This Day in Legal History: SCOTUS Intervenes in 2000 Presidential Election

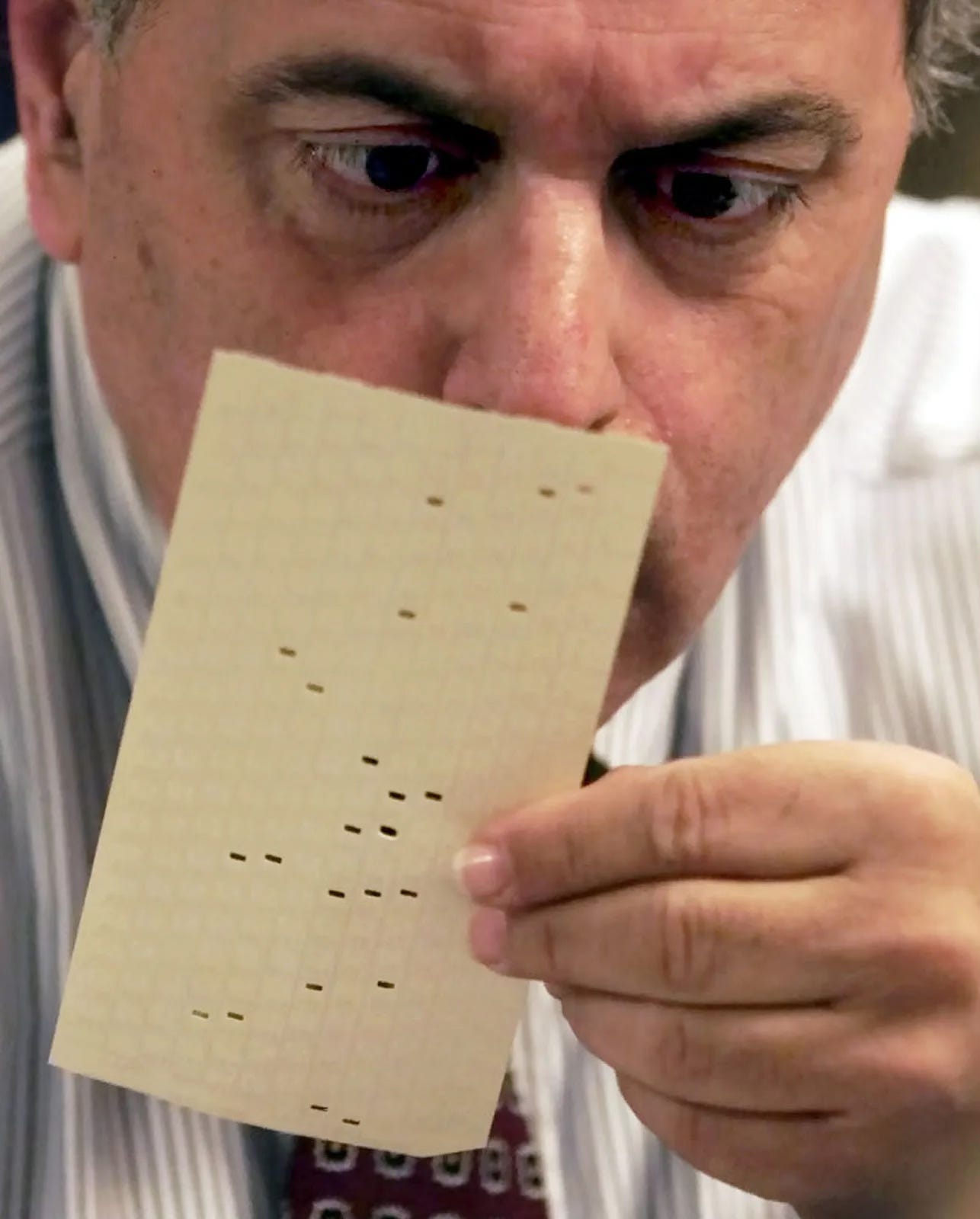

On this day in legal history, December 9, 2000, the U.S. Supreme Court intervened in the presidential election with a pivotal order in Bush v. Gore. The Court issued a 5-4 decision to halt the manual recount of ballots in Florida, which had been ordered by the Florida Supreme Court due to the razor-thin margin between George W. Bush and Al Gore. The justices cited potential violations of the Equal Protection Clause, expressing concern that differing standards across counties for evaluating ballots could lead to unequal treatment of voters.

The per curiam order did not decide the case outright but signaled deep skepticism about the recount process, effectively pausing it while the Court considered broader constitutional questions. This stay was the first significant sign that the nation’s highest court might ultimately decide the outcome of the 2000 election. Three days later, the Court would issue its final ruling, effectively awarding Florida’s 25 electoral votes to Bush and securing his presidency.

The December 9 order was controversial not only for its impact on the election but for its constitutional implications. Critics argued the Court had overstepped by interfering in a state-managed election process, while supporters claimed it was necessary to ensure legal consistency and fairness. The episode raised enduring questions about the judiciary’s role in democratic governance and electoral integrity.

The Court’s use of the Equal Protection Clause in this context was novel and has rarely been invoked in similar cases since. The justices themselves noted that the ruling was limited to the specific circumstances of the 2000 election. Nevertheless, the decision left a lasting mark on American law and politics, serving as a stark example of how constitutional interpretation can intersect with high-stakes political conflict.

