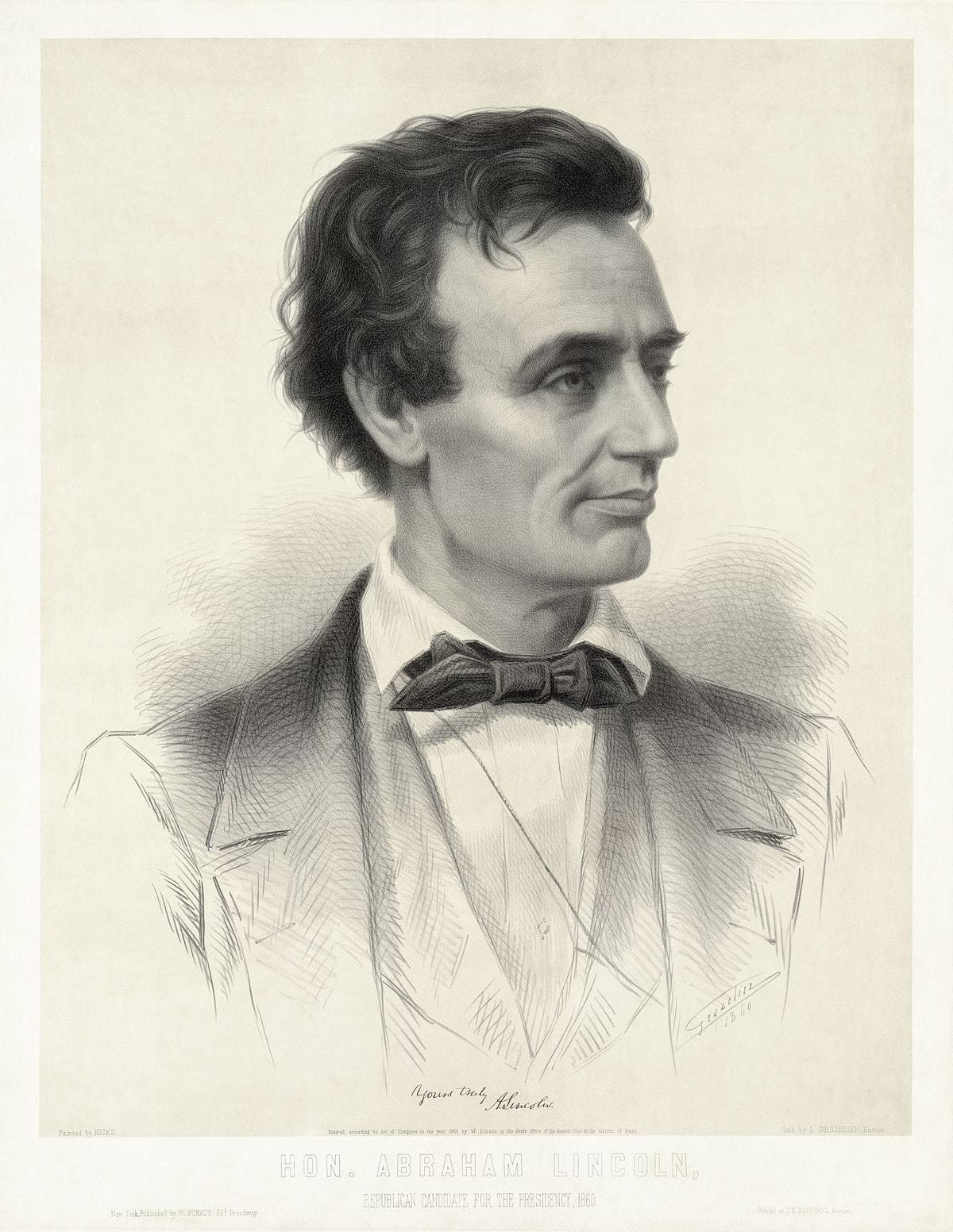

This Day in Legal History: A. Lincoln Admitted to Bar

On September 9, 1836, Abraham Lincoln was licensed to practice law by the Illinois Supreme Court, setting in motion a legal and political career that would ultimately reshape American history. At the time, Lincoln was a 27-year-old former store clerk and self-taught frontier intellectual, with no formal legal education. Instead, like many aspiring attorneys of the era, Lincoln "read law" by apprenticing under established lawyers and studying foundational legal texts such as Blackstone's Commentaries and Chitty's Pleadings. His relentless self-education and growing reputation for honesty earned him the nickname “Honest Abe,” long before he entered the national spotlight.

Shortly after being admitted to the bar, Lincoln moved to Springfield, Illinois, where he set up a law practice. His first lawsuit came less than a month later, on October 5, 1836, marking the beginning of a legal career that would span over two decades. Lincoln took on a wide variety of cases—ranging from debt collection and land disputes to criminal defense and railroad litigation—and traveled extensively on the Illinois Eighth Judicial Circuit.

