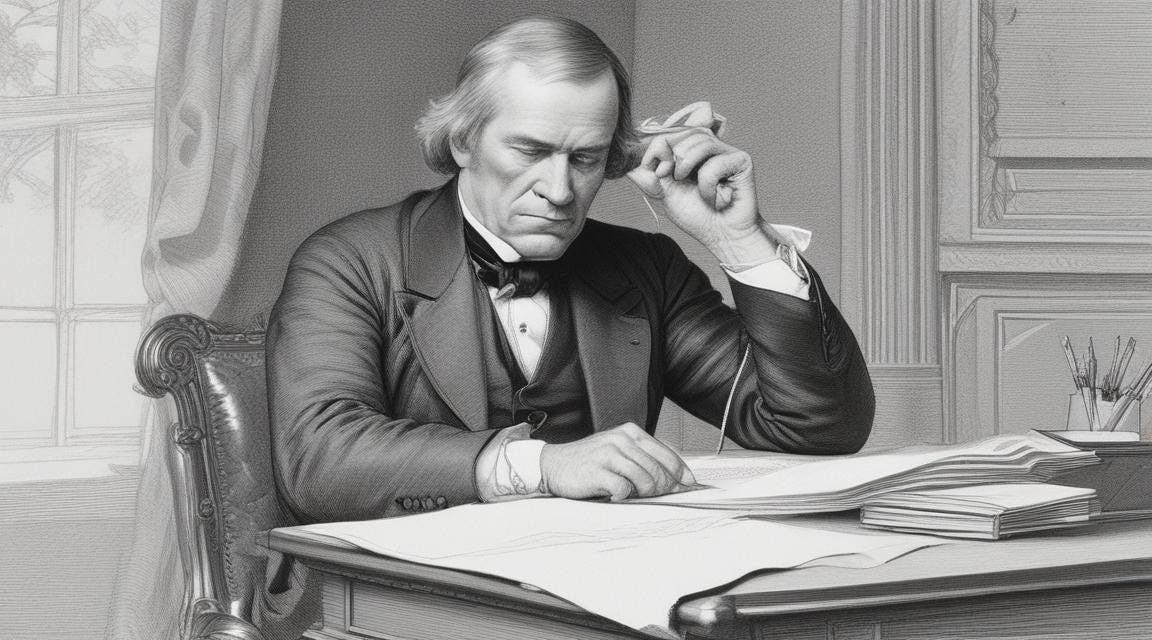

This Day in Legal History: President Johnson Acquitted

On May 16, 1868, a significant moment in U.S. legal and political history occurred when President Andrew Johnson was acquitted in his impeachment trial. Johnson, who had ascended to the presidency following the assassination of Abraham Lincoln, was charged with high crimes and misdemeanors, primarily stemming from his violations of the Tenure of Office Act. This law, which was later repealed, had been designed to restrict the power of the President to remove certain officeholders without the Senate’s approval.

The crux of the case against Johnson was his attempt to remove Edwin Stanton, the Secretary of War, without Senate consent, which ignited a fierce political battle with the Radical Republicans who dominated Congress. These lawmakers sought a stricter Reconstruction of the Southern states following the Civil War, a process Johnson had obstructed through his lenient policies towards the former Confederate states.

The impeachment trial in the Senate was a closely watched affair, reflecting deep national divisions during a tumultuous period in American history. Johnson narrowly escaped removal from office by one vote, securing a "not guilty" verdict with a tally of 35-19, just shy of the two-thirds majority required for conviction.

This verdict had lasting implications for the balance of power between the presidency and Congress, highlighting the complexities of presidential impeachment. Johnson’s trial set a significant precedent, establishing that political disagreements alone were not sufficient grounds for removal from office under the Constitution. This event remains a pivotal chapter in the saga of American governance and legal standards, underscoring the enduring struggle over the limits of presidential authority.

Ghostwriting in legal briefs refers to the practice where an experienced attorney, often a specialist in Supreme Court matters, writes or significantly contributes to a brief without their name appearing on the document. This tactic is predominantly used in opposition briefs—the documents that argue why the Supreme Court should not agree to hear a particular case. The strategy behind ghostwriting is to leverage the expertise of seasoned Supreme Court advocates without drawing attention to the case with a high-profile name. This can make the brief more persuasive without signaling that the case might be significant enough to warrant the Court's attention.

Despite there being no explicit rules against ghostwriting in court documents, and the American Bar Association deeming it ethically permissible under certain circumstances, the practice has sparked debate. Critics, like law professor Daniel Epps, argue that it might be seen as misleading because it intentionally hides the involvement of influential lawyers to influence the Court's decisions indirectly. Advocates of transparency suggest that disclosing all authors of a brief could lead to more informed decision-making by the justices.

