This Day in Legal History: Sirhan Sirhan Convicted

On this day in legal history, April 17, 1969, Sirhan Sirhan was convicted of one of the most high-profile crimes of the 20th century—the assassination of Senator Robert F. Kennedy. Kennedy, a leading candidate for the Democratic nomination for President of the United States, was shot on June 5, 1968, at the Ambassador Hotel in Los Angeles, shortly after delivering his victory speech in the California primary elections. Sirhan, a 24-year-old Palestinian immigrant, was apprehended at the scene.

The trial of Sirhan was a watershed moment in American legal and political history. It highlighted the growing tensions in the United States and the world over issues like the Vietnam War and the Middle East conflict. Sirhan's defense team attempted to argue diminished capacity, claiming that Sirhan was mentally unstable at the time of the shooting. They presented evidence suggesting that Sirhan was psychologically unable to cope with his intense feelings of anger and alienation, stemming primarily from his strong objections to Kennedy's pro-Israeli views.

Despite these arguments, the jury found Sirhan guilty of first-degree murder, and he was sentenced to death. However, his sentence would not be carried out. In 1972, the Supreme Court of California effectively overturned the death penalty in the state, ruling it unconstitutional, which automatically commuted the death sentences of all death row inmates, including Sirhan, to life imprisonment.

Sirhan's case continued to evoke debates about political violence, justice, and capital punishment. The commutation of his death sentence to life imprisonment came during a period of intense scrutiny and reevaluation of the death penalty in the United States, reflecting broader societal shifts. His continued imprisonment has been punctuated by numerous parole hearings, during which the severity of his crime is re-examined alongside his behavior and reform while in custody.

Sirhan Sirhan's conviction and subsequent legal journey through the penal system serve as a grim reminder of the turbulent times during the late 1960s in the United States and represent a significant chapter in the nation's legal history. The assassination and the trial that followed had a lasting impact on American legal practices and the political landscape, highlighting the intersection of mental health issues and the criminal justice system.

A recent legal battle ended with a $101 million jury verdict against Walmart Inc. in favor of London Luxury, a textile vendor. The verdict was reached in Arkansas, close to Walmart’s headquarters, concerning a breached contract for over $500 million in personal protective equipment during the COVID-19 pandemic. The case was represented by the Manhattan litigation boutique Holwell Shuster & Goldberg (HSG), which took over after London Luxury parted ways with two larger law firms. This lawsuit received financial backing from Bench Walk Advisors, who invested over $5.1 million in the case among other suits.

Walmart, represented by Jones Day and at least two other firms, has expressed disagreement with the jury’s decision and is considering an appeal. The spokesperson from Walmart claimed that the verdict was not supported by evidence and emphasized the company's commitment to fair business practices.

The litigation was originally filed in Westchester, New York, early 2022 but was moved to federal court in Fayetteville, Arkansas. The decision followed a 10-day jury trial. HSG, known for handling significant cases on contingency and alternative fee arrangements, benefitted from external funding which is becoming a common strategy among plaintiff-side lawyers to manage litigation costs.

Litigation finance, a growing $15.2 billion industry, involves investors funding lawsuits in exchange for a portion of any financial awards. Bench Walk’s investment in the Walmart case was aimed at covering trial costs, highlighting the evolving dynamics and risks associated with such financial strategies in litigation.

Walmart’s $101 Million Loss Is Win for Firm, Funder Behind Suit

US Senator Bob Menendez is set to present a defense strategy in his bribery trial that involves distancing himself from actions potentially taken by his wife, Nadine Menendez, according to newly unsealed court documents. The couple is accused of accepting various bribes, including cash, gold bars, and a car, in exchange for facilitating business and governmental interests. The documents reveal that Senator Menendez might testify that he was unaware of the true nature of the gifts, suggesting that his wife withheld information from him which led him to believe nothing unlawful was occurring.

This defense strategy emerged during a legal request for separate trials for the senator and his wife, indicating a significant shift from their previously united front. The judge granted this request after Nadine Menendez needed to undergo surgery, leading to separate trial dates for the senator and his wife. The trial for Senator Menendez and two businessmen is set for May 6, while Nadine Menendez’s trial is scheduled for July 8.

The case also involves allegations that Senator Menendez acted as a foreign agent for Egypt, further complicating the charges against him. The decision to potentially expose confidential marital communications during the trial highlights the complex dynamics of the legal strategy and the personal stakes involved. The Menendez legal team's move to request separate trials underscores the challenges of defending a joint case while maintaining marital privileges and the strategic legal positioning that may influence the outcomes of their respective trials.

