This Day in Legal History: National Defense Act

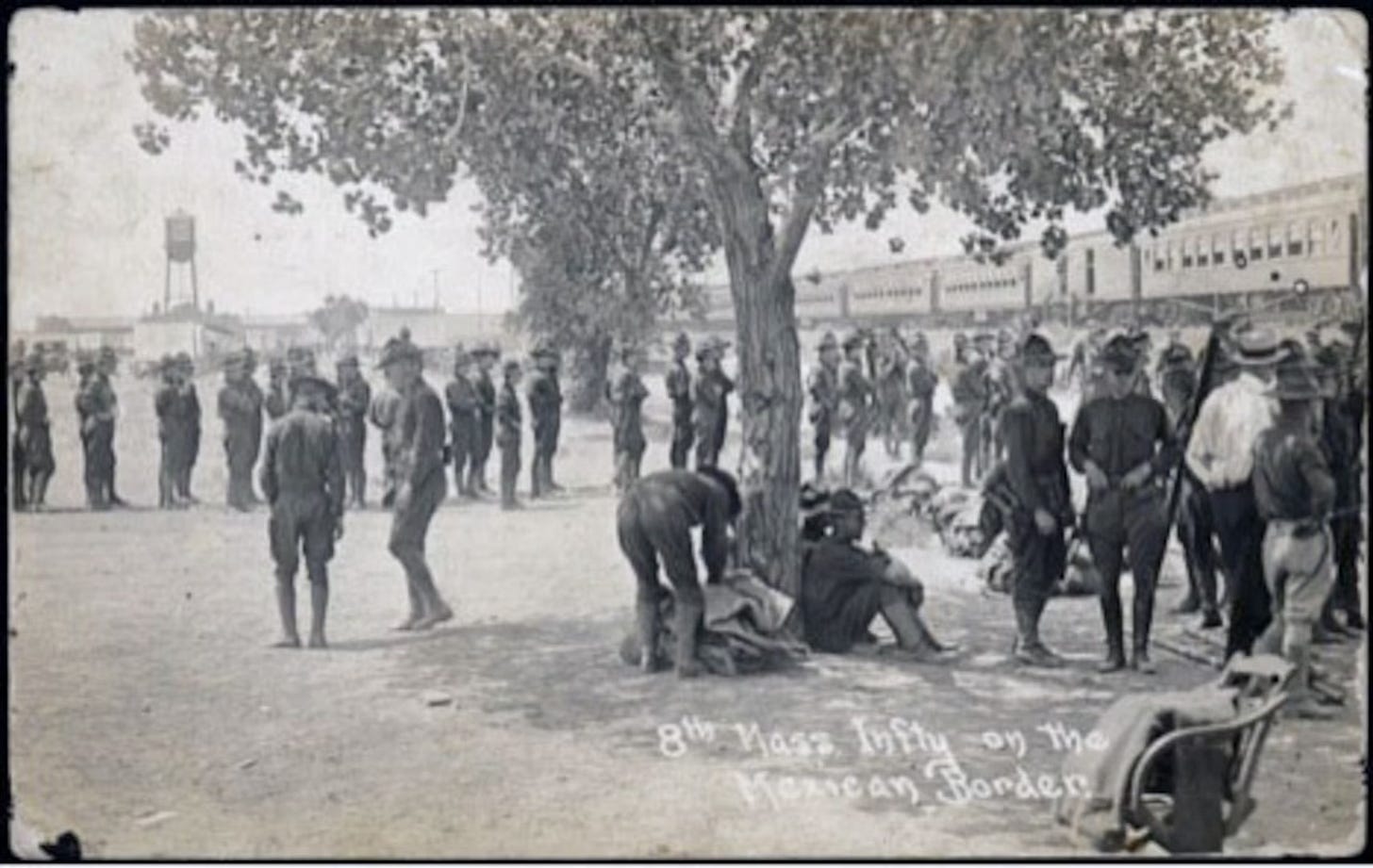

On June 3, 1916, President Woodrow Wilson signed the National Defense Act into law, marking a major shift in American military and legal policy. Passed amid growing tensions related to World War I, the Act dramatically expanded the U.S. Army and strengthened the National Guard, officially integrating it as the Army’s primary reserve force. It increased the size of the Regular Army to over 175,000 soldiers and provided for a National Guard force of over 400,000 when fully mobilized. The law also created the Reserve Officers’ Training Corps (ROTC), formalizing military education at civilian colleges and universities across the country.

