards scale rather than innovation or job creation, essentially turning data center exemptions into bottomless credits for big tech firms. Many states don’t even track the actual cost of these subsidies, creating a feedback loop of growing losses and minimal scrutiny. I call for stronger transparency and for aligning data center growth with public interests—especially as AI infrastructure becomes embedded in state economies. Without intervention, we risk reinforcing outdated, inefficient policy frameworks just as computing becomes more powerful and energy-intensive.

AI Boom Should Prompt States to Rein in Data Center Tax Losses