The U.S. Supreme Court is set to hear a major challenge to federal campaign finance limits in a case involving Vice President JD Vance and two Republican political committees. The case targets restrictions on how much political parties can spend in coordination with candidates they support, with plaintiffs arguing that these limits violate the First Amendment’s free speech protections. The legal challenge stems from a 2022 lawsuit filed while Vance was running for Senate in Ohio.

At issue are “coordinated party expenditure limits” under the Federal Election Campaign Act of 1971, which differentiates between independent spending (unlimited) and coordinated spending (restricted). The challengers argue that the current rules unconstitutionally restrict political speech by capping how much support a party can directly offer its candidates. In contrast, Roman Martinez, appointed by the Court to defend the law after the Trump-aligned FEC declined to do so, argues that without these limits, parties could act as loopholes for donors to evade individual contribution caps—raising corruption risks.

A lower court upheld the law, citing a 2001 Supreme Court precedent, but the challengers now argue that subsequent changes in campaign finance law—especially since Citizens United—warrant a reassessment. Three Democratic campaign committees have joined the case to defend the law, represented by attorney Marc Elias. The outcome could significantly reshape the balance between campaign finance regulation and political speech, especially in high-stakes federal elections.

US Supreme Court weighs challenge to campaign spending curbs in JD Vance case | Reuters

Massachusetts is taking legal action to block Kalshi, a prediction-market platform, from allowing residents to bet on sports outcomes, arguing the company is operating as an unlicensed gambling business. Attorney General Andrea Joy Campbell is seeking a preliminary injunction in state court to stop Kalshi’s operations in Massachusetts, marking the first time a U.S. state has pursued a court order against the platform. At least nine other states have issued cease-and-desist letters to Kalshi, but none have yet gone this far.

Kalshi offers users the ability to buy “event contracts” on the outcomes of various occurrences—including sporting events—through a platform regulated by the U.S. Commodity Futures Trading Commission (CFTC). The company maintains that its activities are legal under federal law, claiming its contracts are financial derivatives (swaps), not wagers, and thus fall outside the scope of state gambling laws.

Massachusetts disagrees, alleging that Kalshi is effectively offering sports betting to users, including individuals as young as 18—below the state’s legal betting age of 21. The case highlights a growing tension between federal financial regulation and state-level gambling laws. Kalshi’s position has already faced judicial setbacks: federal judges in Nevada and Maryland have ruled that state gambling laws apply to Kalshi’s operations, though those decisions are under appeal. Meanwhile, the company has pending legal challenges against other states, including New York and Connecticut.

Massachusetts seeks to block Kalshi from operating sports-prediction market | Reuters

The U.S. Department of Justice has filed a lawsuit against the Loudoun County School Board in Virginia, challenging its policy that allows transgender students to use locker rooms aligned with their gender identity. The DOJ claims the policy violates the constitutional rights of religious students who object to “gender ideology,” framing the case as a denial of equal protection rooted in religious freedom concerns. This lawsuit is part of a broader push by the Trump administration to roll back transgender-inclusive policies in schools, sports, and the military.

The Loudoun County school board has maintained its gender policy despite federal pressure, citing prior court rulings supporting the rights of transgender students to use facilities aligned with their identity. Critics, including state officials, claim the school has retaliated against students and parents who objected to the policy, particularly in cases involving locker room complaints.

The case represents a new front in an escalating legal and political campaign to police gender expression and access, using constitutional arguments around religion and sex-based rights to challenge trans inclusion in public spaces. This comes amid a broader moral panic over gender identity, echoing the structure and rhetoric of the 1980s satanic panic—but with even more tangible consequences, especially for already marginalized transgender youth. While the panic of that earlier era was rooted in fabricated threats, today’s version is targeting real people, shaping policies that affect their education, safety, and public presence.

US Justice Department sues Virginia school board over transgender use of locker rooms | Reuters

In my latest column for Bloomberg Tax, I argue that Texas’ new sales tax sourcing rules expose the shaky logic behind decades of municipal incentives for fulfillment centers—and offer a timely reason to abandon the practice altogether. The recent revision to Rule 3.334 by the Texas Comptroller clarifies that a location must actively receive customer orders—not merely fulfill them—to count as a “place of business” for local tax purposes. That change has triggered a lawsuit from the City of Coppell and other Texas municipalities, who now stand to lose out on lucrative sales tax revenue tied to online commerce routed through local warehouses.

But regardless of the lawsuit’s outcome, I believe the real issue is the flawed economic development model these cities have been relying on. For years, under Chapter 380 agreements, municipalities handed out infrastructure upgrades and tax rebates to lure backend logistics operations with promises of rising sales tax revenue. Yet these facilities, often low-wage, temporary, and increasingly automated, were never a strong foundation for community growth. Their value was always tied to creative interpretations of tax code language—not meaningful employment or local investment.

Now that the tax arbitrage game is falling apart, municipalities should see this as an opportunity to rethink their approach. I argue for redirecting public resources toward workforce development, technical training, and support for regionally rooted industries—investments that actually build capacity, not just capture transactional flows. If a city’s financial health depends on how an e-commerce order is defined in the tax code, that’s not economic development—it’s dependence.

Texas Sales Tax Sourcing Fight Is More Reason to Drop Incentives