Crucially, the Act clarified federal authority over the National Guard, requiring units to conform to federal training standards and granting the president the power to mobilize them for national emergencies. This federalization of a traditionally state-controlled force marked a significant legal development in the balance between state and federal military power. It addressed long-standing constitutional ambiguities surrounding the militia clauses and reflected evolving views of national defense in a modern industrial society.

The Act emerged from broader preparedness debates within the U.S. political and legal spheres, balancing isolationist tendencies with the perceived need for greater military readiness. Though the U.S. would not enter World War I until 1917, the National Defense Act of 1916 laid essential legal groundwork for rapid mobilization. It remains a foundational statute for the structure of the modern U.S. military.

The U.S. Supreme Court declined to hear two significant Second Amendment challenges involving bans on assault-style rifles and high-capacity magazines in Maryland and Rhode Island. By refusing the appeals, the Court left in place lower court rulings upholding the restrictions. Maryland’s law, enacted after the 2012 Sandy Hook shooting, bans certain semi-automatic rifles like the AR-15, while Rhode Island’s 2022 law prohibits magazines holding more than 10 rounds. Plaintiffs in both cases argued that these weapons and accessories are commonly owned by law-abiding citizens and thus protected by the Constitution.

The Court’s conservative bloc showed signs of division. Justices Thomas, Alito, and Gorsuch dissented, indicating they would have reviewed the bans. Justice Kavanaugh did not dissent but issued a statement expressing openness to hearing similar cases in the future, suggesting that the Court would eventually need to rule on whether AR-15s are constitutionally protected.

Lower courts rejected the challenges based on the weapons' military-style design and their use in mass killings, reasoning that they are not suitable for self-defense and thus fall outside Second Amendment protection. The challengers contended that these laws ignore the Court’s prior rulings on weapons in “common use.” Despite recent decisions expanding gun rights, the justices allowed these bans to stand for now.

US Supreme Court won't review assault weapon, high-capacity magazine bans | Reuters

Three federal lawsuits filed on June 2, 2025, allege that major class action settlement administrators and two banks engaged in a kickback scheme that siphoned funds away from class members. The suits, brought in New York, Florida, and California, accuse Epiq Solutions, Angeion Group, and JND Legal Administration of securing illicit payments from Huntington National Bank and Western Alliance Bank in exchange for directing large volumes of settlement deposits to them. In return, the administrators allegedly received a share of the banks’ profits.

Plaintiffs claim the scheme dates back years and coincided with rising interest rates in 2021, which increased the potential value of settlement fund deposits. According to the lawsuits, administrators threatened to stop using the banks unless they shared profits. As a result, class members allegedly received lower payouts due to below-market interest rates on their settlement funds.

Together, the defendant banks are said to control over 80% of the U.S. settlement fund market, while the administrators manage over 65% of class action services. The plaintiffs argue this arrangement violated U.S. antitrust law by reducing competition and fixing prices. JND and Western Alliance have denied wrongdoing, calling the claims baseless or inaccurate. Huntington declined to comment, and other parties have yet to respond.

Class action administrators, banks accused of kickback scheme in new lawsuits | Reuters

My column for Bloomberg this week looks at Spain’s proposed 100% tax on non-EU homebuyers, introduced as a bold fix for the country’s deepening housing crisis. The government is responding to surging public frustration over exploding rents—up more than 60% in Barcelona in five years—and the sense that local housing is being turned into an asset class for absentee owners. But while the policy grabs attention, I argue it misses the real target. The problem isn’t who owns the homes—it’s how those homes are being used. A blanket nationality-based tax is a blunt instrument that’s economically ineffective, legally risky under EU and international law, and symbolically inflammatory.

Instead, I suggest a more focused approach: taxing speculative flipping and underutilization directly. A resale tax on homes sold within a short holding period, calibrated by how quickly they’re flipped, would discourage fast-moving speculation without penalizing genuine residents or workers. Similarly, a progressive vacancy tax—getting steeper the longer a property remains empty—would address the roughly four million vacant or underused homes across Spain. These tools would pressure banks and investors to put housing back into circulation while raising revenue for public housing initiatives.

Critically, these proposals are neutral as to the owner's nationality. Whether a home is owned by a Spanish bank, a Canadian retiree, or a U.S. fund manager, what matters is whether it's being used as shelter or as a sidelined asset. The column makes the case that Spain’s housing crisis won’t be solved by turning foreign investors into political scapegoats, but by confronting speculative behaviors that choke supply and inflate prices—regardless of the flag the buyer flies.