This Day in Legal History: Louis XVI Put on Trial

On December 26, 1792, a significant event in legal history unfolded as Romain de Sèze, a dedicated defense attorney, stood before a French Revolutionary court to defend the deposed King Louis XVI. This trial was a pivotal moment during the tumultuous times of the French Revolution. Louis XVI, once a symbol of monarchical power, faced thirty-three serious charges, primarily centered around treason and crimes against the state. These accusations reflected the intense political and social upheaval of the era.

De Sèze's defense was a remarkable effort under the circumstances, given the prevailing revolutionary fervor and the public's animosity towards the monarchy. His arguments focused on disputing the legitimacy of the charges and the authority of the court itself to try a king. Despite his efforts, the trial led to a conviction for Louis XVI. On January 15, 1793, the former king was found guilty.

This trial and the subsequent events were a testament to the drastic changes in French society and governance. The execution of Louis XVI by guillotine on January 21, 1793, just days after his conviction, marked a profound shift in the balance of power. It signaled the end of absolute monarchy in France and the rise of revolutionary ideals.

The trial of Louis XVI remains a critical study in legal history, illustrating the complexities of law and justice during times of political upheaval. It serves as a reminder of how legal processes can be deeply intertwined with the socio-political context of their times.

In fiscal year 2023, the Securities and Exchange Commission (SEC) witnessed a significant decline in the number of whistleblowers receiving awards, despite an unprecedented surge in tips. The SEC received over 18,000 tips, marking a 50% increase from the previous year. However, only 68 informants were compensated, a stark contrast to the more than 100 in each of the preceding two years. This decline occurred in a period marked by a record payout to a single whistleblower, who received $279 million for exposing a $1 billion fraud at Swedish telecom LM Ericsson.

The program, established under the 2010 Dodd-Frank financial reform law following Bernie Madoff's Ponzi scheme, is designed to encourage reporting of financial misconduct. Since its inception, it has recovered over $6 billion and paid out nearly $2 billion to informants. In the last year alone, nearly $600 million was awarded, with significant sums going to a few individuals, including a group of seven whistleblowers who shared $104 million.

However, the program faces challenges. Attorneys and participants note it is struggling under its own success, hampered by insufficient resources and staffing despite the increasing number of tips. This has led to delays in payouts and difficulties in appeal processes for whistleblowers. Additionally, there is a lack of transparency and communication from the SEC, as evidenced by the limited information shared in its annual reports and decisions to seal critical rulings or deny Freedom of Information Act requests.

A 2022 Bloomberg Law investigation revealed that the SEC often exceeded its mandate for secrecy and inconsistently applied its own rules in decision-making. The whistleblower process, involving an initial vetting by the enforcement division followed by payment determination by the Office of the Whistleblower, can be lengthy, with payouts varying between 10% and 30% of recovered funds.

Calls for reform have been made, urging Congress to allocate more resources to expedite the process and address issues like non-payment in cases of corporate bankruptcy. The case of whistleblowers John McPherson and John Barr, who uncovered a $1 billion fraud but were denied awards due to the bankruptcy of the involved company, highlights this issue.

The purpose of the SEC whistleblower program extends beyond protecting informants; it aims to uphold the stability of U.S. financial markets. Experts suggest improvements like providing more updates to whistleblowers during lengthy investigations and ensuring adequate resources for the program to continue its critical role in enforcing U.S. securities laws.

SEC Payouts to Whistleblowers Plummet Amid Record Surge in Tips

In 2024, legislative and ballot initiatives across various U.S. states will focus on raising minimum wages, influenced by past successes in this arena. States that haven't yet reached a $15 minimum wage, like Ohio and Oklahoma, are considering ballot proposals, while Michigan faces legal battles over past and future initiatives. In contrast, states with an existing $15 minimum wage, such as California and Hawaii, are pushing for even higher rates, with California proposing an $18 minimum by 2026 and Hawaii enacting a gradual increase to the same amount by 2028.

A notable development in California includes industry-specific minimum wages, with $20 for fast-food workers and $25 for health-care facility workers, a strategy that labor groups may replicate in other labor-friendly states. This trend reflects a shift in labor strategies, focusing on sector-specific wage increases. However, these rising wages present challenges for employers, especially small businesses, grappling with staffing shortages and inflation.

The federal minimum wage has remained at $7.25 since 2009, leading state and local governments to take the lead in wage policy. In 2024, over 20 states and around 40 cities and counties will implement increased minimum wages. Despite these efforts, some, like Sen. Bernie Sanders, advocate for a higher nationwide minimum wage, facing resistance even within the Democratic Party.

Progressive groups argue that recent wage increases are insufficient for workers, particularly in high-cost areas like New York. They urge further legislative review and adjustment, citing inflation as a factor in reassessing wage goals. The "Fight for $15" movement, once a benchmark, now seems outdated as advocates push for higher minimums in several states.