His courtroom demeanor was marked by clarity, logic, and moral conviction, attributes that would later define his presidency. Practicing law not only gave Lincoln financial stability but also honed the rhetorical and analytical skills that would serve him in legislative debates and national addresses. His legal work with the Illinois Central Railroad and other corporate clients exposed him to the country’s economic transformation, deepening his understanding of commerce, labor, and the law's role in shaping society.

Lincoln's rise from rural obscurity to respected attorney mirrored the American ideal of self-made success, and his legal background profoundly shaped his political philosophy. It was as a lawyer and legislator that he began to articulate his opposition to slavery’s expansion, using constitutional and moral arguments that would later guide his presidency and the Union’s legal stance during the Civil War.

His legal reasoning and insistence on the rule of law would ultimately be central to the Emancipation Proclamation, his wartime governance, and the framework for reconstructing the nation. The law gave Lincoln the tools to interpret and preserve the Constitution, even amid its greatest crisis.

Lincoln’s admission to the bar on this day in 1836 was not just a personal milestone—it was a foundational step toward the presidency and toward a redefinition of American liberty and union that would endure for generations.

Events ripple in time like waves on a pond, and Lincoln’s admission to the bar in 1836 is one such stone cast into history. Had he not secured that license—had he not taught himself law from borrowed books and legal treatises—it is likely he never would have risen to national prominence or attained the presidency. Without Lincoln’s leadership in 1860, the United States may well have fractured permanently into separate nations, altering the course of the Civil War and leaving a divided continent in its wake. That division would have profoundly reshaped global affairs in the 20th century. Not to put too fine a point on it, but the fact that there was a United States powerful and unified enough to confront the Nazi war machine in 1941 traces, in part, to a frontier shop clerk’s grit, discipline, and determination to study Blackstone’s Commentaries by candlelight.

A Florida state appeals judge who sided with Donald Trump in a high-profile defamation case against the Pulitzer Prize Board has been confirmed to the federal bench. On Monday, the U.S. Senate voted 50–43 along party lines to approve Judge Ed Artau’s nomination to the U.S. District Court for the Southern District of Florida. Artau is now the sixth Trump judicial nominee to be confirmed during the president’s second term.

Artau joined a panel earlier this year that allowed Trump’s lawsuit to proceed after the Pulitzer Board declined to rescind a 2018 award given to The New York Times and The Washington Post for their reporting on Russian interference in the 2016 election. In a concurring opinion, Artau criticized the reporting as “now-debunked” and echoed calls to revisit New York Times v. Sullivan, the Supreme Court precedent that has long protected journalists from most defamation claims by public figures.

The timing of Artau’s nomination has drawn scrutiny from Senate Democrats, who argue it raises ethical concerns. Artau reportedly began conversations about a possible federal appointment just days after Trump’s 2024 victory and interviewed with the White House shortly after issuing his opinion in the Pulitzer case. Senate Minority Leader Chuck Schumer called the confirmation a “blatant” example of quid pro quo, while others questioned Artau’s impartiality.

In response, Artau defended his conduct during his Senate Judiciary Committee hearing, stating that ambition for higher office alone doesn’t disqualify a judge from ruling on politically sensitive cases and that he holds no personal bias requiring recusal.

Florida judge who ruled for Trump in Pulitzer case confirmed to federal bench | Reuters

After 21 years, one of legal academia’s most influential blogs is shutting down. The TaxProf Blog, launched in 2004 by Pepperdine Law Dean Paul Caron, will cease publication by the end of September following the closure of its longtime host platform, Typepad. Caron said he isn’t interested in rebuilding the site on a new platform, though he hopes to preserve the blog’s extensive archive of nearly 56,000 posts.

Initially focused on tax law, the blog evolved into a central hub for news and commentary on law schools, covering accreditation, rankings, faculty hiring, admissions trends, and more. It maintained its relevance even as other law professor blogs declined in the wake of Twitter's rise. Caron’s regular posts made the site a must-read in the legal education world, often mixing in personal reflections and occasional commentary on religion.

The closure also casts uncertainty over the broader Law Professor Blog Network, which includes around 60 niche academic blogs also hosted on Typepad. At least one, ImmigrationProf Blog, has already begun looking for a new publishing home.

Reactions across the legal academy reflected the impact of the blog's departure. One law school dean likened it to daily sports reporting for legal education—a constant, trusted source of updates and debate.

Groundbreaking law blog calls it quits after 21 years | Reuters

The U.S. Supreme Court has sided with the Trump administration in a contentious immigration case, allowing federal agents to resume aggressive raids in Southern California. The Court granted a request from the Justice Department to lift a lower court order that had restricted immigration stops based on race, language, or occupation—factors critics argue are being used to disproportionately target Latino communities. The ruling, delivered in a brief, unsigned order with no explanation, permits the raids to continue while a broader legal challenge proceeds.

