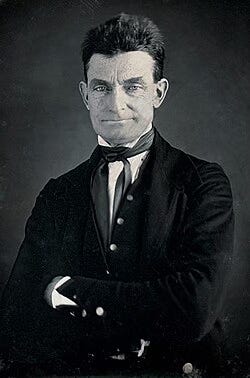

This Day in Legal History: John Brown Assassinated

On December 2, 1859, abolitionist John Brown was executed by hanging in Charles Town, Virginia (now West Virginia), following his conviction for treason against the Commonwealth of Virginia, murder, and inciting a slave insurrection. Brown had led a raid on the federal armory at Harpers Ferry in October, attempting to seize weapons and incite a large-scale slave uprising. His plan failed, with most of his men either killed or captured, and Brown himself wounded and arrested by U.S. Marines under the command of Colonel Robert E. Lee. The legal proceedings against him were swift: Brown was indicted within days, tried in state court, and sentenced to death less than a month after the raid.

His execution was a national event, drawing immense media coverage and polarized public reaction. In the North, many abolitionists hailed him as a martyr who sacrificed his life to end the moral atrocity of slavery. In the South, he was widely viewed as a terrorist whose actions confirmed fears of Northern aggression and interference. Brown’s trial and punishment underscored the deepening legal and moral divide between free and slave states, particularly regarding states’ rights, federalism, and the use of violence to oppose injustice. The charges of treason and insurrection also raised complex constitutional questions, since Brown was prosecuted under state, not federal, law — despite attacking a federal facility. His case set the stage for intensifying legal and political disputes over the limits of protest, the legitimacy of armed resistance, and the definition of loyalty to the state.

Brown’s final words, predicting that “the crimes of this guilty land will never be purged away but with blood,” would prove prescient less than two years later when the Civil War began.

A federal appeals court has ruled that Alina Habba, a former personal attorney to Donald Trump, was unlawfully appointed as the interim U.S. Attorney for the District of New Jersey. The 3rd Circuit Court of Appeals unanimously upheld a lower court’s finding that the Trump administration violated federal appointments law in installing Habba without Senate confirmation or proper legal authority. This decision disqualifies her from overseeing federal cases in the state, potentially disrupting numerous active prosecutions.

The case was brought by defense attorneys who argued that the Justice Department used procedural workarounds to improperly extend Habba’s tenure after New Jersey’s district judges declined to reauthorize her. In response, DOJ fired her court-appointed successor and tried to reassign Habba under a different title, which the court rejected. The ruling is significant because it’s the first appellate decision pushing back on Trump-era efforts to place loyalists in key legal roles without Senate oversight.

Habba, who had no prior prosecutorial experience, previously represented Trump in high-profile civil litigation, including the defamation case involving E. Jean Carroll. During her controversial tenure, she was criticized for politicized statements and for filing charges against a Democratic congresswoman. Similar appointment disputes are playing out in other states, and this decision sets a strong precedent against bypassing constitutional and statutory nomination processes. The administration is expected to appeal to the Supreme Court.

Court disqualifies Trump ally Habba as top New Jersey federal prosecutor | Reuters

HSBC has announced a multi-year partnership with French start-up Mistral AI to integrate generative AI tools across its global operations. The bank plans to self-host Mistral’s commercial AI models and future upgrades, combining its own tech infrastructure with Mistral’s cutting-edge AI capabilities. The collaboration aims to boost automation, productivity, and customer service, with use cases spanning financial analysis, multilingual translation, risk assessment, and personalized client interactions.

By adopting Mistral’s tools, HSBC expects to significantly reduce time spent on routine, document-heavy tasks, such as those in credit and financing teams. Already active in AI applications like fraud detection and compliance, the bank sees this deal as a way to accelerate innovation cycles and roll out new features more efficiently. The move comes amid a broader industry trend as banks seek to scale generative AI solutions, while addressing ongoing concerns around data privacy. HSBC emphasized that all deployments will comply with its responsible AI governance standards to ensure transparency and protection.

HSBC taps French start-up Mistral to supercharge generative-AI rollout | Reuters

President Donald Trump has commuted the prison sentence of David Gentile, the former CEO of GPB Capital Holdings, who was convicted under the Biden administration for his role in what prosecutors called a Ponzi scheme. Gentile had been serving a seven-year sentence after being found guilty of securities fraud in 2024. The DOJ argued that GPB misled investors by using new investor funds to pay returns, rather than profits from legitimate operations.

However, in announcing the commutation, a White House official pushed back on the prosecution’s claims, arguing that investors had been clearly informed about the firm’s payment practices and that prosecutors failed to directly link fraudulent misrepresentations to Gentile during trial. The official also alleged misconduct, claiming the government elicited and failed to correct false testimony.

The commutation comes amid heightened political scrutiny of financial fraud prosecutions and continues Trump’s trend of intervening in controversial white-collar cases. The Department of Justice has not yet responded to the decision.

Trump frees former GPB Capital CEO after Biden admin’s Ponzi scheme sentence | Reuters

My column for Bloomberg this week is about … the penny. The official end of penny production may seem trivial, but it’s creating real legal headaches for retailers and tax administrators alike. Without the one-cent coin, states are facing ambiguity about how to round sales tax totals for cash transactions—should it happen before or after tax, and who absorbs the rounding loss? These questions go largely unanswered, and in the absence of clear rules, businesses are improvising, which risks inconsistent compliance and enforcement challenges. There’s also a legal tension where cash transactions require rounding but card payments do not—potentially running afoul of laws banning payment-method discrimination or even the Internet Tax Freedom Act.

Streamlined Sales Tax rules add more complexity, limiting when and how rounding can occur and cautioning against systems that enrich the state at consumers’ expense. I argue that instead of patchwork fixes, this moment should push states to modernize their sales tax systems with mandatory e-invoicing and real-time reporting. This would standardize how tax is calculated and rounded, reduce compliance uncertainty, and shrink the window for fraud. Paired with something like a receipt lottery—used successfully in countries like Brazil and China—states could turn customers into compliance allies by rewarding them for scanning and validating receipts.

Ultimately, automating rounding decisions and reporting in point-of-sale systems would lift the burden off retailers and give governments cleaner data with lower enforcement costs. The penny may be dead, but this is a rare chance to bring sales tax enforcement into the 21st century.