On this day in history, October 4, 1974, the trial of key Watergate conspirators began, marking a seminal moment in American political history. The defendants were H.R. Haldeman, John Ehrlichman, John Mitchell, Robert Mardian, and Kenneth Parkinson. Each played a significant role in the Nixon administration and faced serious charges related to the Watergate scandal.

H.R. Haldeman, Nixon's Chief of Staff, was accused of conspiracy and obstruction of justice. He was ultimately convicted and served 18 months in prison. John Ehrlichman, a close advisor to Nixon, faced similar charges and was also convicted, serving 18 months. John Mitchell, the former Attorney General, was charged with conspiracy, obstruction of justice, and perjury. He was convicted and served 19 months in prison.

Robert Mardian, a lesser-known figure, was initially convicted but his conviction was later overturned on appeal. Kenneth Parkinson, a lawyer for the Committee for the Re-Election of the President, was acquitted of all charges.

The Watergate scandal originated from a break-in at the Democratic National Committee headquarters in 1972 and the Nixon administration's subsequent attempts to cover it up. Investigations revealed that Nixon had approved plans to conceal the administration's involvement, leading to a constitutional crisis and his eventual resignation.

The trial was a culmination of investigations by both the Department of Justice and the U.S. Senate Watergate Committee. These investigations were intensified by the discovery of a voice-activated taping system in the Oval Office, which provided crucial evidence against Nixon and his associates.

The scandal led to the indictment of 69 people, with 48 of them being convicted, many of whom were top Nixon administration officials. It also led to the impeachment process against Nixon, who became the only U.S. president to resign from office. His successor, Gerald Ford, later pardoned him.

The Watergate scandal had a lasting impact on American politics, leading to greater scrutiny of political actions and making the term "Watergate" synonymous with political scandal. It also led to significant reforms in campaign financing and governmental ethics. It remains a cultural touchstone, standing as the platonic ideal of the heights of presidential scandal until a young upstart out of Queens descended an escalator into the presidency and rewrote what was possible in the realm of scandal and legal entanglements.

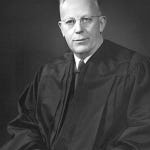

Judge Arthur Engoron, overseeing Donald Trump's civil fraud trial in New York, has imposed a gag order on Trump and others involved in the case. This decision came after Trump criticized the judge's top law clerk on social media. Engoron warned of "serious sanctions," potentially including contempt of court, for any violations of the gag order. The case, brought by New York Attorney General Letitia James, accuses Trump, his adult sons, and the Trump Organization of inflating asset values to secure favorable loans and insurance terms.

Trump had shared a social media post featuring the clerk and Senate Majority Leader Chuck Schumer, calling for the case's dismissal. The post was later deleted. James is seeking at least $250 million in fines and various bans against Trump and his sons from running businesses in New York.

Trump, who attended the trial, told reporters he plans to testify. The first government witness was Trump's former accountant, Donald Bender, who stated that financial statements for the Trump Organization were largely based on self-reported figures. Trump's lawyer questioned the accuracy of these reports.

The trial could last until December and will review additional claims including falsifying business records and insurance fraud. Other witnesses expected to testify include the Trump Organization's former CFO and Trump's former lawyer, Michael Cohen. Trump also faces four criminal indictments and a civil damages trial for defamation, all of which he denies.

Trump hit with gag order after lashing out at court clerk in NY fraud case | Reuters

The U.S. Supreme Court recently heard arguments concerning the funding structure of the Consumer Financial Protection Bureau (CFPB), an agency established to regulate predatory lending. The case is an appeal against a lower court ruling that found the CFPB's funding mechanism unconstitutional, as it draws money from the Federal Reserve rather than from budgets passed by Congress. Both liberal and some conservative justices, including Brett Kavanaugh and Amy Coney Barrett, expressed skepticism about the argument that the CFPB's funding violates the Constitution's "appropriations clause."

Kavanaugh noted that Congress could change the funding structure if needed, while Barrett questioned how the challengers would rectify the issue. U.S. Solicitor General Elizabeth Prelogar argued that the funding mechanism is lawful and similar to those of other financial regulators like the Federal Reserve Board and the Federal Deposit Insurance Corporation.

However, conservative justices like Clarence Thomas and Chief Justice John Roberts raised concerns about the agency's setup, questioning whether it undermines Congress's control over appropriations and the constitutional separation of powers.

