This Day in Legal History: Residence Act

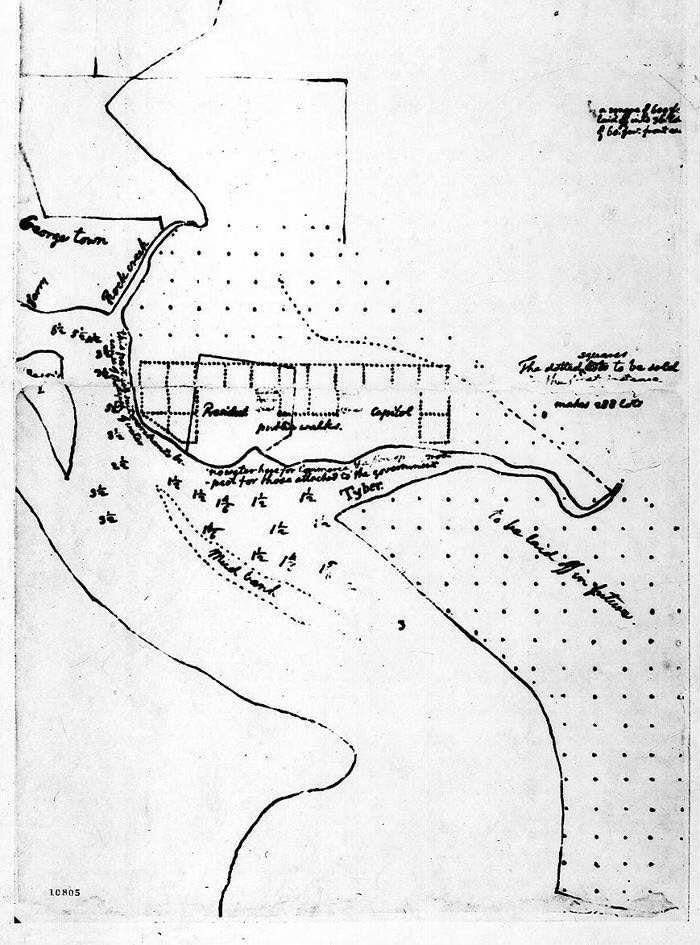

On July 16, 1790, the U.S. Congress passed the Residence Act, establishing the District of Columbia as the permanent seat of the federal government. The decision was the product of a political compromise between Alexander Hamilton and Thomas Jefferson, brokered in part by James Madison, whereby southern states would support federal assumption of state debts in exchange for locating the capital along the Potomac River. The land for the new district was ceded by both Maryland and Virginia, and the Constitution allowed for a federal district not exceeding ten miles square. President George Washington personally selected the site, which straddled the Potomac and included portions of Alexandria and Georgetown.

Pierre Charles L’Enfant was tasked with designing the city’s layout, envisioning broad avenues and grand public spaces to reflect the dignity of the new republic. In the early years, however, Washington, D.C. remained underdeveloped and muddy, with many of the federal buildings still under construction. Over time, most major institutions and monuments were built on the Maryland side of the river, causing concern among residents on the Virginia side. In 1846, responding to economic neglect and the declining significance of Alexandria as a port, Congress approved Virginia’s request to retrocede its portion of the district. This land, now Arlington County and part of the city of Alexandria, rejoined Virginia, reducing the size of D.C. to its current boundaries.

The Residence Act and subsequent development of Washington, D.C. created a unique legal and political entity—neither a state nor part of one. This status continues to affect the rights and representation of its residents, a legal debate that remains active today.

An $8 billion shareholder lawsuit against Meta CEO Mark Zuckerberg and other current and former company leaders began this week in Delaware’s Chancery Court, focusing on alleged failures to uphold Facebook's 2012 privacy agreement with the Federal Trade Commission (FTC). The plaintiffs argue that Zuckerberg, Sheryl Sandberg, Peter Thiel, Marc Andreessen, Reed Hastings, and others knowingly allowed Facebook user data to be harvested—specifically in relation to the Cambridge Analytica scandal that surfaced in 2018. That breach led to a record $5 billion FTC fine, which shareholders now want the defendants to personally reimburse, along with additional legal costs.

The trial, presided over by Chief Judge Kathaleen McCormick, will feature testimony from several high-profile witnesses, including White House Chief of Staff Jeffrey Zients, who served on Meta’s board from 2018 to 2020. Plaintiffs claim Zuckerberg profited by selling Facebook stock before the public learned of the data misuse, allegedly netting over $1 billion. Defendants deny all wrongdoing, maintaining they relied on compliance experts and were misled by Cambridge Analytica.