However, some legal experts argue that ghostwriting is detectable by justices familiar with the distinct writing styles and argumentative structures typical of veteran Supreme Court lawyers. This recognition could potentially undermine the purpose of ghostwriting by making the justices aware of the underlying significance and expert handling of the case. Despite these concerns, ghostwriting remains a utilized, albeit controversial, tactic in the strategic presentation of cases to the Supreme Court.

Ghostwriters Try Steering Supreme Court Justices Away from Cases

Quinn Emanuel, a prominent law firm, has integrated an AI-powered tool from Pre/Dicta to predict judicial decisions in litigation cases, enhancing strategic planning and case management. The tool, developed by Pre/Dicta—a company specializing in judicial analytics—utilizes artificial intelligence to analyze various judge-specific factors such as age, gender, education, and net worth, which the company's CEO, Dan Rabinowitz, suggests, in reporting by Bloomberg Law, influence decision-making. This predictive capability is seen as critical for litigators, akin to writing briefs.

The technology is designed to anticipate judges' rulings on various motions including summary judgments, class certifications, and venue transfers with an impressive accuracy of about 85%, as evidenced by tests on 50,000 cases. Ryan Landes, a partner at Quinn Emanuel, highlights the strategic advantage this provides, potentially altering the cost-benefit analysis of legal actions based on predicted outcomes.

Currently, the tool is used only for analyzing federal court cases, with plans to expand to state court cases, starting with California. This AI application underscores the broader trend of law firms leveraging new technologies to improve efficiency and decision-making.

Quinn Emanuel Adopts AI-Powered Tool to Predict Judicial Rulings

Federal lawmakers have begun efforts to repeal a new rule by the Department of Labor (DOL) that broadens the definition of a fiduciary, impacting more financial advisors. This rule, finalized in April, extends fiduciary responsibilities to include advice on rolling over 401(k) funds into annuities and individual retirement accounts. Critics, including some Wall Street firms and life insurers, argue that this rule could hinder their ability to earn commissions and offer services, potentially complicating retirement planning for individuals.

The resolution to overturn the rule is led by Senators Ted Budd, Bill Cassidy, Joe Manchin, and Roger Marshall, along with support in the House from Representatives Rick Allen and Virginia Foxx. They claim the rule constitutes executive overreach and could limit consumers' financial management options and access to advice, risking their future financial security.

The rule is already facing legal challenges from the insurance industry, which seeks to prevent its enforcement through a lawsuit filed under the Administrative Procedure Act. This legal action requests both a preliminary and permanent injunction against the rule.

The process to repeal the rule involves a Congressional Review Act (CRA) procedure, where Congress, after receiving a report from the Labor Department, has 60 days to pass a joint resolution of disapproval. If passed, this would proceed to President Joe Biden's desk, where he is likely to veto it based on previous actions, such as his veto of a resolution against the DOL’s ESG rule in March 2023. However, there remains a possibility for Congress to override such a veto.

Biden 401(k) Advice Rule Repeal Effort Begins in Congress (2)

Boeing Co. is facing significant scrutiny from shareholders at its annual meeting on May 17, reflecting deep dissatisfaction with the company's management and response to ongoing safety issues with its jets. Shareholders, advised by proxy-voting firms Glass Lewis and Institutional Shareholder Services (ISS), are particularly critical of Boeing’s board and executive compensation, signaling discontent with how the company has addressed the systemic safety failures that have plagued its newer aircraft models.

Glass Lewis has recommended voting against the reelection of certain board members, including those leading the audit and aerospace safety committees, due to their perceived failure in overseeing necessary safety improvements. Additionally, ISS has advised shareholders to reject the outgoing CEO Dave Calhoun’s pay package, which saw a substantial increase despite the company’s troubling safety record and operational challenges. This package includes a significant bonus that coincided with additional safety incidents, raising concerns about the misalignment between executive compensation and company performance.

The dissatisfaction comes amid a backdrop of operational failures that have not only affected Boeing’s share price, which has dropped significantly, but also raised potential for criminal prosecution due to violations of a deferred-prosecution agreement related to past crashes. These ongoing issues, coupled with a wave of executive retirements, including that of CEO Calhoun, suggest a tumultuous period for Boeing.

Despite the likelihood that the board members and executive pay proposals will pass, a substantial number of dissenting votes would highlight the shaky confidence investors have in the current leadership's ability to turn around the company’s fortunes and address its safety culture effectively. This climate of uncertainty could also impact Boeing’s ability to attract a capable successor for Calhoun, as potential candidates may be deterred by the reputational risks and scrutinized compensation involved.

Boeing Safety Woes Fuel Opposition to CEO’s Pay, Board Make-Up