The CFPB was created in 2010 to curb predatory lending practices and has delivered $16 billion in relief to consumers through various enforcement actions. The case has broader implications as it could affect the power of federal agencies, a topic the court is set to tackle in its new term.

Supporters of the CFPB warn that a ruling against the agency could leave consumers vulnerable to deceptive practices and jeopardize existing rules. A decision is expected by the end of June.

US Supreme Court appears wary in case targeting consumer financial watchdog | Reuters

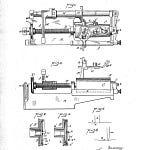

Hunter Biden, son of U.S. President Joe Biden, has pleaded not guilty to charges related to lying about his drug use while purchasing a handgun in 2018. This marks the first-ever criminal prosecution of a sitting U.S. president's adult child. Hunter Biden faces three counts, including lying on a federal form to acquire a Colt Cobra handgun and being an illegal drug user in possession of the firearm. The hearing took place in a federal courthouse in Wilmington, Delaware, and lasted 25 minutes.

Conditions for Hunter Biden's release pending trial were set, including clearing travel with a probation officer and abstaining from illegal drugs and alcohol. His attorney, Abbe Lowell, plans to file a motion to dismiss the case, arguing that a previous agreement to resolve the gun and separate tax charges should still be in effect. The case has constitutional implications, especially after the U.S. Supreme Court expanded gun rights under the Second Amendment last year.

The trial sets a historic precedent as it involves the adult child of a sitting president who is campaigning for reelection. The case has garnered significant attention, especially from Republicans who have long scrutinized Hunter Biden's activities. A ruling is expected to be filed by November 3.

Hunter Biden pleads not guilty to gun charges in Delaware court | Reuters

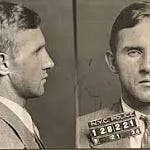

Sam Bankman-Fried, the founder of the now-defunct FTX cryptocurrency exchange, is facing trial on charges of stealing billions from customers. The trial resumed with the aim of completing jury selection and moving on to opening statements. The case comes nearly a year after FTX's collapse, which had a significant impact on financial markets and damaged Bankman-Fried's reputation. U.S. District Judge Lewis Kaplan has selected a pool of nearly 50 jurors, with the final panel expected to be chosen soon.

Prosecutors allege that Bankman-Fried misused FTX customer funds to support his hedge fund, Alameda Research, acquire luxury real estate, and make political donations. Three former associates, who have already pleaded guilty, are expected to testify against him. Bankman-Fried has pleaded not guilty, and his defense is likely to argue that while he may have mismanaged risk, he did not engage in theft.

The defense may also attempt to shift blame onto the cooperating witnesses, suggesting they are implicating Bankman-Fried to receive lighter sentences. Bankman-Fried has been in detention since August for likely witness tampering. The trial is closely watched given its implications for the cryptocurrency sector, which has been marred by scams and regulatory scrutiny.

Sam Bankman-Fried's trial to resume with jury selection, opening statements | Reuters

The IRS's recent Notice 2023-63 has redefined software development for the purpose of current year expensing, requiring most related costs to be amortized. This change poses a significant challenge for "bootstrap" software developers who typically self-fund their projects. These startups often rely on expensing their software development costs, which can make up a large portion of their annual expenses.

Previously, Section 174 of the tax code allowed businesses to either deduct research and experimentation costs in the current year or amortize them over a period. Most businesses preferred the former option as it allowed them to recoup costs immediately. However, the new IRS rules have created ambiguity, making it more advantageous for some to acquire software rather than develop it, thus discouraging innovation.

The new rules also introduce an administrative burden, requiring developers to meticulously track and categorize their activities to differentiate between what can and can't be expensed in the current year. This increases the complexity of tax compliance and demands additional resources and training.

Moreover, the rules leave open questions about what constitutes "maintenance activities" that don't give rise to upgrades and enhancements. Such ambiguities could lead to differing interpretations and increased litigation, further straining IRS resources.

The significance there is that so-called “maintenance activities” that do not give rise to upgrades or enhancements are expensable in the current year–but your guess is as good as mine what kind of development work would meet that criteria? On some level, does not every new software release intend to upgrade or enhance the previous version?

I suggest that either the post-TCJA changes must be rolled back or a more well-considered policy should be implemented. If not, there's a risk that these changes could stifle software innovation, particularly affecting startups and smaller companies that were previously incentivized to innovate.

New IRS R&E Rules Risk Stifling Software Innovation for Startups