The case stems from a July order by U.S. District Judge Maame Frimpong, who found that the administration’s actions likely violated the Fourth Amendment by enabling racially discriminatory stops without reasonable suspicion. Her injunction applied across much of Southern California, but is now paused by the Supreme Court's decision.

Justice Sonia Sotomayor, joined by the Court’s other two liberals, issued a sharp dissent, warning that the decision effectively declares all Latinos "fair game to be seized at any time," regardless of citizenship. She described the raids as racially motivated and unconstitutional.

California Governor Gavin Newsom and civil rights groups echoed those concerns. Newsom accused the Court of legitimizing racial profiling and called Trump’s enforcement actions a form of "racial terror." The ACLU, representing plaintiffs in the case, including U.S. citizens, denounced the raids as part of a broader “racist deportation scheme.”

The Trump administration, meanwhile, hailed the decision as a major legal victory. Attorney General Pam Bondi framed it as a rejection of “judicial micromanagement,” and Justice Brett Kavanaugh, writing separately, argued that while ethnicity alone cannot justify a stop, it may be used in combination with other factors.

This ruling adds to a series of recent Supreme Court decisions backing Trump’s immigration agenda, including policies that limit asylum protections and revoke humanitarian legal statuses. In Los Angeles, the raids and the use of military personnel in response to protests have escalated tensions between the federal government and local authorities.

US Supreme Court backs Trump on aggressive immigration raids | Reuters

A federal appeals court has upheld an $83.3 million jury verdict against Donald Trump for defaming writer E. Jean Carroll, rejecting his claims of presidential immunity. The 2nd U.S. Circuit Court of Appeals found the damages appropriate given the severity and persistence of Trump’s conduct, which it called “remarkably high” in terms of reprehensibility. The ruling noted that Trump’s attacks on Carroll grew more extreme as the trial neared, contributing to reputational and emotional harm.

The lawsuit stemmed from Trump’s repeated public denials of Carroll’s allegation that he sexually assaulted her in the 1990s. In 2019, Trump claimed Carroll was “not my type” and said she fabricated the story to sell books—comments he echoed again in 2022, prompting a second defamation suit. A jury in 2023 had already found Trump liable for sexual abuse and defamation in an earlier case, awarding Carroll $5 million. That verdict was also upheld.

Trump’s legal team argued that his 2019 comments were made in his official capacity as president and should be shielded by presidential immunity. The court disagreed, citing a lack of legal basis to extend immunity in this context. Trump also objected to limits placed on his testimony during trial, but the appeals court upheld the trial judge’s rulings as appropriate.

The $83.3 million award includes $18.3 million in compensatory damages and $65 million in punitive damages. Carroll’s legal team expressed hope that the appeals process would soon conclude. Trump, meanwhile, framed the ruling as part of what he calls “Liberal Lawfare” amid multiple ongoing legal battles.

Trump fails to overturn E. Jean Carroll's $83 million verdict | Reuters

My column for Bloomberg this week takes aim at the so-called "Taylor Swift Tax" in Rhode Island—an annual surtax on non-primary residences valued over $1 million. While the headline-grabbing nickname guarantees media coverage, the underlying policy is flawed, both economically and politically.

Rhode Island isn’t alone—Montana, Cape Cod, and Los Angeles have all attempted to capture revenue from wealthy property owners through targeted taxes on high-end real estate. But these narrowly tailored levies often distort markets, suppress transactions, and encourage avoidance rather than compliance. LA’s mansion tax, for example, dramatically underperformed because property owners simply didn’t sell.

The appeal of taxing second homes is clear: they’re luxury assets often owned by out-of-staters with little political influence. But that lack of local connection also makes them an unreliable revenue base. It’s relatively easy to sell, reclassify, or relocate a vacation property, particularly for the affluent. And when policies hinge on fuzzy concepts like "primary residence," they invite loopholes and enforcement challenges—especially when properties are held by LLCs or trusts.

Rhode Island’s new tax could drive potential buyers to nearby Connecticut, undermining its own housing market and revenue goals. If states want to tax wealth effectively, they must resist headline-chasing and instead build durable, scalable policies: regular reassessments, vacancy levies, and infrastructure-based cost recovery. These methods avoid the pitfalls of ambiguous residency tests and create more predictable revenue streams.

And because discretionary wealth is mobile, real solutions will require cooperation—harmonized assessments, multistate compacts, and shared reporting. But more fundamentally, states looking for progressive revenue should aim higher—toward income and wealth taxes—rather than tinkering at the margins with weekend homes.

Rhode Island Should Shake Off ‘Taylor Swift Tax’ on Second Homes