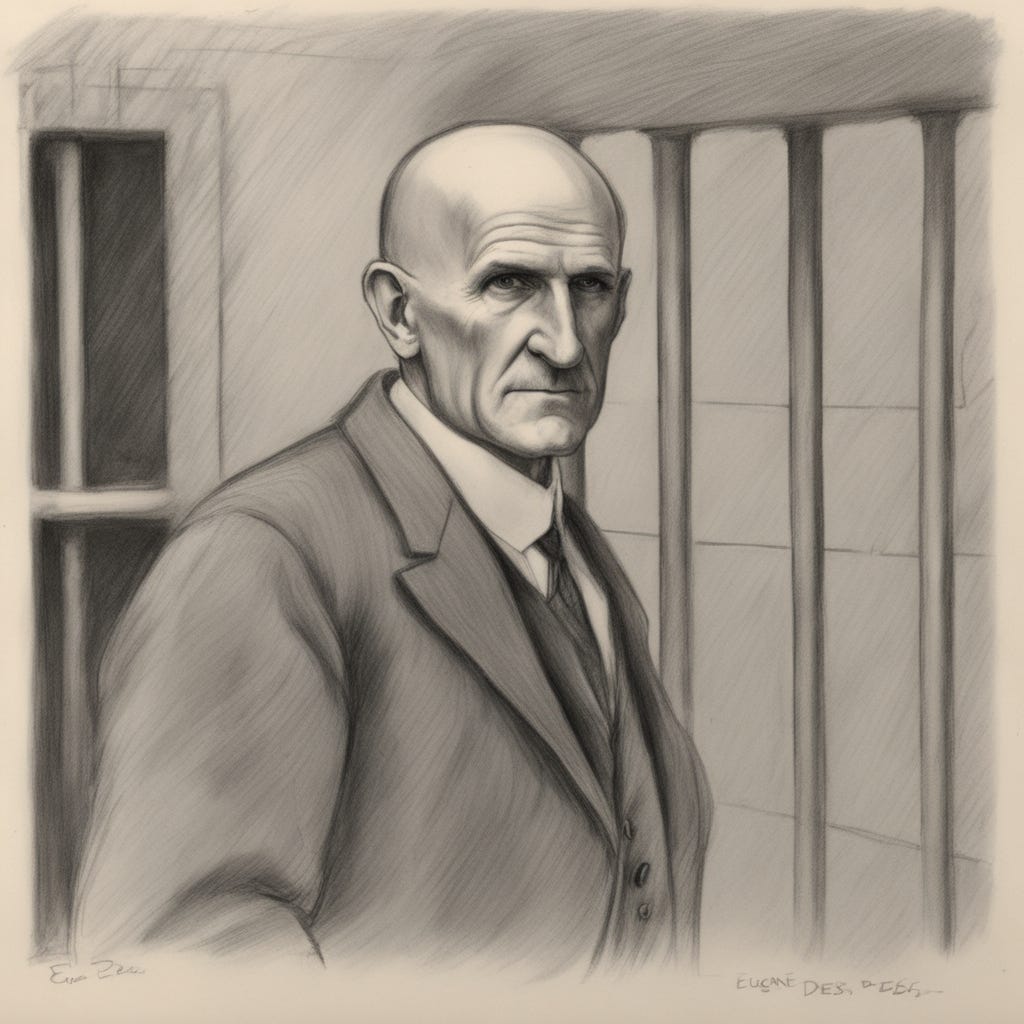

On this day in legal history, September 14, 1918, Eugene Debs was sentenced to ten years in prison for opposing the United States entry into World War I.

In the early 20th century, Eugene V. Debs, a prominent socialist and labor organizer, rose to prominence as a vocal critic of capitalist structures and the American involvement in the First World War. Born to French immigrants in Indiana, Debs left school at 14 to work on the railways, a decision that sparked his lifelong commitment to labor rights. Over the years, he became a significant figure in the labor movement, aligning with the Democratic Party and even serving a term in the state legislature.

