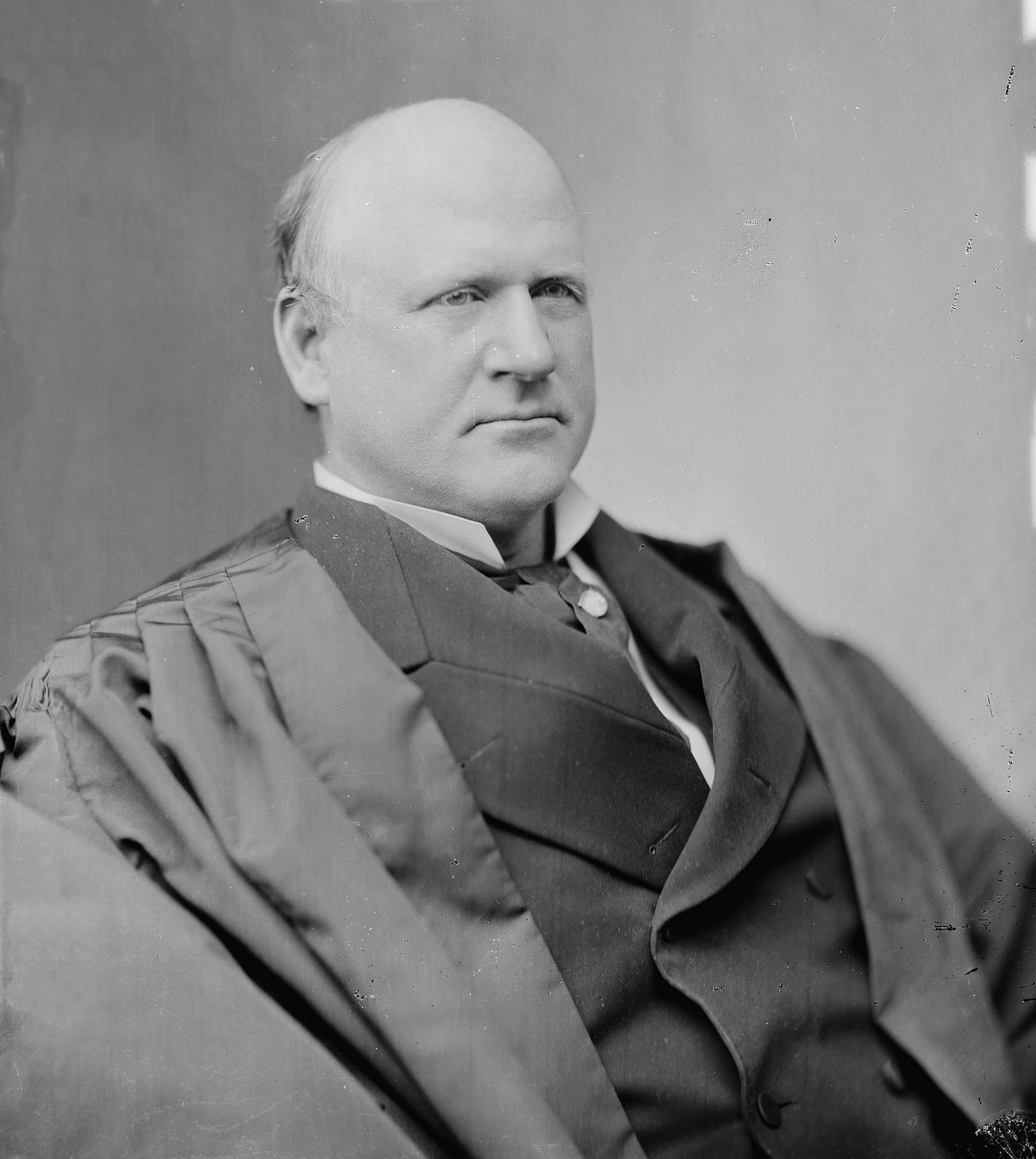

This Day in Legal History: John Marshall Harlan Dies

On October 14, 1911, Supreme Court Justice John Marshall Harlan I died, closing the chapter on one of the Court’s most powerful voices of dissent. Appointed in 1877 by President Rutherford B. Hayes, Harlan served for 34 years and left an indelible mark on constitutional law—not through majority opinions, but through unwavering dissents that often read as moral indictments of the Court’s direction.

Most famously, Harlan stood alone in Plessy v. Ferguson (1896), rejecting the Court’s embrace of “separate but equal” and warning that the Constitution is “color-blind.” At a time when the legal system was ratifying segregation, Harlan insisted that racial classifications violated both the spirit and letter of the Fourteenth Amendment. His lone dissent—widely criticized at the time—would later become foundational to the Court’s reversal in Brown v. Board of Education more than half a century later.

But Harlan’s commitment to constitutional principles extended beyond race. He defended civil liberties in United States v. E.C. Knight Co., supported expansive readings of the Thirteenth and Fourteenth Amendments, and warned against unchecked corporate power. His approach was rooted in a belief that the Reconstruction Amendments were designed not just to end slavery, but to secure full legal equality.

Though his views often put him in the minority, time has proven Harlan prophetic. His jurisprudence helped shift the constitutional center of gravity in the 20th century, as future courts took up the causes he championed alone. Remarkably, his grandson, John Marshall Harlan II, would go on to sit on the Court as well, carving out his own legacy in cases like Katz v. United States and Reynolds v. Sims.

Justice Harlan I’s death marked the loss of a constitutional conscience—one that held firm against the tide of his era. His dissents remain a blueprint for principled judging, reminding us that sometimes the most enduring legal influence comes not from prevailing, but from refusing to go along.

