This Day in Legal History: Volstead Act

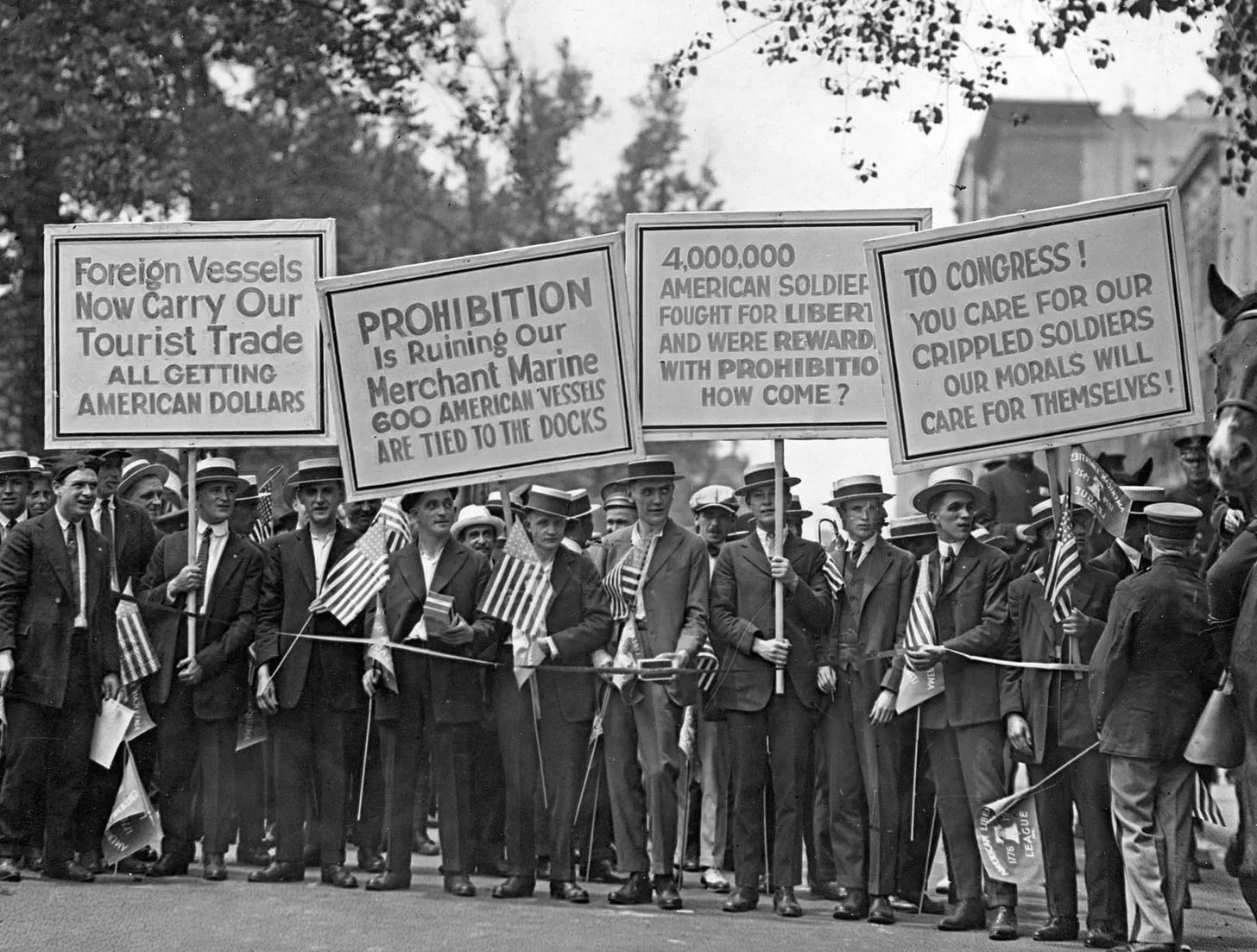

On October 28, 1919, the Volstead Act was passed by the U.S. Congress over President Woodrow Wilson’s veto, laying the legal foundation for Prohibition in the United States. Formally titled the National Prohibition Act, the law was intended to provide for the enforcement of the 18th Amendment, which had been ratified earlier that year and prohibited the manufacture, sale, and transportation of intoxicating liquors.

The Volstead Act, named after Representative Andrew Volstead of Minnesota who introduced it, defined what constituted “intoxicating liquors”—a key point of contention. It set the threshold at anything containing more than 0.5% alcohol by volume, thereby banning even beer and wine, which many Americans had not expected to be included. The law also outlined penalties and enforcement mechanisms, giving the federal government new policing powers.

Prohibition officially began in January 1920, sparking a surge in bootlegging, speakeasies, and organized crime. While intended to curb alcohol consumption and related social problems, the law instead fueled a vast illicit economy. Enforcement proved difficult and inconsistent, and public support for Prohibition declined steadily throughout the 1920s.