Several states are set to reach or exceed $15 minimum wages in 2024, with local governments in some areas already mandating over $17 per hour. In Republican-majority states, where legislatures oppose wage hikes, voter-approved ballot measures have successfully raised minimum wages, as seen in Florida and Nebraska. Upcoming ballot measures in Ohio and Oklahoma are thus a focus for groups like the National Federation of Independent Business (NFIB), which sees these initiatives as critical battlegrounds. Meanwhile, Virginia Democrats are attempting to raise the state's minimum wage to $15 by 2026, facing potential gubernatorial opposition.

Minimum Wage Hikes Primed for Ballot, Statehouse Battles in 2024

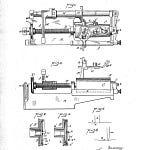

On December 26, Apple Inc. appealed a U.S. International Trade Commission (ITC) decision to ban imports of its Apple Watches that infringe on patents held by medical monitoring technology company Masimo. The ban, which took effect the same day, specifically targets Apple Watches using a pulse oximeter feature for reading blood-oxygen levels, a technology incorporated since the Series 6 model in 2020. The U.S. Trade Representative Katherine Tai, after careful consultation, chose not to reverse the ban.

Apple, disagreeing with the ITC's decision, stated it is taking measures to resume sales of its Apple Watch Series 9 and Apple Watch Ultra 2 in the U.S. The company has already paused sales of these models in the U.S., but they remain available through other retailers. The ban does not affect the Apple Watch SE model or previously sold watches.

Masimo has accused Apple of stealing its pulse oximetry technology and incorporating it into the Apple Watch. A previous jury trial on Masimo's allegations ended in a mistrial, and Apple has countersued Masimo for patent infringement in a separate case.

This ban comes amid a broader context where the Biden administration has not vetoed ITC rulings, continuing a trend since the Obama administration. The ban is significant given that Apple's wearables, including the Apple Watch, are a substantial revenue generator for the company.

Apple Watch import ban takes effect after Biden administration passes on veto | Reuters

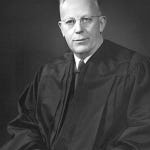

Twitter, now known as X Corp, was found to have breached contracts by not paying millions of dollars in promised bonuses to its employees, as ruled by a U.S. federal judge. Mark Schobinger, the former senior director of compensation at Twitter, filed a lawsuit against the company in June, alleging breach of contract. He claimed that Twitter, both before and after its acquisition by Elon Musk, had committed to paying employees 50% of their 2022 target bonuses, which were never disbursed.

U.S. District Judge Vince Chhabria denied Twitter's motion to dismiss the case, stating that Schobinger's claim plausibly constituted a breach of contract under California law. The judge affirmed that a binding contract was formed when Twitter offered the bonus in exchange for Schobinger's work. Twitter's argument, asserting that only an oral promise was made and that Texas law should apply, was rejected by the judge, who ruled that California law was applicable and dismissed Twitter's counterarguments.

Since Musk's takeover, X Corp has faced numerous lawsuits from former employees and executives. These lawsuits include allegations of discrimination against various groups, including older employees, women, and workers with disabilities, as well as accusations of failing to provide advance notice for mass layoffs. The company has denied any wrongdoing in these cases. The ruling on the breach of contract regarding unpaid bonuses adds to the legal challenges faced by the company under its new management.

Twitter violated contract by failing to pay millions in bonuses, US judge rules | Reuters

In my column this week, I discuss the proposed bills in the New York State Assembly and Senate aimed at repealing property tax exemptions for private universities. These bills primarily target large institutions such as New York University and Columbia University, which benefit significantly from these exemptions. However, I argue that without broader reforms, such repercussions would only lead to increased tuition fees, burdening students.

I propose a progressive solution: linking university endowment taxes to tuition rates. This approach would compel universities to absorb the costs of property tax reforms while restraining tuition hikes. I emphasize the economic principle of incidence, highlighting how universities, like landlords, pass costs onto students, similar to tenants facing rent increases. This phenomenon has implications beyond fiscal aspects, potentially reshaping the socioeconomic landscape of campuses and threatening diversity.

Considering the recent U.S. Supreme Court decision on affirmative action, universities are seeking alternative ways to maintain diversity. Increased tuition could disproportionately affect lower-income students, impacting the demographic composition of these institutions. In response, I suggest a two-pronged policy reform. Firstly, introducing a state-level tax on university endowments, akin to the federal Tax Cuts and Jobs Act of 2017, which taxes certain large endowments. Secondly, implementing a simple endowment tax that rises with tuition increases.

This approach would pressure universities to find alternative funding sources instead of raising tuition. It aims to make a dollar taken from students less valuable than one sourced elsewhere. Additionally, universities should be prevented from cutting scholarships and grants as a means to counterbalance property tax expenses.

Proper implementation of these reforms would require careful consideration of tuition thresholds and tax rates to discourage universities from raising tuition. The revenue generated should ideally support public university systems without disadvantaging private university students. This balanced approach seeks to ensure that tax policies do not adversely affect students' educational opportunities and financial burdens.

New York College Tax Exemption Bills Need Progressive Solution