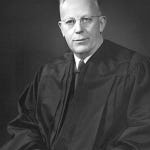

On this day, June 12th, in legal history the landmark Supreme Court Decision Loving v. Virginia was decided.

On June 12, 1967, a relatively scant 56 years ago, the Supreme Court issued its decision in Loving v. Virginia. Mildred and Richard Loving, an interracial couple, faced legal challenges when they moved to Virginia, where interracial marriage was prohibited. They filed a lawsuit, arguing that the ban violated the Equal Protection Clause. The Court ruled in their favor, stating that the Virginia law violated the Fourteenth Amendment due to its clear intention to impose racial restrictions. The Court reasoned that the law discriminated against individuals based on race, as it criminalized marriages between a white person and a black person. This landmark decision expanded the Court's interpretation of the Equal Protection Clause and the rights it safeguards, acknowledging that individuals should not be treated differently or penalized based on their race when it comes to marriage.

Chief Justice Burger, writing for the majority, held:

“The clear and central purpose of the Fourteenth Amendment was to eliminate all official state sources of invidious racial discrimination in the States.

…

There is patently no legitimate overriding purpose independent of invidious racial discrimination which justifies this classification. The fact that Virginia prohibits only interracial marriages involving white persons demonstrates that the racial classifications must stand on their own justification, as measures designed to maintain White Supremacy. We have consistently denied the constitutionality of measures which restrict the rights of citizens on account of race. There can be no doubt that restricting the freedom to marry solely because of racial classifications violates the central meaning of the Equal Protection Clause. . . .”

For perspective, Loving v. Virginia was decided in 1967 – the same year Kurt Cobain was born. Bans on interracial marriage are a relative new thing and, without vigilance, similar restrictions of rights can easily coalesce around other marginalized groups.

A Washington state agency and two officials have been ordered by a jury to pay $2.4 million to an employee as compensation for retaliation she faced due to whistleblowing and opposing workplace bias. Kim Snell successfully proved that the state Department of Social and Health Services, Judith Fitzgerald, and Una Wiley violated her rights under whistleblower protection laws and Washington's Law Against Discrimination. The jury awarded Snell $83,000 in back pay, $320,000 in front pay, $201,000 in lost retirement benefits, and $1.8 million in noneconomic damages. The defendants' bid for summary judgment on Snell's retaliation claims was rejected by Judge John H. Chun, as they failed to meet the burden of proving the absence of a factual issue for trial. Snell's protected activities included reporting discriminatory comments and engaging in whistleblowing against wasteful spending and unfair hiring practices.

Washington State Employee Wins $2.4 Million for Job Retaliation

New Jersey lawmakers are pushing for a significant overhaul of the state's corporate business tax through a revenue-neutral package. The proposed bill, SB 3737, includes changes to how the state taxes the earnings of foreign subsidiaries of multinational corporations, as well as modifications to the method of apportioning taxable income and determining economic presence or nexus with the state for out-of-state businesses.

The legislation aims to update New Jersey's corporate business tax, which has not been modified since 2018. The bill is expected to move forward with an amendment that removes a controversial provision granting the director of taxation broad discretion in determining the composition of the combined group for tax purposes. The proposed changes are intended to be revenue-neutral and operate independently of broader budget discussions, which have faced challenges, including disagreements over property tax cuts for homeowners 65 and older.

The legislation also addresses the taxation of global intangible low-taxed income (GILTI), expanding the exclusion for GILTI income to 95% to align with neighboring states. The bill includes revenue-raising measures such as changes to allocation factors for corporate filers, adopting economic nexus thresholds, and ending special tax treatment for certain entities like real estate investment trusts (REITs).