Bob Menendez Poised to Blame His Wife in Bribery Case Defense

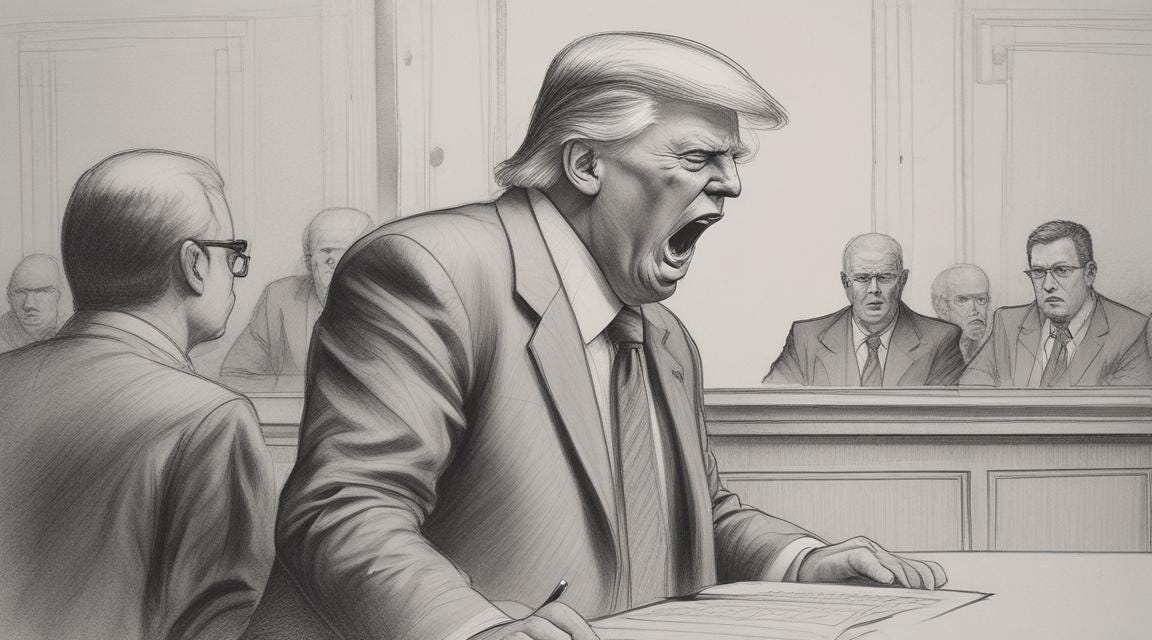

Michael Cohen, former attorney and fixer for Donald Trump, has shifted from a loyal supporter to a key witness in the first criminal trial of a U.S. president. The trial, which began recently in New York, revolves around allegations that Trump concealed payments made to the porn star Stormy Daniels to maintain her silence about a past sexual encounter. Cohen, who facilitated a $130,000 payment to Daniels prior to the 2016 election, claims Trump directed these actions. Trump has pleaded not guilty to the charges, dismissing the allegations and labeling Cohen a "serial liar."

This is not Cohen's first testimony against Trump; he has previously testified in a civil fraud trial concerning the Trump Organization's asset valuations. In that trial, Cohen admitted to manipulating property values on Trump's directive, which resulted in Trump being ordered to pay $454 million in penalties and interest. Furthermore, Cohen’s history includes a three-year prison sentence for this payment and other offenses, including tax fraud and lying under oath about the Trump Organization’s Russian business dealings.

Cohen's role in Trump's legal saga underscores a dramatic transformation from a close presidential confidant to an outspoken critic, a change catalyzed by federal investigations into his activities. Despite his controversial past, including admitting to lying during legal proceedings, Cohen's insights are central to the prosecution's case. His involvement illustrates the complex dynamics and potential risks in relying on testimony from figures with compromised credibility. The outcome of this trial could have significant legal and political ramifications, reflecting Cohen’s intricate and troubled relationship with the former president.

Trump's ex-fixer Michael Cohen to be key witness in hush money criminal trial | Reuters

My column this week discusses the importance and implications of introducing an open-source tax credit for software developers. Open-source software, valued at $8.8 trillion, is fundamental to both private and governmental technology systems. These projects often start as hobbyist pursuits by individual developers and require long-term maintenance from a broader community, which currently lacks sufficient incentives. The proposed tax credit would allow developers to deduct expenses related to their voluntary contributions to open-source projects, including a portion of the time they dedicate, aiming to motivate broader participation and enhance project oversight.

The idea of such a tax credit is not new, having been previously proposed at the state level. However, economic reliance on open-source software has only increased, highlighted by incidents like the XZ security breach, which underscore the risks of exploiting these resources without adequate compensation to the contributors. The proposed tax credit, potentially worth up to $2,000, would recognize the contributions of developers by helping to offset their financial costs, thus encouraging more significant investment in the security and enhancement of open-source projects.

The broader impact of the tax credit includes not only financial benefits for developers but also societal acknowledgment of the value of their contributions, akin to charitable efforts in other professional fields. This recognition could help alleviate financial barriers and align developers’ interests with wider societal benefits, promoting a more robust and secure open-source software ecosystem.

However, implementing such a credit faces challenges, particularly in quantifying individual contributions and valuing developers’ labor. In the column I suggest using the mean hourly wage for software developers as a baseline for these calculations and stresses the importance of designing this policy with inputs from various stakeholders to mitigate risks like fraud.

Modern tools like GitHub and GitLab provide traceable records of contributions, making it feasible to verify and quantify individual efforts within open-source projects. This proposed tax credit aims to correct a significant oversight in our technological infrastructure, incentivizing valuable contributions that enhance the security and viability of open-source software in an increasingly digital world.

Open-Source Tax Credit Would Better Compensate Tech Developers