This Day in Legal History: Smith v. Allwright

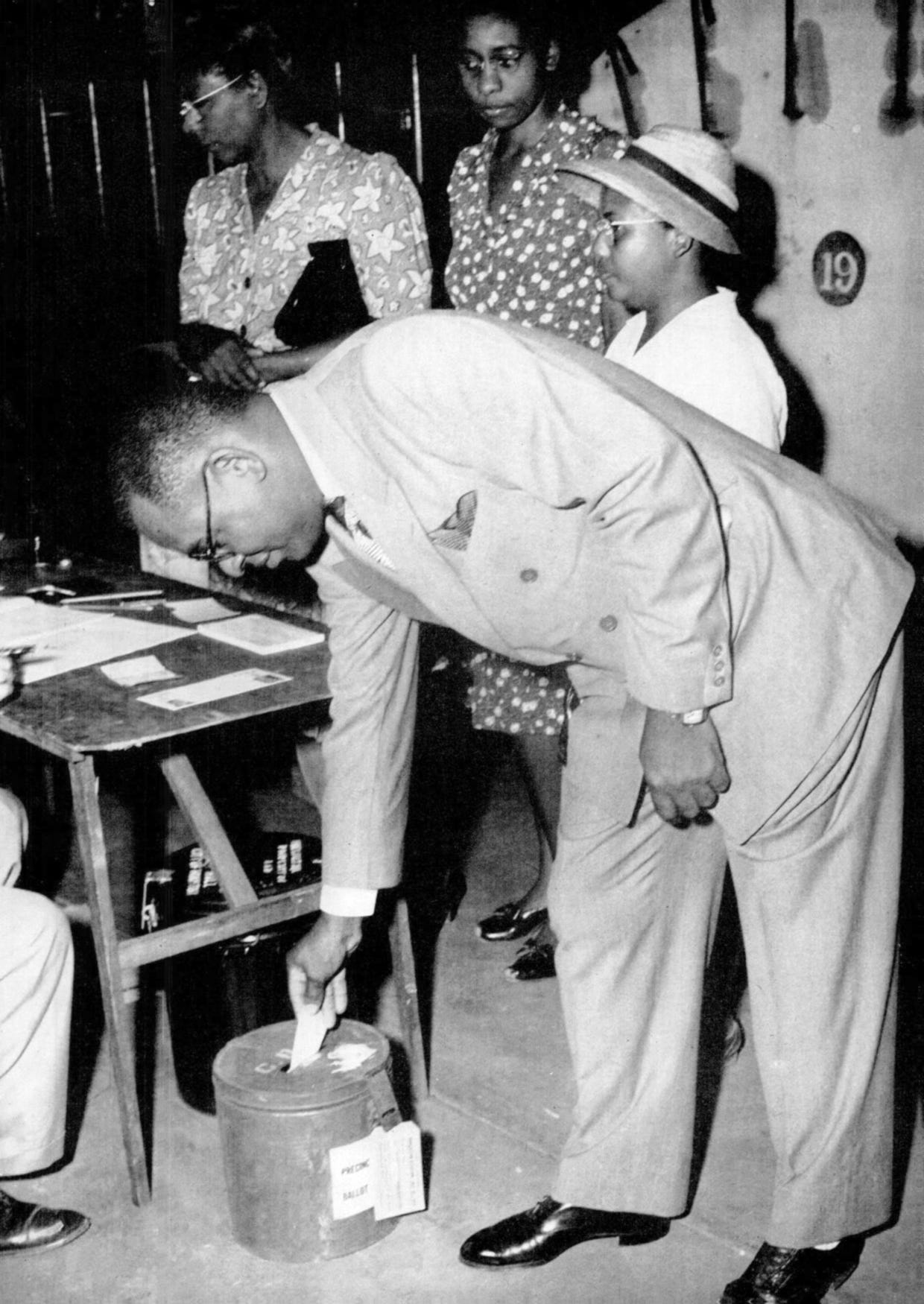

On April 3, 1944, the United States Supreme Court delivered a landmark decision in Smith v. Allwright, reshaping the landscape of voting rights in the American South. The case centered on Lonnie E. Smith, a Black voter from Texas who was denied the right to vote in the Democratic Party’s primary election due to a party rule that only allowed white voters to participate. At the time, the Democratic primary was the only meaningful election in many Southern states, as the party dominated politics, making exclusion from the primary tantamount to disenfranchisement.

The Texas Democratic Party argued that, as a private organization, it had the right to determine its own membership and voting rules. However, the Court, in an 8–1 decision authored by Justice Stanley Reed, held that primaries were an integral part of the electoral process and could not be exempt from constitutional scrutiny. The justices concluded that excluding Black voters from primaries violated the Fifteenth Amendment, which prohibits racial discrimination in voting.

This ruling effectively overturned the Court’s 1935 decision in Grovey v. Townsend, which had upheld the use of white primaries. The Smith decision marked a critical step toward dismantling the legal architecture of Jim Crow voter suppression. While states continued to use other tactics to limit Black political power, the ruling energized civil rights activists and laid the foundation for future litigation.

By reasserting federal authority over state electoral practices, Smith v. Allwright signaled a turning point in the judicial battle against racial segregation and disenfranchisement. It also demonstrated the Court’s growing willingness to confront systemic racism in voting, a commitment that would deepen during the civil rights era. This case is remembered as one of the pivotal moments in the long struggle for voting rights in the United States.

