This Day in Legal History: Black Tuesday

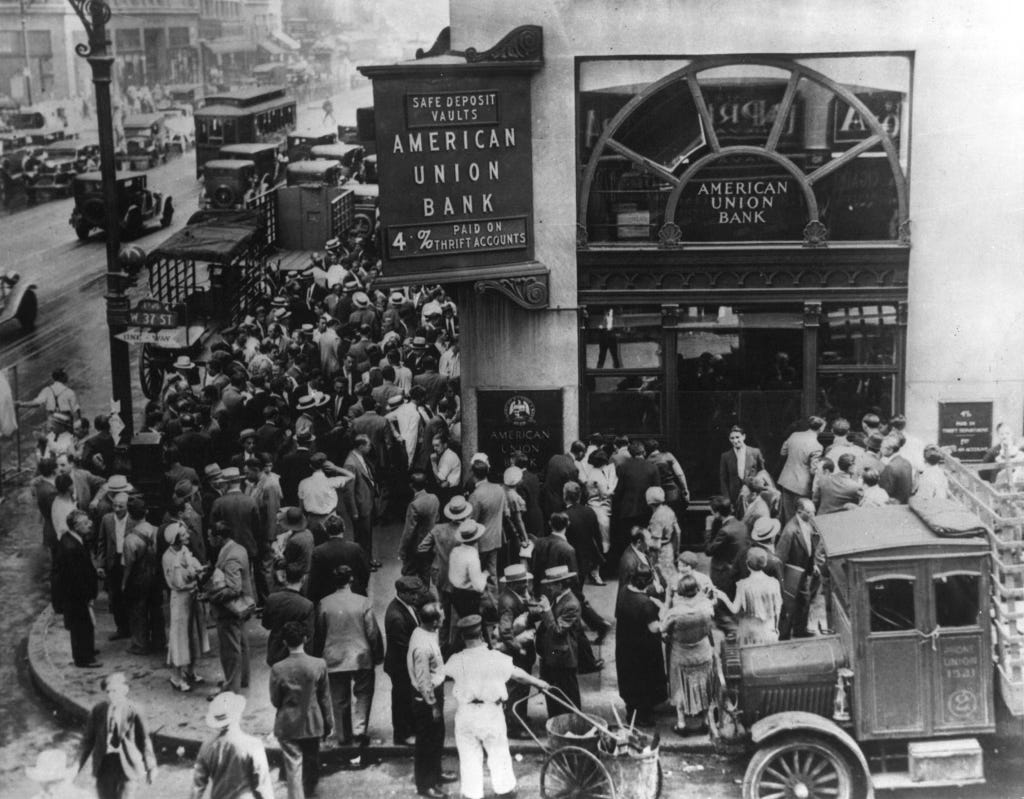

On October 29, 1929, the United States experienced a significant legal and economic turning point with the stock market crash known as "Black Tuesday." This day marked the beginning of the Great Depression, a period of profound economic hardship that spurred vast changes in U.S. financial laws and regulations. The crash revealed serious flaws in the stock market, including speculative trading, inadequate banking oversight, and lack of investor protections, which led to widespread economic instability and massive unemployment. In response, the U.S. government, under President Franklin D. Roosevelt’s administration, enacted substantial legislative reforms aimed at stabilizing the economy and preventing similar disasters in the future.

Key legislation introduced during this period included the Securities Act of 1933 and the Securities Exchange Act of 1934, which established critical oversight mechanisms for the stock market. The 1933 Act mandated that companies provide transparent financial information before public stock offerings, while the 1934 Act created the Securities and Exchange Commission (SEC), tasked with regulating the securities industry to protect investors and maintain fair trading practices. Additional reforms under the New Deal included the Glass-Steagall Act, which separated commercial and investment banking to reduce conflicts of interest and curb risky practices in the banking sector.

The legal changes initiated after Black Tuesday set foundational principles for U.S. financial regulation, significantly increasing the federal government's role in monitoring economic practices and protecting public interests. These reforms not only stabilized the U.S. economy but also introduced regulatory practices that continue to shape financial law and securities oversight to this day.