In a massive trial that began this week in London’s High Court, over 1.6 million claimants are suing several major carmakers—including Mercedes-Benz, Ford, Nissan, Renault, Peugeot, and Citroën—over allegations that they used illegal “defeat devices” to cheat diesel emissions tests. The lawsuit, one of the largest in UK legal history, follows in the wake of Volkswagen’s 2015 “dieselgate” scandal and targets vehicles manufactured between 2012 and 2017.

Claimants argue that these manufacturers deliberately programmed cars to meet legal nitrogen oxide (NOx) emissions standards only under lab testing, while on-the-road emissions were allegedly up to 12 times higher—harming the environment and misleading consumers. They seek compensation for what they claim was a systemic, industry-wide choice to cheat rather than comply with the law.

The defendants deny any wrongdoing, rejecting comparisons to VW and maintaining that emissions systems are legally and justifiably calibrated to function differently under certain conditions for technical and safety reasons. A central point of contention is whether the sample vehicles in the case contain prohibited defeat devices.

The trial currently focuses on 20 vehicles, but its outcome will set a precedent for nearly 850,000 claims and influence another 800,000 similar suits against other carmakers, including Vauxhall/Opel and BMW. The court’s decision on liability is expected by mid-2026, with damages to be determined separately.

Carmakers accused in huge UK lawsuits of cheating diesel emissions tests | Reuters

Visa and Mastercard have agreed to a $199.5 million settlement to resolve a class action brought by merchants who alleged the companies colluded to shift fraud-related costs onto businesses. Filed in federal court in Brooklyn, the settlement—still awaiting judicial approval—stems from a lawsuit first initiated in 2016, challenging rule changes that made merchants liable for chargebacks when they hadn’t upgraded to chip-enabled point-of-sale systems.

The plaintiffs argued this policy shift violated antitrust laws, claiming Visa and Mastercard moved in parallel to implement changes that benefited the networks while leaving merchants exposed to fraud losses without any offsetting fee reductions. According to the proposed agreement, Visa will pay $119.7 million and Mastercard will contribute $79.8 million. Discover and American Express, also named in the litigation, previously agreed to a $32.2 million settlement.

While all four companies deny wrongdoing, plaintiffs’ lawyers praised the deal, saying it recovers around 13% of the best-case damages scenario and over half of a more conservative estimate. Mastercard stated the settlement supports its broader efforts to increase security through technological upgrades, while Visa and the plaintiffs’ counsel did not comment.

This case is separate from the larger $5 billion settlement Visa and Mastercard reached in 2019 over allegations of fixing credit and debit card fees.

Visa, Mastercard agree to $199.5 million settlement in merchants’ class action | Reuters

Federal courts in California and Alabama recently fined two attorneys thousands of dollars for submitting legal filings that contained fake case citations generated by AI. These sanctions highlight a persistent problem: despite repeated warnings, some lawyers continue to rely uncritically on generative AI tools that produce fictitious case law, a phenomenon known as “hallucination.” Judges in both cases criticized the attorneys for failing to verify the AI-generated content, calling the misconduct more serious than simple oversight.

In Alabama, Judge Terry F. Moorer imposed a $5,000 sanction on James A. Johnson, a court-appointed criminal defense attorney, who filed a motion containing fabricated citations. The judge noted that Johnson used a Microsoft Word plugin called Ghostwriter Legal and submitted the motion during a holiday weekend while caring for a relative, but emphasized that such explanations do not excuse the lack of basic diligence. Johnson must now disclose the sanctions order in all cases he handles for the next year, and his client—visibly upset in court—requested new counsel, delaying the case.

In California, Judge Araceli Martínez-Olguín fined attorney Edward A. Quesada $1,000 after his civil filing contained at least three false citations. Quesada admitted he had run out of time and may have accidentally copied one fake citation from an AI-generated web summary. He was also ordered to complete a CLE course on responsible AI use, with the judge citing his failure to stay informed about relevant legal technologies as a violation of professional conduct rules.

Fake AI Citations Produce Fines for California, Alabama Lawyers

In my column for Bloomberg this week, I examine the property rights implications at the heart of Pung v. Isabella County, a case the US Supreme Court has agreed to hear. I argue that when the government seizes and sells property for unpaid taxes, “just compensation” shouldn’t be defined by whatever price the property fetches at a government-run auction. That process—entirely designed and controlled by local officials—often prioritizes administrative efficiency over fair market value, turning tax sales into what I describe as “clearance rack” events.

The problem is structural. Local treasurers are incentivized to close the books quickly rather than ensure former owners recover equity. That means the government may undersell a home, pay itself the back taxes, and call it a day—leaving the former owner uncompensated for the true value of what they lost. Worse, when courts treat the auction price as constitutionally adequate, they allow the taker to set the value of what it took.

I draw a comparison to Tyler v. Hennepin County, where the Court ruled the government can’t pocket surplus proceeds from a tax sale. Pung asks the natural follow-up: what rules apply when determining how much surplus exists? If courts accept fire-sale auction prices as “just compensation,” they effectively endorse an end-run around the Fifth Amendment.

As a compromise, I propose a clear rule: auction prices should only be presumed fair if they fall within 10% of an appraised value. Outside that range, the burden should shift to the government to prove the sale was legitimate. After all, if local governments want the legitimacy of a market sale, they need to run a sale that looks like one. Otherwise, taxpayers are left holding the bag—punished not for failing to pay taxes, but for the government’s indifference to recovering real value from their property.