This Day in Legal History: Abrams v. United States Argued

On October 21, 1919, the U.S. Supreme Court heard arguments in Abrams v. United States, a seminal case in the development of First Amendment jurisprudence. The case arose during the post–World War I Red Scare, when the government aggressively prosecuted speech perceived as dangerous or subversive. The defendants were Russian immigrants who distributed leaflets in New York City denouncing U.S. military intervention in the Russian Revolution and calling for a general strike. They were charged and convicted under the Sedition Act of 1918 for allegedly inciting resistance to the war effort.

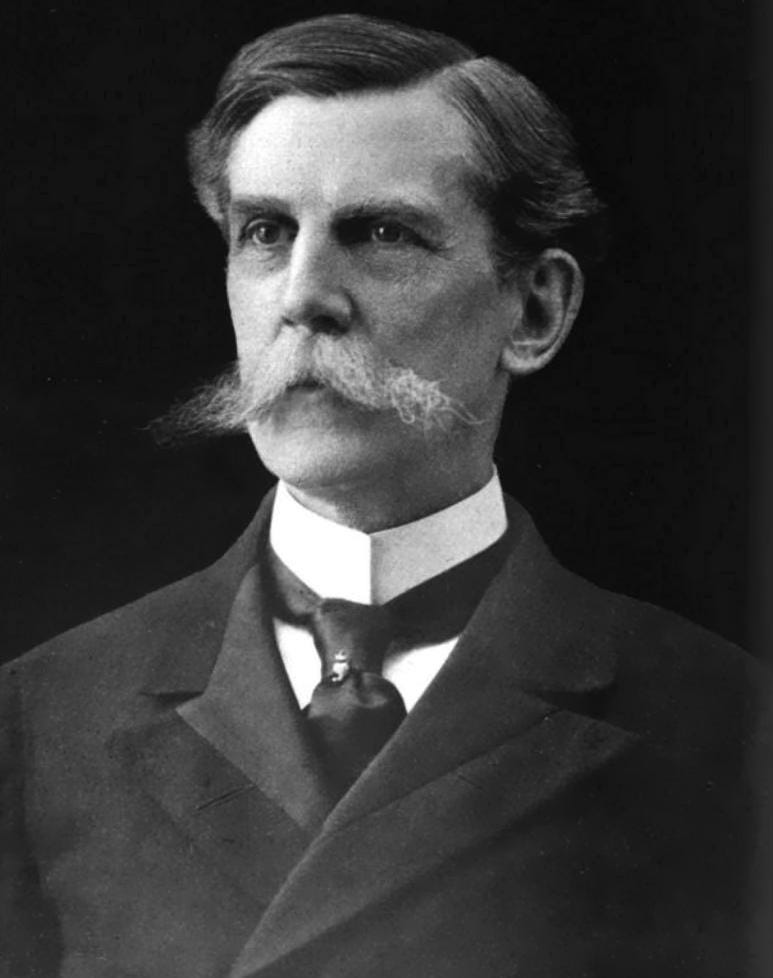

The Supreme Court upheld their convictions in a 7–2 decision, finding that the speech posed a “clear and present danger” to national security. However, it was Justice Oliver Wendell Holmes’ dissent, joined by Justice Louis Brandeis, that left the most lasting impression. Holmes argued that only speech intended to produce imminent lawless action should be punished, introducing the enduring metaphor of the “marketplace of ideas” as essential to democratic deliberation.

Legally, the case illustrates the government’s ability to impose post-speech punishment—penalties after speech has occurred—as opposed to prior restraint, which involves preventing speech before it happens. The distinction is vital in American law: prior restraints are almost always unconstitutional, while post-speech sanctions may be permitted under narrow circumstances. In Abrams, the Court leaned toward deference to governmental wartime authority, but Holmes’ dissent marked the beginning of a shift toward greater speech protections.

The decision laid the groundwork for the more speech-protective standards adopted in later cases such as Brandenburg v. Ohio (1969). The post-speech punishment principle debated in Abrams remains a cornerstone of First Amendment law, highlighting the tension between state interests and individual liberties in times of political conflict.

When two alleged drug traffickers survived a U.S. military strike in the Caribbean, the Trump administration immediately repatriated them rather than detain them — a decision that reveals a troubling logic behind the president’s new “war” on narco‑terrorism. The administration has declared the campaign a “non‑international armed conflict,” but legal experts note that this classification offers no real authority for military detention. In other words, the United States can kill suspects under this self‑declared war framework, but it has no clear legal footing to hold survivors.

Experts said the administration likely chose the least damaging option: send the survivors home and avoid a courtroom. Detaining them at Guantanamo or on U.S. soil would have triggered habeas corpus challenges, forced disclosure of evidence, and risked exposing the strikes as legally indefensible. One former State Department lawyer said any trial would have “undermined the narrative” that the attacks were lawful military operations. By refusing to hold prisoners, the administration sidesteps both judicial scrutiny and transparency.

