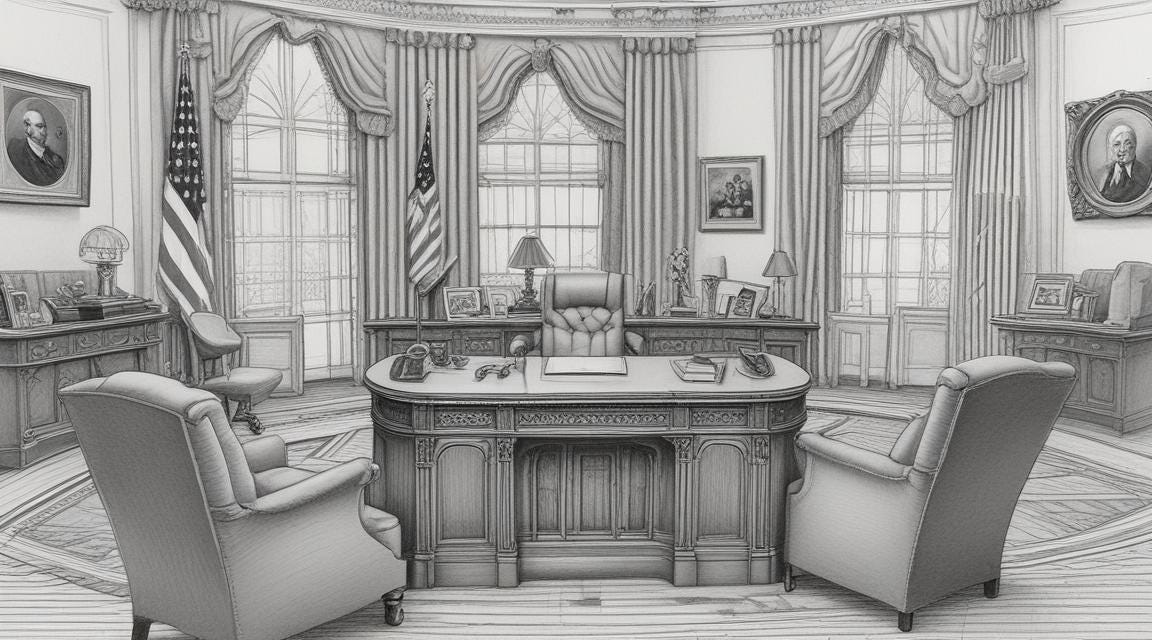

This Day in Legal History: Nixon Resigns

On this day in legal history, August 8, 1974, President Richard Nixon announced his resignation from the office of the President of the United States, becoming the first and only president to do so. This unprecedented event followed the Watergate scandal, a complex political affair that began with a break-in at the Democratic National Committee headquarters and led to a series of revelations about abuses of power by the Nixon administration. Facing almost certain impeachment by Congress on charges of obstruction of justice, abuse of power, and contempt of Congress, Nixon chose to resign rather than prolong the national crisis.

In his televised resignation speech, Nixon acknowledged that he no longer had a sufficient political base in Congress to continue effectively governing. He expressed regret for any injuries caused by his actions and highlighted his achievements while in office, yet he did not admit to any wrongdoing in the Watergate affair. Vice President Gerald Ford was sworn in as President on August 9, 1974, and later granted Nixon a full pardon for any crimes he might have committed against the United States while in office.

Nixon’s resignation marked a significant moment in American legal and political history, underscoring the constitutional processes in place to address presidential misconduct. It also led to reforms aimed at increasing transparency and accountability in government, such as the Ethics in Government Act and amendments to the Freedom of Information Act. This event reshaped public trust in the presidency and highlighted the importance of upholding the rule of law at the highest levels of government.

A federal judge indicated that the attorneys in a class action lawsuit against Google over Chrome's “Incognito” mode are unlikely to receive their full $217 million fee request. During a hearing in Oakland, Judge Yvonne Gonzalez Rogers also showed skepticism towards Google’s proposal to cut the plaintiffs' attorney fees by 25%. She criticized Google’s legal team for suggesting she personally review thousands of time sheet entries.

The case, which began four years ago, was settled in April with Google agreeing to delete billions of records from Incognito mode users and make some reforms, but without providing monetary damages to users. The plaintiffs’ attorneys, from firms including Boies Schiller Flexner LLP, claimed their fees were justified by 78,880 hours of work and sought a “lodestar multiplier” of 3.5, bringing their total request to $217 million.

Judge Rogers commented that she rarely awards multipliers above three and noted the case’s partial success. Google’s attorney, Andrew Schapiro, argued that the plaintiffs’ fees were excessive, pointing out that Google spent only $40 million on the case. The lawsuit initially filed in 2020 alleged that Incognito mode improperly retained user data despite claims of privacy.

The settlement requires Google to clarify data collection practices and allow Incognito users to block third-party cookies for five years. Individuals can also seek monetary damages in California state court. The plaintiffs originally sought $9 billion in damages, but Google's attorney argued the final settlement warranted a lower fee due to its limited success. The case is Brown v. Google LLC.

Google ‘Incognito’ Case Attorneys Unlikely to Win $217 Million

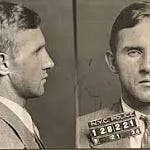

Thomas Girardi concealed a $53 million settlement from a young man, Joseph Ruigomez, whose home exploded, and misled him about the funds' status, a Los Angeles federal jury heard. Ruigomez and his family, receiving inconsistent interest payments, repeatedly asked Girardi for settlement details after their 2013 agreement with Pacific Gas & Electric, but Girardi never complied. Girardi claimed he held the funds for Ruigomez's protection, citing his youth and alleged drug dependency, though Ruigomez clarified he was on narcotics for pain management due to extensive medical procedures.