The Republican National Committee and the Pennsylvania GOP have asked the U.S. Supreme Court to block a Pennsylvania court decision requiring the counting of provisional ballots for voters whose mail-in ballots were rejected due to errors. The state Supreme Court’s ruling, made on October 23, supports two voters from Butler County who sought to count their provisional ballots after their mail-in votes were disqualified for lacking a secrecy envelope. The Republicans argue this decision undermines the legislature's authority to set election rules and comes too close to the November 5 presidential election, potentially influencing the results in the swing state. They have requested that, if the U.S. Supreme Court does not entirely suspend the ruling, it at least order these provisional ballots to be segregated, allowing further review post-election.

This dispute highlights differences in ballot counting practices across Pennsylvania’s counties, with most already counting provisional ballots in cases of rejected mail-ins, unlike Butler County. Republicans claim the state law disallows counting provisional ballots if a defective mail-in was received, while Democrats counter that voters with uncounted mail-in ballots should have their provisional ballots counted. The Pennsylvania Supreme Court sided with the Democrats, citing voter protections in the state constitution to prevent disenfranchisement.

Republicans ask US Supreme Court to block Pennsylvania provisional ballots decision

Cybersecurity firm CrowdStrike and Delta Air Lines are suing each other over a widespread IT outage on July 19 that disrupted multiple industries and led to significant flight cancellations. CrowdStrike filed a lawsuit in U.S. District Court in Georgia, claiming Delta wrongly blamed it for the outage and repeatedly rejected support from CrowdStrike and Microsoft. CrowdStrike seeks a declaratory judgment and coverage of legal fees. In a separate suit filed in Georgia’s Fulton County Superior Court, Delta accused CrowdStrike of issuing an untested software update that caused 8.5 million Windows computers to crash globally, leading to 7,000 flight cancellations and an estimated $500 million in losses. Delta’s lawsuit claims the faulty update severely impacted its operations and tarnished its reputation, and it seeks compensation for various damages including legal fees and future revenue loss.

The July incident also spurred a U.S. Department of Transportation investigation. CrowdStrike countered that Delta’s own technological response exacerbated delays, with both companies now contesting liability.

CrowdStrike, Delta sue each other over flight disruptions | Reuters

Since President Joe Biden took office, the U.S. Justice Department has initiated 12 civil rights investigations into police departments, focusing on "pattern or practice" probes of alleged systemic misconduct. Although Attorney General Merrick Garland quickly launched investigations into departments like Minneapolis and Louisville following high-profile police killings, none have reached binding reform settlements, known as consent decrees. The lack of final agreements has raised concerns, especially given the possibility of the Justice Department abandoning these cases if a Republican administration assumes office in 2025.

The department has encountered obstacles, including political resistance and a slow, resource-intensive review process involving body-worn camera footage. Under former President Donald Trump, the Justice Department largely avoided using consent decrees, and though Garland has reversed this stance, progress remains slower compared to the Obama administration’s efforts, which saw 17 investigations and multiple consent decrees in Obama’s first term alone. Additionally, some cities, like Phoenix, openly oppose consent decrees, complicating negotiations. Experts highlight that current leadership may be less committed to aggressively pursuing these investigations than in past administrations. Meanwhile, the Justice Department faces challenges in balancing internal staffing shortages and external political pressures.

Biden's Justice Dept has yet to reach accords in police misconduct cases

In my column for Bloomberg this week I lay out how green roofs, a near necessity for urban rainwater management, need to be incentivized.

Green roofs have promising benefits for urban areas, including managing rainwater runoff, reducing cooling demands, and addressing urban heat. However, adoption rates are low, despite tax incentives. For instance, New York City’s green roof tax credit, initiated over a decade ago, has seen minimal uptake due to insufficient financial rewards—only 14 properties have claimed credits since 2011. While some cities have tried enhancing these incentives, the results remain limited since property owners often find installation costs too high relative to the benefits.

A more impactful approach would be to introduce a tiered, time-sensitive incentive system, offering substantial early tax benefits that gradually decrease, followed by tax penalties for delays. For example, an initial tax credit of $20 per square foot in the first year could significantly reduce the installation cost, then drop annually, creating urgency. After the incentive period ends, penalties would begin, making it costly for owners to delay green roof installations. Such a model motivates property owners by balancing substantial early rewards with future penalties, ensuring that adoption increases over time without continuously high government expenditure. This combined incentive-penalty approach would likely make green roofs both a fiscally smart and environmentally beneficial option.

The general idea here is a proposed use of a “carrot-and-stick” tax policy in sequence, designed to balance fiscal encouragement with financial consequences. This approach may be a useful strategic legal framework to drive sustainable development.