This is the first oversight liability case of its kind to reach trial, a notoriously difficult claim under Delaware corporate law. Meta itself is not named as a defendant, and the company has declined to comment, though it has previously stated it has invested heavily in privacy protections since 2019.

Facebook privacy practices the focus of $8 billion trial targeting Zuckerberg | Reuters

Kilmar Abrego, a Salvadoran migrant wrongly deported from the U.S. despite legal protections, is scheduled to appear in a Tennessee federal court on smuggling charges, though the future of his case remains murky. Abrego had been living legally in Maryland with a work permit and was protected by a 2019 court order barring deportation to El Salvador due to threats of gang violence. Nonetheless, he was deported in March and imprisoned there before being returned to the U.S. after federal prosecutors indicted him for allegedly participating in a human smuggling operation.

He has pleaded not guilty, and his lawyers claim the charges are politically motivated—a cover for the Trump administration’s mishandling of his case. They also challenge the credibility of prosecution witnesses, who are alleged co-conspirators seeking to avoid their own deportation or charges. A magistrate judge ordered Abrego released on bail, but prosecutors are appealing, arguing he poses a flight risk and should remain detained. Even if released from criminal custody, immigration officials have said they plan to detain him immediately for possible deportation.

Judge Waverly Crenshaw is expected to hear arguments and potentially rule on his bail status. Abrego’s attorneys have asked to delay any release until Wednesday to prevent sudden removal before he can challenge deportation. The administration has signaled it may try to deport him to a third country—possibly Mexico or South Sudan—instead of El Salvador. His case has become emblematic of broader concerns over due process in the Trump administration’s aggressive immigration enforcement agenda.

Returned deportee Abrego due in Tennessee court; future of smuggling case uncertain | Reuters

Milbank, a prominent New York-based law firm, is representing the cities of Newark and Hoboken in a lawsuit brought by President Donald Trump’s administration over their immigration policies. The federal suit, filed in May, accuses the cities of obstructing immigration enforcement by acting as “sanctuary jurisdictions.” Milbank’s defense team includes notable figures like former acting U.S. Solicitor General Neal Katyal and ex-New Jersey Attorney General Gurbir Grewal, now both partners at the firm.

Milbank’s involvement in the case comes just months after it agreed to a deal with the Trump administration to avoid being targeted by executive orders aimed at major law firms. Trump had accused those firms of politicizing legal work and using racial diversity initiatives improperly. In response, several firms—including Milbank—committed to providing nearly $1 billion in pro bono legal services to mutually agreed-upon causes. Milbank set aside $100 million as part of its agreement, though it was not formally sanctioned.

Despite that arrangement, Milbank has taken on multiple high-profile cases opposing the Trump administration. In addition to defending Newark and Hoboken, Katyal is leading two other cases challenging Trump policies, including import tariffs and alleged wrongful termination of a federal board member. The firm’s role in these cases highlights its continued legal pushback against the administration, even while navigating its negotiated settlement with the White House.

Law firm Milbank defends NJ cities in Trump immigration lawsuit | Reuters

A piece I wrote for Inside Higher Ed this week argues that tax policy deserves a central place in the undergraduate liberal arts curriculum—not as a technical specialty but as a cornerstone of civic education. I open by reflecting on the tax legislation passed under President Trump, that is the One Big Beautiful Bill Act, noting how its complexity served political ends by shielding its full implications from public understanding. That opacity, I suggest, is not accidental—and it's exactly why we need to teach tax more broadly.

In my course at Drexel University, “Introduction to Tax Theory and Policy,” I approach tax not as accounting or law but as a form of civic infrastructure. The course welcomes students from all majors, encouraging them to think about taxation in terms of fairness, power, and values. We explore how tax policy shapes economic behavior, redistributes resources, and reflects assumptions about what and whom government should support. Students analyze topics ranging from estate taxes to digital surveillance and propose their own reforms grounded in ethical and civic reasoning.

By demystifying the tax code and framing it as a site of public decision-making, I aim to empower students to see themselves not just as subjects of tax policy but as potential shapers of it. Their engagement—often surprisingly enthusiastic—reveals a hunger for this kind of critical, values-based education. Ultimately, I argue that tax belongs in the liberal arts because it teaches students not just how the world works, but how it’s been made to work—and how it could be remade more equitably.