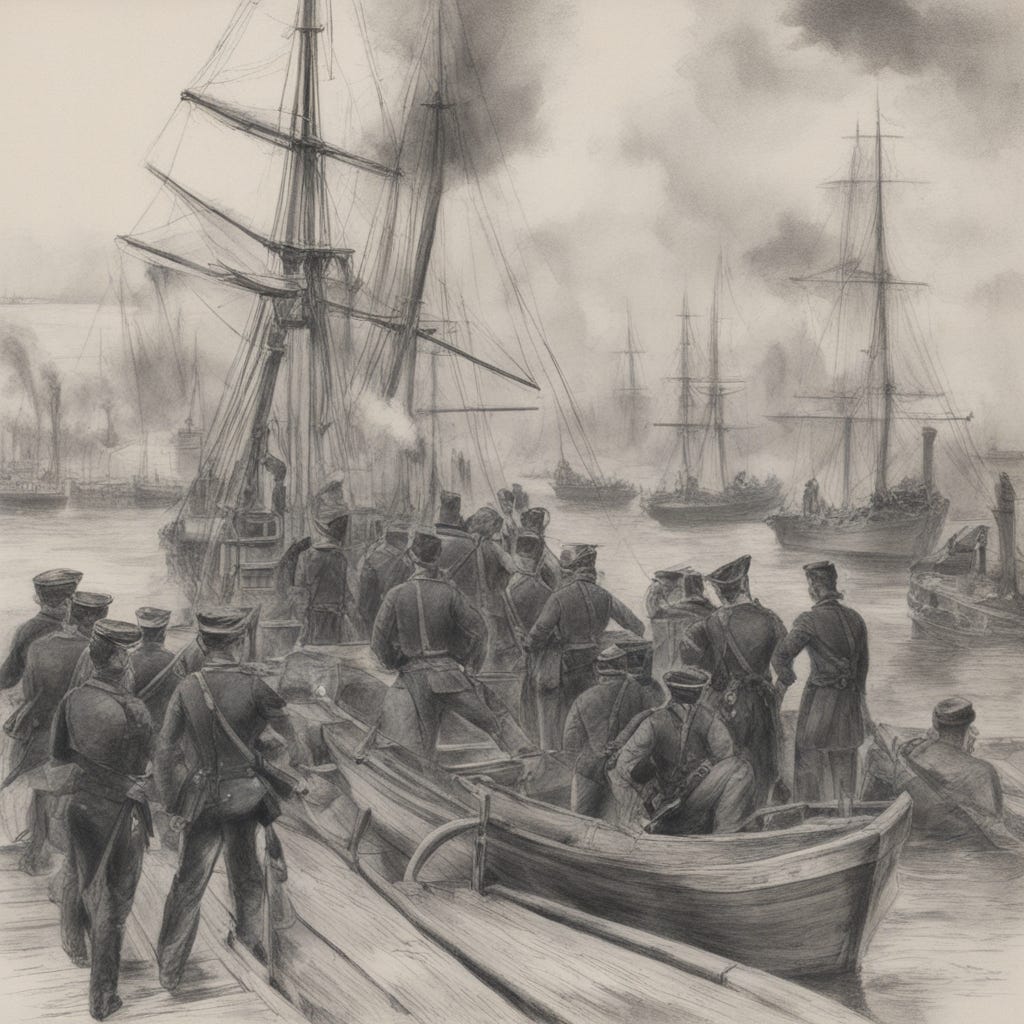

On this day in legal history, the “Trent Affair” occurred during the U.S. Civil War. The USS San Jacinto stopped the British mail ship Trent and arrested two Confederate envoys onboard–leading to a diplomatic crisis between the UK and the United States.

On the 8th of November, 1861, a diplomatic incident with potential major ramifications for the U.S. unfolded as Captain Charles Wilkes of the U.S. Navy seized two Confederate diplomats from the British vessel, the Trent. This bold action by Wilkes was not sanctioned by the U.S. government and rapidly escalated into an international crisis, with Great Britain deeming the seizure a blatant infringement on its neutrality. The Confederacy had hoped that the envoys, James Mason and John Slidell, would secure recognition and support from Britain and France, but their capture threatened to pivot the two powers from neutrality to active opposition against the Union.

The Trent Affair tested the diplomatic resolve of the Lincoln administration, which was simultaneously engaged in the Civil War. The British government's response was swift and stern, demanding the release of the envoys and an apology, while reinforcing its military presence near U.S. borders. The U.S. faced the predicament of managing foreign relations without provoking war with Britain. Through careful negotiation, the U.S. conceded to British demands, releasing the envoys and thus diffusing a situation that could have dramatically altered the course of the Civil War. Lincoln was reported to have quipped that he should like to fight “one war at a time.” The resolution of the Trent Affair highlighted the Union's commitment to maintaining international peace during its internal strife, while also confirming Britain's staunch defense of its declared neutrality.

On Britain’s side, the diplomatic crisis was occuring at the same time as a scandal in the royal family and before a terminally ill Prince Albert, consort to Queen Victoria. In the tense days leading up to Prince Albert's death, he played a pivotal role in steering the British response to the Trent Affair. His influence led to the critical offer to the United States: that an apology would suffice, coupled with the release of the detained Confederate envoys, to prevent hostilities. President Lincoln, aware of the perils of dual conflicts, agreed to these terms.

As Britain mourned Prince Albert, Lincoln expressed his condolences to Queen Victoria, underscoring the amicable relations between the nations. This gesture of diplomacy and shared sorrow laid the groundwork for a reciprocal display of sympathy from Queen Victoria when she later reached out to Mary Lincoln upon President Lincoln's assassination, highlighting a personal bond formed amidst national crises.

