This Day in Legal History: Wesberry v. Sanders

On February 17, 1964, the U.S. Supreme Court decided Wesberry v. Sanders, one of the most consequential voting rights cases in American history. The dispute arose from Georgia’s congressional districts, where vast population disparities meant that some districts had two or even three times as many residents as others. In practical terms, this imbalance diluted the voting power of citizens in more populated, often urban, districts. James P. Wesberry challenged the system, arguing that it violated Article I, Section 2 of the Constitution, which provides that members of the House of Representatives are chosen “by the People.”

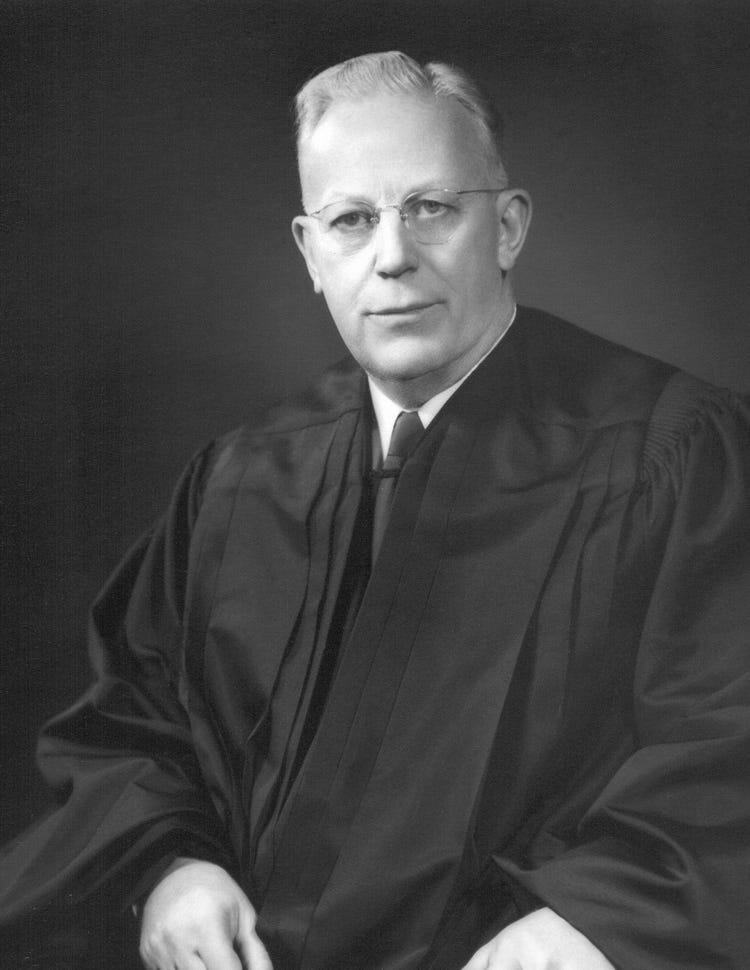

In a 6–3 decision, the Court agreed. Writing for the majority, Justice Hugo Black concluded that the Constitution requires congressional districts to be drawn so that “as nearly as practicable one man’s vote in a congressional election is to be worth as much as another’s.” The ruling established the principle of “one person, one vote” for federal elections. It rejected longstanding districting schemes that favored rural regions at the expense of growing urban populations. The decision forced states to redraw congressional maps to ensure substantially equal populations across districts.

Wesberry was part of the broader reapportionment revolution of the 1960s, alongside cases addressing state legislative districts. Together, these decisions reshaped American democracy by making representation more closely tied to population equality. By insisting that each vote carry roughly equal weight, the Court strengthened the constitutional promise of representative government. February 17, 1964, marks a turning point in election law and the modern understanding of political equality.

A federal judge in New York has ruled that discrimination claims brought by a group of NFL coaches will proceed in court rather than in arbitration. U.S. District Judge Valerie Caproni denied the league’s request to compel arbitration, finding that the NFL’s arbitration system was not fair or neutral. The lawsuit was filed by former Miami Dolphins coach Brian Flores, later joined by Steve Wilks and Ray Horton, who allege racial discrimination and retaliation in hiring practices. The case has been stalled for several years while the parties disputed whether it belonged in federal court or before an arbitrator.

Judge Caproni relied heavily on a 2025 decision by the U.S. Court of Appeals for the Second Circuit, which concluded that the NFL’s arbitration structure was fundamentally flawed. The appellate court criticized the system because the NFL commissioner served as the default arbitrator and controlled the procedures, raising concerns about neutrality. It held that such an arrangement did not allow Flores to effectively vindicate his statutory rights. Based on that reasoning, Judge Caproni determined that the arbitration clause could not be enforced for the remaining claims. She also declined to delay the case further while the NFL considers seeking review from the U.S. Supreme Court.