In the mid-1890s, after departing from the Brotherhood of Locomotive Firemen over disagreements about its direction, Debs formed the American Railway Union (ARU), envisioning it as a united front for railway workers. Despite early victories, the ARU met a crushing defeat during the Pullman Strike of 1894, which saw Debs imprisoned and led him to reassess his political stance, firmly adopting socialism. In the following years, Debs became the face of the burgeoning Socialist Party in the US, running for president multiple times under its banner.

By the time World War I approached, Debs and the Socialist Party vehemently opposed American involvement, viewing it as a venture serving corporate interests at the expense of the working class. Despite shifts in public opinion favoring the war, they maintained their anti-war stance, drawing the ire of the government, especially after the enactment of the Espionage Act of 1917 which penalized interference with military operations or recruitment.

In 1918, Debs delivered a fiery speech in Canton, Ohio, criticizing the war and the government's manipulation of the working class. This act brought him under the scrutiny of the U.S. Department of Justice, leading to his arrest and subsequent conviction for sedition under the Espionage Act, a move that Debs viewed as an unconstitutional curb on free speech. Despite a swift and largely predetermined trial, Debs utilized his court appearance as a platform to defend his views and the principle of free speech.

Sentenced to ten years in prison on September 14, 1918, Debs remained undeterred, utilizing his time behind bars to continue advocating for socialism, albeit without preaching to his fellow inmates. Even as World War I came to an end, the judiciary upheld Debs' conviction, showcasing the government's stringent stance against anti-war and socialist narratives during this tumultuous period in American history.

In the lead-up to the 1920 presidential election, Debs made his fifth bid for the presidency as a socialist candidate, even as he campaigned from prison where he was serving out his ten year sentence. Despite his incarceration, Debs' anti-war message resonated with a significant portion of the American populace, securing nearly a million votes–for context, the winner, Warren Harding, had about 16 million votes. Debs’ efforts were somewhat vindicated when President Harding commuted his sentence in 1921, and he was released amidst applause from fellow inmates and at least a portion of the American populace. After a brief meeting with Harding in Washington D.C., he returned to a warm welcome in his hometown. However, his declining health coupled with the diminishing popularity of the Socialist Party marked the end of his active political life; Debs passed away in 1926, leaving a lasting impact on American politics.

Though perhaps most notably, and perhaps the final insult for Debs, is his forever being referred to when someone wants to make the point that a presidential candidate could theoretically run from prison. Invariably, that has connected his name to some sordid characters through the years.

The hacking group Scattered Spider, also known as UNC3944, targeted MGM Resorts International, a renowned gaming giant valued at $14 billion, causing significant system disruptions across various operations including in locations like Las Vegas and Macau. A significant cybersecurity issue prompted the company to shut down several of its systems as it undertakes an in-depth investigation into the breach. Notably, MGM Resorts operates over 30 hotels and gaming venues globally. The breach, which had a noticeable impact on MGM's daily operations, including the disabling of slot machines as per social media posts, has spurred a law enforcement probe. Simultaneously, it is affecting the company's stock shares adversely, with a potential detrimental effect on MGM's credit rating as warned by Moody's.

Scattered Spider has a track record of targeting not just business process outsourcing (BPO) and telecom companies, but more recently critical infrastructure organizations, utilizing complex tradecraft which is challenging to defend against, even for organizations with mature security systems. Despite the relatively young and perhaps less experienced demographic of the group, they represent a substantial threat to large organizations in the U.S, as noted by Charles Carmakal of Mandiant Intelligence. According to security firm Crowdstrike, the group often employs social engineering tactics to manipulate users into relinquishing sensitive login details, which helps them to bypass multi-factor authentication security measures.