The U.S. Supreme Court largely upheld the FDA’s authority to deny applications for flavored vaping products, supporting actions taken during the Biden administration under the 2009 Tobacco Control Act. The unanimous ruling rejected arguments from companies like Triton Distribution and Vapetasia LLC, which claimed the FDA unfairly imposed new testing requirements and ignored their marketing plans. These companies had applied to sell flavors like “Suicide Bunny Mother’s Milk and Cookies” and “Killer Kustard Blueberry.”

The Court found the FDA’s approach consistent with its earlier guidance, despite claims from the 5th U.S. Circuit Court of Appeals that the agency had pulled a “regulatory switcheroo.” Justice Samuel Alito wrote the opinion, agreeing with most of the FDA’s decisions but sending the case back to the appeals court to reassess whether the agency erred in refusing to consider the companies’ marketing plans—an element the FDA had previously called “critical” for evaluating youth appeal.

Though the ruling solidifies the FDA’s regulatory role, its long-term impact is uncertain. President Trump, in furtherance of his undying effort to always be on the wrong side of everything, has promised to “save vaping,” though his campaign never clarified what that means in terms of future regulation. The case, FDA v. Wages and White Lion, leaves the appeals court to decide whether any procedural missteps by the FDA were ultimately harmless.

Supreme Court Largely Backs Biden-Era FDA on Flavored Vapes (1)

Elon Musk’s time in Washington as head of the Department of Government Efficiency (DGE) appears to be nearing its end. Both Musk and President Trump have hinted that his departure is imminent, with Trump noting that DGE itself “will end.” Originally designed as a temporary advisory panel to cut federal costs, DGE has morphed into a more integrated part of the government, staffed with Musk allies tasked with canceling contracts and slashing budgets.

However, signs of a wind-down are emerging. DGE staff are being reassigned to federal agencies, layoffs are underway, and the organization’s influence seems to be diminishing. Musk, a special government employee limited to 130 working days per year, is approaching that limit, though neither he nor the administration has confirmed when his tenure will end.

Musk’s recent political involvement also took a hit when his preferred candidate for the Wisconsin Supreme Court lost, despite significant financial backing and a campaign visit. Tesla’s 13% drop in quarterly sales adds further pressure. Trump praised Musk’s contributions but acknowledged his corporate obligations, suggesting a graceful exit is likely rather than a public fallout.

DGE had once shared leadership between Musk and Vivek Ramaswamy, but Ramaswamy left to run for Ohio governor. While Musk boasted about aiming to reduce the deficit by a trillion dollars, critics say the group’s progress has been overstated. Despite speculation, Trump hasn’t committed to keeping DGE operational post-Musk, indicating the administration may be moving to a new phase of governance.

Musk could be headed for a Washington exit after turbulent times at Trump's DOGE | AP News

President Donald Trump announced a new agreement with law firm Milbank, marking another chapter in the growing divide among U.S. law firms over how to handle pressure from his administration. According to Trump’s Truth Social post, Milbank initiated the deal, which includes a commitment to provide $100 million in pro bono legal services for causes like veterans’ support and combating antisemitism.

The agreement comes amid a broader Trump administration effort to punish firms that have opposed or challenged his policies. Several law firms—such as Perkins Coie, WilmerHale, and Jenner & Block—have filed lawsuits seeking to block executive orders they claim were retaliatory and violated constitutional protections of free speech and due process. Federal judges recently issued temporary blocks on parts of those orders.

In contrast, other firms including Paul Weiss, Skadden Arps, and Willkie Farr have opted for settlement-style deals with the administration to avoid similar sanctions. Milbank's chairman, Scott Edelman, reportedly described the agreement as aligned with the firm’s values and praised the productive talks with the administration.

This situation underscores a growing rift in the legal community: some firms are resisting what they see as political coercion, while others are choosing cooperation to preserve their standing with the federal government.

Trump reaches agreement with Milbank law firm | Reuters

President Trump announced a sweeping new tariff policy during a Rose Garden press conference, unveiling a "reciprocal" trade strategy aimed at countering what he described as decades of unfair treatment by U.S. trading partners. Holding a copy of a government report titled Foreign Trade Barriers, Trump declared that the U.S. will now impose tariffs that are approximately half the rate other countries charge American exports—but with a minimum baseline tariff of 10%, and many rates going significantly higher.

Countries hit with new tariffs include:

China: 34%

European Union: 20%

Japan: 24%

South Korea: 25%

Switzerland: 31%

United Kingdom: 10%

Taiwan: 32%

Malaysia: 24%

India: 26%

Brazil: 10%

Indonesia: 32%

Vietnam: 46%

Singapore: 10%

Trump also confirmed a 25% tariff on all foreign-made automobiles, stacking on the above-referenced rates, effective at midnight, and pointed to motorcycle tariffs as a key example of longstanding trade imbalances. He argued that U.S. manufacturers face rates as high as 75% abroad, while the U.S. imposes just 2.4%.

The president justified the move as necessary to protect American jobs and industry, singling out countries like Canada and Mexico for benefiting from U.S. subsidies and defense spending. Detroit autoworker Brian Pannebecker spoke in support, calling Trump’s actions a hopeful step toward revitalizing shuttered factories.

While Trump emphasized that the tariffs fall short of full reciprocity to avoid overwhelming allies, he made clear the era of what he called “economic surrender” was over. The announcement included plans to sign an executive order formalizing the new tariff regime, which boosted U.S. stock futures as markets reacted positively to the aggressive trade stance. Oh no I’m sorry, I got that wrong: stock futures tanked.