This Day in Legal History: The Stamp Act of 1765

On this day, March 22, 1765, a pivotal event in the prelude to the American Revolution occurred when the British Parliament enacted the Stamp Act. This legislation required that a wide array of documents within the American colonies—ranging from newspapers and legal documents to playing cards and dice—be printed on specially stamped paper produced in London, carrying an embossed revenue stamp. This act marked the first direct tax imposed by Britain on its American colonies, designed to raise funds to pay for the British troops stationed in North America after the French and Indian War.

The Stamp Act ignited a firestorm of protest across the American colonies. Colonists united under the banner of "No taxation without representation," arguing that the British Parliament had no authority to levy taxes on them since they were not represented in the House of Commons. This principle challenged the very foundation of British authority in the colonies and set the stage for the escalating conflict that would eventually lead to the American Revolution.

The colonies' response was swift and decisive. By October 1765, the Stamp Act Congress convened in New York City, bringing together representatives from nine of the thirteen colonies. This Congress was a significant step towards colonial unity, drafting a detailed petition to King George III and the British Parliament, demanding the repeal of the Stamp Act. They argued that only their own colonial assemblies had the legal authority to tax them.

The Act also spurred the formation of secret societies, such as the Sons of Liberty, which organized protests and even intimidated stamp distributors, leading many to resign. The widespread boycott of British goods by American colonists further strained economic relations between the colonies and the mother country.

The colonial resistance had a profound impact. By March 1766, less than a year after its enactment, the Stamp Act was repealed by Parliament, marking a significant victory for colonial opposition. However, the relief was short-lived as Parliament passed the Declaratory Act, asserting its right to legislate for the colonies "in all cases whatsoever," setting the stage for future conflicts.

The Stamp Act and its repeal were crucial moments in American legal and political history, illustrating the colonies' growing resolve to govern themselves and laying the groundwork for their eventual fight for independence. This day marks not just a legislative act but a moment that galvanized the American spirit of liberty and self-determination.

Law firms are reinforcing their diversity, equity, and inclusion (DEI) initiatives in response to conservative criticism and economic downturns, which have jeopardized recent advancements in diversity. Initiatives like increasing DEI education and clarifying the inclusivity of their programs are among the steps taken by firms such as Davis Wright Tremaine and Foley & Lardner. This response aims to sustain the progress made following the widespread calls for racial justice after George Floyd's murder in May 2020, which had led to a notable increase in the hiring of women and people of color. However, a Supreme Court decision and subsequent legal threats have pressured firms to modify their DEI practices, leading to a decline in the hiring of diverse candidates. The industry has witnessed a reduction in requests for diverse candidates and a significant drop in hiring amid a challenging economic climate, with global deal activity and recruitment of third-year law students declining. Despite these challenges, law firms remain committed to their diversity goals, as evidenced by the resilience of DEI fellowship programs and the positive outcomes for diversity fellows. This commitment is seen as crucial in maintaining diversity within the legal profession, despite the current political and economic headwinds.

Law Firms Boost Diversity Defenses After Conservative Backlash

In a significant legal ruling, Sysco Corp. has been granted permission by a federal judge in Illinois to transfer its claims in a major chicken price-fixing lawsuit to Burford Capital Ltd., the external financier that provided $140 million in funding for the litigation. This decision comes after Burford Capital opposed Sysco's intentions to settle some of the claims for what it considered an insufficient amount, leading to an agreement that Burford would assume control of the claims. The move faced opposition from meat producers, who argued that Burford, being an outsider to the direct litigation, should not be allowed to take over the cases. This stance was somewhat supported by a previous ruling in Minnesota, where a judge denied a similar request by Burford to substitute itself in pork and beef price-fixing lawsuits, citing concerns that the funder's profit motives could obstruct settlement efforts. However, Judge Thomas M. Durkin's approval of Burford's substitution in the chicken litigation case marks a departure, emphasizing that such arrangements are increasingly common in modern litigation. This decision represents a notable victory for Burford Capital in its strategic litigation financing endeavors, highlighting the evolving dynamics of legal funding and the roles of external investors in litigation.

Burford Notches Win in Quest to Take Over Sysco Chicken Lawsuits

The U.S. government's antitrust lawsuit against Apple, alleging monopolistic practices in the smartphone market, echoes the landmark 1998 case against Microsoft. However, legal experts believe that the differing market dynamics between Apple's current smartphone dominance and Microsoft's past control over desktop software present unique challenges for the government's case. The lawsuit accuses Apple of stifling competition and innovation through restrictive app developer policies, potentially leading to higher consumer prices. Apple, holding a 55% share of the North American smartphone market, contrasts with Microsoft's 95% desktop OS market share in the 1990s, suggesting a less clear-cut case of monopolistic behavior. Additionally, Apple faces significant global competition from Android, which commands a strong market presence outside North America. A previous antitrust case brought by Epic Games against Apple did not find that Apple users were unduly "locked-in" to its ecosystem, potentially complicating the government's position. Nonetheless, the Department of Justice and the Biden Administration's Federal Trade Commission are pursuing the case, reflecting a willingness to challenge big tech companies to foster competition and innovation in the sector.