The Volstead Act remained in effect until the 21st Amendment repealed Prohibition in 1933, marking the only time a constitutional amendment has been entirely undone by a subsequent amendment. The legacy of the Volstead Act lingers in ongoing debates about federal regulation, moral legislation, and the limits of enforcement.

In a push to speed up electricity access for the fast-growing data center sector, U.S. Energy Secretary Chris Wright has directed federal energy regulators to consider a rule that would streamline how new projects connect to the electric grid. The proposed rule, sent to the Federal Energy Regulatory Commission (FERC), would allow customers to file combined requests for both energy demand and generation at the same site—cutting study times and costs. Wright also asked FERC to explore completing grid project reviews within 60 days, a sharp departure from the years-long timelines currently common.

This move comes as U.S. power demand rises sharply, largely due to artificial intelligence workloads, prompting the Trump administration to seek expanded capacity, particularly from fossil fuel and nuclear sources. Though the Energy Secretary cannot compel FERC to act, the Republican-led commission will now weigh the proposals. Industry groups like the Edison Electric Institute praised the initiative as a necessary step to stay competitive, while environmental advocates criticized the fast-tracked timelines as reckless, especially during a government shutdown.

Wright also urged FERC to ease the permitting process for hydroelectric development, drawing praise from the hydropower industry, which sees regulatory delays as a major barrier to growth. The proposals reflect the administration’s strategy to meet surging energy demand quickly, though they raise concerns about environmental oversight and procedural rigor.

US pushes regulators on connecting data centers to grid | Reuters

Texas’s new Business Court, launched in September 2024 across five major cities, is quickly becoming a boon for law firms, attracting a wave of high-stakes commercial litigation and prompting staffing increases. Major firms like Jackson Walker, Norton Rose Fulbright, and Baker Botts are leading the charge, with over 220 cases already filed—far exceeding early expectations. The court, designed to compete with Delaware’s Court of Chancery and bolster Texas’s business-friendly reputation, is drawing interest from corporate giants like AT&T, BP, and Exxon Mobil.

Lawyers are treating the venue as a prestige arena for complex business disputes, and firms are responding by hiring, publishing guides, and producing media content to market their expertise. For example, Norton Rose launched a video series on court developments, while Haynes Boone created an internal task force to track rule changes.

The court’s promise of faster timelines—often under 18 months compared to multi-year waits in traditional courts—is one of its major selling points. Judges are aiming to build out a body of corporate case law to make Texas a viable alternative to Delaware for resolving business disputes. Despite no trials yet, over three dozen cases are jury-bound in the next year, signaling strong demand. The court’s rapid rise suggests it could reshape where and how major commercial litigation happens in the U.S.

Law Firms Join Early Winners in ‘Very Hot’ Texas Business Court

The head of the American Federation of Government Employees (AFGE), the largest federal worker union, is urging Senate Democrats to help end the nearly month-long government shutdown—the second longest in U.S. history. AFGE President Everett Kelley called for an immediate reopening of the government through a “clean” short-term funding bill, aligning with a version passed by the Republican-controlled House in September.

Democrats have resisted that approach, instead demanding that Republicans first agree to renew subsidies for Obamacare insurance plans. Kelley’s statement increases pressure on Democrats, as federal employees begin to feel the financial strain—many missed their first full paycheck last week, and essential services like food aid and air traffic control are being impacted.

Kelley also called for guaranteed back pay for all affected workers and urged bipartisan efforts to fix the broken appropriations process and address rising costs. A senior Senate GOP aide noted the union’s position might signal a turning point in negotiations, potentially encouraging Democrats to reconsider the short-term funding route.

Federal Worker Union Calls to End Shutdown, Pressuring Democrats

My column for Bloomberg this week looks at Italy’s decision to raise its flat tax on wealthy foreign residents—a move that reflects the unsustainability of luring the rich with short-term tax deals. Italy isn’t backtracking because its plan failed outright; it’s doing so because it succeeded just long enough to paper over a deeper revenue gap. The original policy, a 100,000-euro annual payment to exempt new wealthy residents from foreign income taxes, was a bold but limited solution that boosted luxury markets without delivering long-term fiscal stability. Now, Italy is bumping that fee up to 300,000 euros by 2026 to keep the scheme afloat.

That’s a warning for the U.S., where the Trump Tax Cuts and Jobs Act followed a similar path—offering generous upfront tax cuts to high earners with no lasting funding mechanism. Rather than building resilience into the tax system, both countries are layering short-term relief on top of structural deficits, leaving future policymakers to scramble for temporary fixes. I argue for automatic sunset provisions that scale back preferential tax treatment when equity or revenue metrics worsen, allowing tax codes to serve as stabilizers instead of giveaways. Metrics like tax revenue as a share of GDP or the Gini coefficient could trigger phaseouts without requiring political intervention.

Italy’s flat tax is a case study in what happens when fiscal policy becomes a subscription model for the wealthy: the price keeps going up, and the returns diminish. The U.S. is running a version of the same play, just with fewer disclosures and rosier assumptions.