The result is a perverse incentive structure. If survivors are released but detainees are liabilities, the easiest path for officials is to ensure there are no survivors at all. The legal asymmetry—where killing is simpler than capture—encourages tactics that maximize lethality while minimizing accountability. As a result, Trump’s “drug war” risks becoming less about law enforcement and more about ensuring that no one lives long enough to challenge the legality of U.S. actions.

In Trump’s drug war, prisoners may be too much of a legal headache, experts say | Reuters

Global pharmaceutical companies are rapidly ramping up U.S. manufacturing in response to a looming Trump administration policy that would impose 100% tariffs on imported branded and patented drugs. While enforcement is delayed for companies that commit to domestic investment, the threat has already triggered a wave of fast-tracked spending, direct-to-consumer sales shifts, and pricing concessions in exchange for temporary tariff exemptions.

Major players like Pfizer, AstraZeneca, Merck, Johnson & Johnson, Eli Lilly, and Roche have pledged tens of billions of dollars to build or expand plants across the U.S. to shield themselves from future penalties. Some, like Pfizer and AstraZeneca, secured multi-year tariff exemptions by agreeing to pricing deals and participation in the administration’s new TrumpRx.gov program. Others, like Novartis and Sanofi, are spreading investments across multiple states and sites, creating thousands of jobs as part of their strategic insulation.

The tariff threat is driving a major reshaping of global supply chains and investment strategies, as companies aim to avoid the legal and financial burden of import duties by domesticating both manufacturing and distribution. While some firms say they are already well-positioned with sufficient U.S. inventory, the broader trend reflects a defensive industry-wide shift to preemptively comply with the administration’s protectionist push.

Global drugmakers rush to boost US presence as tariff threat looms | Reuters

Trevor Milton, the disgraced founder of electric-truck startup Nikola, is somehow back as a CEO—this time leading SyberJet Aircraft, a private jet manufacturer, according to reporting by Techdirt. Milton was convicted of fraud for deceiving investors about Nikola’s technology, most famously releasing a misleading video of a prototype truck that was actually rolling downhill, not self-propelled. He was sentenced to four years in prison but never served a day, thanks to a pardon from Donald Trump earlier this year—reportedly after donating millions to Trump-aligned causes and hiring the brother of current Attorney General Pam Bondi as his attorney.

Now, just months after that pardon, Milton has been tapped to lead development of a new high-speed jet for SyberJet, with promised performance metrics that already sound suspiciously ambitious. The company, privately backed, won’t need to answer to public shareholders—but it will still need investor trust to raise money for a jet not slated for delivery until 2032. TechDirt points out how the company’s promotional material leans into rewriting Milton’s history, calling him “renowned” rather than acknowledging the full scope of his fraudulent past.

The piece underscores a broader theme of “failing upward,” highlighting how white-collar offenders, especially white men with political connections, often land on their feet despite serious criminal convictions–and has some interesting implications for the future career of George Santos. Milton’s quick rebound from federal fraud conviction to C-suite leadership is less an exception than a reminder of how accountability gaps persist in American corporate culture.

Convicted Fraudster Trevor Milton Rides His Trump Pardon To Another CEO Job, Somehow | Techdirt

In my column for Bloomberg this week, I dive in to the governor’s race in my home state. The 2025 New Jersey gubernatorial race has become a tax-policy showdown between Jack Ciattarelli and Mikie Sherrill—both of whom are framing affordability as their central mission, but doing so with deeply flawed approaches. Ciattarelli is offering aggressive tax cuts and structural overhauls that are, frankly, reckless in a state with a delicate and complicated fiscal ecosystem. His plan to flatten income tax brackets and slash corporate rates isn’t just optimistic—it’s ahistorical. We’ve seen this movie before in Kansas, where sweeping tax cuts led to revenue collapse, credit downgrades, and bipartisan regret. Ciattarelli is essentially proposing a rerun, but with no clearer escape plan if it fails.

Sherrill, by contrast, is pragmatic to the point of inertia. Her emphasis on municipal service sharing and administrative tweaks is fine as far as it goes—but it doesn’t go very far. Her promise to freeze utility rates via emergency powers, for instance, isn’t just legally questionable, it also misdiagnoses the issue: state governments don’t control wholesale energy prices. It’s a symbolic gesture dressed up as policy.

Neither candidate seems willing to address the structural drivers of New Jersey’s notoriously high property taxes, preferring instead to nibble around the edges or promise caps that could backfire. That’s a missed opportunity. As I argue in the column, New Jersey doesn’t need sweeping cuts or more bureaucratic tinkering—it needs targeted relief for the people who actually feel the pinch. Expanding the state Earned Income Tax Credit and implementing a robust child tax credit would offer immediate, evidence-backed help to those struggling most with affordability. These aren’t radical ideas; they’re already working in other states.

Ciattarelli’s plan is built on trickle-down economics and wishful math. Sherrill’s is built on competent management, but lacks ambition. The voters deserve more than either of those options.

Tax Platforms in NJ Governor's Race Leave Out the Best Ideas