Apple antitrust suit mirrors strategy that beat Microsoft, but tech industry has changed | Reuters

In my column this week, I examine President Joe Biden's proposed housing tax credit, highlighted in his state of the union address, which aims to alleviate the financial burden for homeowners amidst high mortgage rates. I argue that while the intention behind the tax credit is commendable, its focus on demand rather than supply could exacerbate the existing housing imbalance. To truly foster homeownership, I suggest reforms to the Low-Income Housing Tax Credit (LIHTC) program to incentivize the construction of affordable homes. I also discuss the stalled Affordable Housing Credit Improvement Act of 2023 and propose radical supply-side reforms, such as more permissive tax-exempt financing for developers, to address the affordability crisis effectively.

I critique the tax credit proposal for potentially favoring those who can afford higher upfront costs, thus disadvantaging lower-income buyers who need immediate relief. This, coupled with the proposal's year-end application, could inadvertently sideline the very demographic it aims to help. Moreover, without addressing the supply side of affordable housing, the policy might inflate prices further, making homeownership less accessible for first-time and lower-income buyers. Despite the good intentions behind Biden's proposal, I stress that solving the affordable housing crisis requires a comprehensive approach that balances supply and demand, and caters to the immediate financial needs of aspiring homeowners. Policymakers must prioritize long-term strategies over temporary fixes to ensure that homeownership is attainable for all Americans.

Biden Housing Tax Credit Targets Demand, but Supply Is the Issue

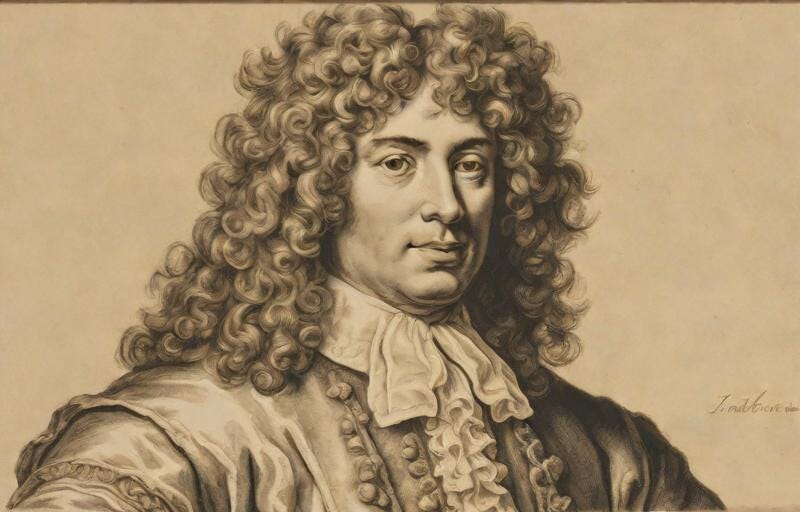

This week’s closing theme is by Jean Baptiste Lully.

Jean-Baptiste Lully, born Giovanni Battista Lulli in Florence, Italy, in 1632, became one of the most influential composers of the French Baroque era and a founding father of French opera. His journey from Italian immigrant to the court composer for King Louis XIV of France is a remarkable tale of talent, ambition, and transformation. Lully's mastery of music and his ability to mirror the grandeur of the Sun King's reign through his compositions led him to become the superintendent of the king's music and the director of the Royal Academy of Music.

Moving to France in his teens, Lully initially served as a dancer and violinist at the court of Louis XIV. His exceptional musical skills soon caught the attention of the king, leading to his appointment as the court composer. Lully's close relationship with Louis XIV allowed him to monopolize French opera, a position he maintained through a mix of talent and shrewd manipulation. He significantly contributed to the development of the tragédie lyrique, a genre combining French classic drama and ballet with music, which became immensely popular in the 17th century.

One of Lully's most enduring works is "Le bourgeois gentilhomme," a comédie-ballet created in collaboration with the playwright Molière. First performed in 1670, this piece was commissioned by Louis XIV and is a satirical take on the pretensions of the social-climbing merchant class. The suite from "Le bourgeois gentilhomme," particularly its overture, showcases Lully's genius in blending witty musical themes with the elegance and majesty of the French court. The overture, with its lively and refined character, sets the tone for a work that is both entertaining and a subtle critique of contemporary society.

Lully's influence extended beyond the confines of the opera house and the court, shaping the future of French music and leaving a legacy that endured well into the 18th century and beyond. His death in 1687, caused by gangrene from a wound sustained while conducting, marked the end of an era. Yet, through compositions like "Le bourgeois gentilhomme," Lully's genius continues to be celebrated for its pivotal role in the development of Western classical music.

Without further ado, the overture from “Le bourgeois gentilhomme,” by Jean Baptiste Lully.