During the trial, the defense presented numerous financial documents, while the prosecution did not clarify the annuity terms or the full distribution of the $53 million settlement, which included a $25 million annuity and $12.7 million in legal fees. Kathleen Ruigomez, Joseph's mother, testified that she only learned of the full settlement amount two years later and didn't suspect the discrepancy initially. She later sued Girardi with the help of Robert Finnerty, a former Girardi Keese lawyer.

Girardi faces charges of wire fraud for allegedly stealing $15 million in settlement funds meant for clients. He pleaded not guilty, with prosecutors claiming he delayed payments under false pretenses. Girardi, who avoided disciplinary action despite over 200 misconduct complaints, also faces fraud charges in Illinois federal court and multiple civil lawsuits. His firm, Girardi Keese, went bankrupt in 2020. Girardi's mental competency to stand trial is contested, yet he was seen taking organized handwritten notes during the proceedings. The case is USA v. Girardi, in the Central District of California.

‘Kingpin’ Girardi Hid $53 Million Settlement, Client Says (1)

Delta Air Lines Inc. is facing a proposed class action lawsuit following a software outage on July 19 caused by CrowdStrike, which led to widespread flight delays and cancellations. The lawsuit, filed in the US District Court for the Northern District of Georgia, claims that Delta failed to adequately refund passengers or provide the promised meal, hotel, and transportation vouchers. Instead of issuing refunds, Delta allegedly offered e-credits without informing passengers of their legal right to cash refunds, resulting in many passengers accepting the e-credits.

The plaintiffs argue that Delta did not fulfill its commitments to passengers affected by cancellations within the airline’s control, leading to breaches of contract, fraud, unjust enrichment, and violations of state consumer protection laws. They are seeking class certification and damages, representing all passengers whose flights were canceled between July 19 and July 31, with specific subclasses for California, Colorado, Florida, and Washington state.

The CrowdStrike software update that caused the outage disrupted millions of devices using Microsoft Windows, impacting thousands of flights globally. Delta, the official airline of Team USA, struggled particularly hard, affecting nearly 2,000 athletes and staff traveling to Paris for the Olympics. While other airlines recovered quickly, Delta continued to cancel flights into the following week, even though they announced normal operations by July 25.

The US Department of Transportation is investigating Delta’s response to the glitch after receiving 3,000 complaints from passengers. Delta has declined to comment on the lawsuit, which is being handled by Webb Klase & Lemond LLC and Sauder Schelkopf LLC. The case is Bajra v. Delta Air Lines Inc.

Delta Sued Over Inadequate Refunds Following CrowdStrike Outage

The FCC’s proposed rules for disclosing AI-generated content in political ads on radio and television have sparked a jurisdictional dispute with the Federal Election Commission (FEC). The FCC’s rules, announced on July 25, would require broadcasters to announce when AI is used in political ads. FCC Chairwoman Jessica Rosenworcel emphasized the need for voter transparency, comparing the requirement to existing rules about disclosing ad sponsors.

Supporters, including AI regulation advocates, see it as a positive step amidst increasing deepfake use in campaigns. However, critics, including the FCC’s two Republican commissioners and their FEC counterparts, argue that regulating political disclosures should fall under the FEC’s jurisdiction.

The proposed FCC rules, now open for public comment until September 4, face uncertainty about whether they can be finalized before the upcoming election. This uncertainty is compounded by the US Supreme Court’s decision in Loper Bright Enterprises v. Raimondo, which limits federal agencies’ regulatory powers.

The FEC had already been considering similar AI content regulations since last year and recently sought public input on deepfakes in political ads. FCC critics argue that the FCC’s efforts overlap and potentially conflict with the FEC’s authority. Democratic FEC Vice Chair Ellen Weintraub, however, supports the FCC’s initiative, suggesting that both agencies can complement each other.

Despite the challenges, proponents believe the FCC’s move will raise public awareness about AI in political ads, though the timeline for finalizing these rules remains unclear. The case’s complexity is heightened by the evolving legal landscape and potential challenges to the FCC’s authority following recent Supreme Court rulings.

FCC Election Deepfake Ads Proposal Sparks Turf Fight With FEC

Ripple Labs has been ordered by a Manhattan court to pay the U.S. Securities and Exchange Commission (SEC) approximately $125 million in penalties for the improper sale of XRP tokens. This decision follows the SEC's lawsuit against Ripple, CEO Brad Garlinghouse, and co-founder Chris Larsen, accusing them of raising over $1.3 billion through an unregistered securities offering by selling XRP. Although the SEC initially sought $2 billion in fines and penalties, the court's ruling resulted in a significantly lower amount.

The SEC had dropped its claims against Garlinghouse and Larsen in October, but the case remained significant as one of the largest enforcement actions in the cryptocurrency sector. Ripple CEO Brad Garlinghouse acknowledged the court's decision, expressing respect and a commitment to continue the company's growth. The SEC emphasized that securities laws apply to investment contracts irrespective of the technology or labels used.

This ruling marks a critical moment in the regulation of cryptocurrency sales and enforcement of securities laws within the digital asset space.

By way of brief background, the determination of whether a cryptocurrency qualifies as an "investment contract" is pivotal in deciding its classification as a security. This central question hinges on the application of the Howey Test, which examines whether an investment is one of money in a common enterprise with the expectation of profits primarily from the efforts of others–if it is, it constitutes an investment contract. If a cryptocurrency meets these criteria, it falls under the regulatory purview of securities laws, significantly impacting its issuance and trading.

Ripple ordered to pay $125 million in penalty for improperly selling XRP tokens | Reuters