New Jersey Lawmakers Launch Action on Corporate Tax Changes

More news out of the garden state, AeroFarms Inc., an indoor vertical farming company known for selling greens in grocery chains like Whole Foods and Harris Teeter, has filed for Chapter 11 bankruptcy. The Newark-based company listed $50 million to $100 million of liabilities in its petition. Existing investors have agreed to provide $10 million to support AeroFarms during the bankruptcy process. The company aims to quickly exit bankruptcy through a transaction with its investors and is exploring additional financing options to maximize credit recoveries and company value. AeroFarms' co-founder and CEO, David Rosenberg, will step down, with CFO Guy Blanchard assuming the additional role of president. AeroFarms attributes its bankruptcy filing to industry and capital market challenges, although its farm in Virginia continues to operate as planned. This bankruptcy follows similar challenges faced by other vertical farming companies, such as Kalera, which filed for bankruptcy in April.

Indoor Vertical Farmer AeroFarms Files for Chapter 11 Bankruptcy

Former President Trump is in the biggest legal mess of his illustrious legal mess career.

Donald Trump is facing an uphill battle in a case where he is charged with illegally retaining classified documents upon leaving the White House in 2021. Legal experts believe that neither the law nor the facts appear to be in his favor. The indictment against Trump includes 37 counts, such as violations of the Espionage Act, obstruction of justice conspiracy, and false statements. National security law experts find the evidence in the indictment to be extensive and compelling, supporting the allegation that Trump unlawfully took the documents and attempted to cover it up. Trump's defense lawyers have not yet commented on the charges.

Trump's greatest risk may lie in the charges of conspiracy to obstruct justice, which carry a maximum sentence of 20 years in prison. The evidence suggests that Trump was aware of the documents subject to a subpoena but refused to turn them over and encouraged his lawyers to mislead the FBI. Legal experts consider this a clear case of obstruction.

Obstruction of justice charges are challenging to defend against, as they offend people's sense of justice and honesty. Trump's alleged years-long effort to conceal the documents likely played a significant role in his indictment. The cover-up is seen as worse than the initial crime, and the conspiracy element in the obstruction charges makes them more serious. Prosecutors only need to prove that Trump collaborated with someone else to hinder the investigation, regardless of the outcome.

Trump has claimed that he declassified the documents before taking them, but a taped conversation cited in the indictment contradicts this assertion. The classification issue may ultimately be irrelevant, as Trump is charged under the Espionage Act, which criminalizes the unauthorized retention of national defense information, regardless of its classification status. Georgetown University law professor Todd Huntley explained that the Espionage Act does not care if the documents were declassified.

Trump's defense team could challenge witness accounts, shift blame to others, or argue that he was following his attorneys' advice and did not intend to break the law. If the case goes to trial, a Florida jury would hear it, and in a conservative-leaning state, Trump would need just one juror to oppose his conviction for a mistrial to occur. His defense team could also file motions to delay the trial until after the November 2024 election. The possibility of Trump pardoning himself if he were to win is a topic of debate among legal experts.

Trump faces difficult odds in classified-documents case | Reuters

Long term followers of crypto will remember the rise and fall of Mt. Gox. Suffice it to say, Mt. Gox exploded on the runway so that FTX could one day crash directly into a mountain.

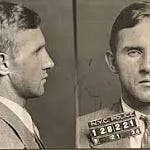

The Department of Justice has unsealed an indictment revealing the identities of the hackers behind the 2011 attack on the Mt. Gox cryptocurrency exchange. The hackers, identified as Russian nationals Alexey Bilyuchenko and Aleksandr Verner, allegedly orchestrated the theft of 647,000 bitcoins from the exchange, which at the time was the largest in the world. The stolen bitcoins would be worth $17.2 billion today. The indictment claims that Bilyuchenko, Verner, and other co-conspirators gained access to a web server storing users' assets and transferred the funds into their own wallets. The duo is also accused of conspiring to launder the money through a New York-based bitcoin brokerage service. Assistant Attorney General Kenneth A. Polite, Jr. emphasized the Department's commitment to prosecuting criminals in the cryptocurrency ecosystem and preventing financial system abuse.

Feds Say They've Finally Identified the Hackers Behind the Mt. Gox Crypto Collapse