The ongoing FBI investigation into the incident underlines the seriousness of the threat posed by the group, which appears to have turned its focus onto casino operations, finding them to be lucrative targets for financially-motivated cybercrimes. Casinos, heavily reliant on technology for their business operations, face heightened risks and operational disruptions from such cyber-attacks. Given the current focus on casinos, industry experts like Allan Liska of Recorded Future advise global casino operations to be on heightened alert, as the attention garnered by these incidents could spur copycat attacks. This situation demonstrates the inherent risks in the heavy reliance on technology in business operations, as noted in a Moody's report, and indicates a pressing need for fortified cybersecurity measures in the industry.

MGM, Caesars Hacked by ‘Scattered Spider’ in Span of Weeks (2)

MGM Resorts breached by 'Scattered Spider' hackers: sources | Reuters

As backlash against diversity, equity, and inclusion (DEI) initiatives mounts, several prominent law firms are altering their strategies both internally and for their clients. Gibson Dunn & Crutcher revised its diversity scholarship criteria recently, emphasizing the eligibility of all law students demonstrating a commitment to diversity in the profession, as confirmed by chief diversity officer Zakiyyah Salim-Williams. Moreover, McGuireWoods has joined other firms in forming dedicated teams to help clients navigate the increasing scrutiny and legal challenges targeted at corporate DEI programs, aiming to minimize legal risks and advising on government investigations pertaining to diversity policies. This move comes as a response to escalating legal threats following the U.S. Supreme Court's decision against race-conscious admissions policies in colleges, which spurred wider challenges to diversity initiatives. Concurrently, several law firms, including Morrison & Foerster and Perkins Coie, are defending against lawsuits alleging that their diversity fellowships discriminate against white applicants. These shifts denote a broader trend where law firms are reevaluating and amending their DEI programs to avoid potential legal confrontations while maintaining their diversity goals.

Gibson Dunn Changes Diversity Award Criteria as Firms Face Suits

Law firms target DEI backlash as their own diversity programs draw fire

Citigroup Inc. is gearing up for a significant restructuring initiative, the largest in two decades, under the direction of CEO Jane Fraser. This move, aimed at reversing a persistent decline in the stock price, will see the company operate five primary businesses, doing away with the roles of three regional chiefs who supervised activities in approximately 160 countries. A reshuffle at the top echelons sees new roles for at least four of Fraser's senior deputies, and a search is underway for a head of banking. This structural overhaul is anticipated to lead to numerous job cuts, particularly in back-office functions, although precise numbers are yet to be determined.

Fraser acknowledges that these tough decisions might not be well-received universally within the company. Despite a recent rise, the company's shares have plummeted around 40% since Fraser assumed her role in early 2021. The newly formed five main operating units are spearheaded by Shahmir Khaliq, Andy Morton, Gonzalo Luchetti, Peter Babej (interim), and soon-to-join Andy Sieg. This adjustment is predicted to enhance coordination within the company, albeit with risks of unwanted exits and internal discord, as noted by Wells Fargo analyst, Mike Mayo. As the firm gears up to reduce its burgeoning workforce, which currently stands at 240,000, a significant focus will be on evaluating positions tied to eliminated sectors and regions.

Citi Plans Job Cuts as It Revamps Top Management Structure (4)

The Town of Westport in Connecticut is suing the IRS to reclaim approximately $466,638, alleging that the federal agency incorrectly assessed and collected taxes in the 2020 tax year. According to the lawsuit filed in the US District Court for the District of Connecticut, the IRS wrongly applied $354,302 and $88,440, which the town had paid in payroll taxes for the second quarter, to the first quarter of the same year. Consequently, a $4.5 million payroll tax deposit made by the town in the first quarter was mistakenly treated as a credit for other taxable years, creating an “artificial deficit” in 2020 and resulting in overpayments in other tax periods.

The town also contends that the IRS transferred $113,300 from the 2020 first quarter funds to settle a civil penalty from the fourth quarter of 2018, but failed to inform the town until September 2020. This mistake has apparently generated erroneous penalties for underpayment in various tax quarters. Despite Westport's requests for refunds, they haven't received any response from the IRS, which also hasn't commented on the case publicly.