Milbank LLP has initiated the bonus season in the legal industry by increasing associate salaries by $10,000 and announcing annual bonuses. The salary range for associates at the firm now stands between $225,000 and $425,000, with bonuses reaching up to $115,000. The firm's chairman, Scott Edelman, attributes this to the firm's sustained high activity levels and anticipates this trend to continue. This move may influence other major law firms to adjust their salary structures to stay competitive. Despite a quieter transactions market, the legal industry is expected to maintain the current bonus scale. The announcement is part of a broader trend where law firms announce year-end bonuses towards the end of the year, often leading to a series of matching bonuses across firms.

Milbank Raises Associate Salaries And Announces Year-End Bonuses! - Above the Law

Milbank Raises Associate Salaries, Kicks Off Bonus Season

Cravath, Swaine & Moore has introduced a salaried partner tier, reflecting a shift among elite Wall Street law firms to adapt their compensation structures in the face of new market pressures. This move aims to retain key talent and maintain competitiveness, offering salaries to partners rather than shares in firm profits. The firm, known for its high-profile client work and traditional business model, has also relaxed its seniority-based pay system. These changes come as the firm expands, opening a Washington office and entering the UK legal market, all while ensuring that salaried partners still have the opportunity to become equity partners, according to Cravath’s presiding partner, Faiza Saeed.

Cravath Adds Salaried Partner Tier in Latest Wall Street Shift (1)

Ivanka Trump is scheduled to testify in a civil fraud trial involving her father Donald Trump's business practices. This trial, initiated by New York Attorney General Letitia James, alleges that the Trump family business inflated asset values. Judge Arthur Engoron has found evidence of fraud and is contemplating penalties. Donald Trump, along with his sons Donald Jr. and Eric, have denied any wrongdoing, attributing inaccuracies in property valuations to errors irrelevant to financial institutions. Ivanka was not deeply involved in the Trump Organization's operations during Trump’s presidency and was dismissed from the case by an appeals court. The lawsuit seeks substantial fines and business restrictions against the Trumps, amid other legal challenges the former president faces.

Ivanka Trump to testify in father's New York civil fraud trial | Reuters

WeWork is making its first appearance in U.S. bankruptcy court, seeking approval for a restructuring plan that would reduce its debt by $3 billion and decrease its real estate footprint. The office-sharing firm, supported by Softbank, filed for bankruptcy to manage over $4 billion in debt and high rent costs after a rapid expansion and a downturn in demand due to the pandemic. Despite renegotiating hundreds of leases, WeWork is looking to exit 69 more, including 41 in New York. U.S. bankruptcy law may give WeWork the leverage needed to reject these leases. The company, with $164 million in cash, is asking the court to allow the continuation of employee and critical vendor payments during the restructuring process.

WeWork seeks permission to begin canceling leases in bankruptcy | Reuters

Amazon's legal team, led by David Zapolsky, has sketched out their defense against the FTC's antitrust accusations in a private company meeting. Zapolsky called the company's actions "absolutely defensible behavior" and quoted Taylor Swift to underscore the company's stance against criticism. The FTC's lawsuit claims that Amazon has created an illegal monopoly by restricting sellers on its platform from offering lower prices on competing platforms. Amazon refutes these allegations, arguing that showcasing higher-priced products would undermine customer trust. The company, which has been under investigation for four years, may be forced to divest assets if the lawsuit succeeds. Zapolsky also addressed the FTC's criticism of Amazon's logistics services, emphasizing that their use is optional for sellers. He reassured employees that Amazon is familiar with such legal challenges and is prepared to defend its practices in court.

Exclusive: Amazon.com previews FTC defense at companywide meeting -transcript | Reuters

My column this week is on the importance of the federal estate tax as a mechanism for combatting wealth inequality.

The federal estate tax, designed to prevent wealth accumulation across generations, is exemplified by the case of George Steinbrenner, who passed away in 2010—a year when the estate tax was not in effect. Steinbrenner's estate benefited significantly, avoiding a tax that would have been imposed at a rate of 45% the previous year or 55% the following year. This absence of tax exemplifies how fortunes can be preserved and potentially grown through investment, influencing the wealth of future generations. The history of the estate tax in the United States dates back before the Revenue Act of 1916, which formally introduced variable rates based on estate value. These rates have changed over time, peaking at 77% during World War I to fund national efforts and declining thereafter, including a scheduled repeal in 2010.

The impact of such a suspension is profound, with the Steinbrenner family's potential to grow their inheritance considerably through investments. For instance, if the tax savings were invested in an index fund or in a company like Apple Inc., the returns could have been substantial. The Tax Cuts and Jobs Act of 2017 further altered the estate tax landscape by doubling the exemption amounts, resulting in significant revenue loss for the government. This legislative change is temporary, however, set to expire in 2025. The Penn Wharton Budget Model suggests that without these cuts, the revenue generated could have been nine times greater, illustrating the substantial role of the estate tax in federal revenue generation.

As wealth inequality continues to rise, the estate tax serves as a crucial tool in the pursuit of economic equity. Its effectiveness has waned over the decades due to increasing exemptions and decreasing rates. The upcoming expiration of the TCJA's provisions is an opportunity to reassess and restructure the estate tax to better align with its original intent. Reducing the exemption threshold and increasing rates could serve as a step toward mitigating wealth disparity, emphasizing the tax's role in promoting a more balanced economic landscape.

Steinbrenner’s Legacy Shows Importance of Federal Estate Tax