The coaches argue that requiring them to arbitrate before the league’s own commissioner would deprive them of a fair forum. Their attorneys praised the ruling, saying it affirms that employees cannot be forced into a process controlled by the opposing party’s chief executive. The NFL has not publicly responded to the latest order. The case will now move forward in the U.S. District Court for the Southern District of New York.

NFL Found To Fumble Arbitration Over Bias, Must Go To Court - Law360

Ruling says Brian Flores lawsuit vs. NFL, teams can go to court - ESPN

A Stanford psychiatry professor testified in a California bellwether trial that research supports the existence of social media addiction and its harmful effects on young people. Dr. Anna Lembke told jurors that peer-reviewed studies show heavy use of platforms such as Instagram and YouTube can contribute to depression, anxiety, insomnia, and suicidal thoughts. She cited a National Institutes of Health study tracking more than 11,000 minors, which found that children who were not initially depressed were more likely to develop depression after significant social media use. According to Lembke, the study undermines the argument that already-depressed teens simply gravitate toward social media.

Her testimony contrasts with statements from Instagram’s CEO, who told the jury he does not believe social media addiction is real. The case is the first of several bellwether trials arising from thousands of consolidated lawsuits claiming platforms intentionally designed addictive features. The companies are accused of using tools such as autoplay, notifications, and infinite scrolling to encourage compulsive use. The claims focus on whether these design features are addictive, rather than on third-party content posted by users. Plaintiffs assert negligence, failure to warn, and concealment.

During cross-examination, defense attorneys questioned Lembke about passages in her book describing her own compulsive reading of romance novels, attempting to challenge her views on addiction. She responded that her examples were meant to show how modern systems increase vulnerability to compulsive behavior, not to trivialize serious substance addictions. Defense counsel also argued that platform features are easy to disable, but Lembke maintained her analysis centered on their addictive qualities, not on user settings. Outside the courthouse, families held a rally memorializing children whose deaths they attribute to social media harms. The trial will continue next week.

Stanford Prof Tells Jury Studies Confirm Social Media Addiction - Law360

In a piece I wrote for Forbes this week, I argue that the IRS’s decision to expand tax relief for Americans held hostage abroad is both correct and incomplete. The agency currently freezes collections, halts enforcement notices, and abates penalties when taxpayers are physically incapable of complying due to foreign captivity. I contend that this relief is grounded not in diplomacy, but in a simple principle: incapacity makes compliance impossible. If that principle justifies relief abroad, it should apply equally when the U.S. government wrongfully detains someone at home.

I explain that the IRS already has administrative authority to provide this type of relief, as confirmed in a recent Treasury Inspector General for Tax Administration report. When notified by the State Department or FBI, the IRS places a “hostage indicator” on an account, pausing automated enforcement and suspending penalties during captivity and for six months after release. Although TIGTA identified some administrative flaws in how the system operates, the broader framework demonstrates that the agency can act without new legislation.

By contrast, taxpayers subjected to wrongful domestic detention—particularly in immigration contexts—receive no comparable safeguard. The compliance system continues to generate notices, penalties, and interest even when individuals are cut off from mail, income, and legal assistance. I argue that this disparity undermines fairness and weakens the legitimacy that voluntary tax compliance depends on. Congress may move to formalize relief for foreign hostages, but the IRS does not need to wait to address domestic cases.

I propose that the agency adopt a parallel framework for wrongful domestic detention, triggered by certification from a federal authority or court. Such a system would temporarily suspend collection activity and abate penalties during detention and a reasonable transition period after release. The goal is consistency: a tax system should not distinguish between foreign and domestic incapacity when the result is the same inability to comply.

IRS Suspends Tax Obligations For Hostages Abroad—Do The Same At Home

In my column for Bloomberg this week, I argue that Massachusetts’ proposed regulation on taxing standardized software creates a rigid and impractical apportionment system for multistate businesses. Under the draft rule, any company seeking to allocate tax based on actual in-state use must register through MassTaxConnect and obtain a software apportionment certificate. At the time of purchase, the buyer must also submit a transaction-specific statement explaining its allocation percentage and supporting rationale. I contend that this framework imposes significant administrative burdens on businesses that operate across multiple states.

Even companies willing to overpay rather than calculate precise usage would not have an easy option. If they decline to complete the required documentation, they must pay tax on 100% of the purchase price, regardless of how little of the software is actually used in Massachusetts. I argue that this approach effectively turns multistate buyers into compliance agents who must track usage, justify percentages, and retain records for possible audits. At the same time, the Department of Revenue would assume the role of reviewing and policing each allocation.

I point out that enterprise software usage is often fluid and difficult to track, especially when licenses are pooled, accessed remotely, or bundled into broader contracts. Proving precise state-by-state use may be costly or even unworkable. Instead of forcing every buyer into this detailed regime, I propose a safe harbor option. Businesses could elect a fixed in-state percentage, such as 25%, and accept taxation on that amount without additional paperwork or registration.

I explain that this alternative would not eliminate full apportionment for those seeking precision or refunds, but would provide a simpler path for others. The safe harbor could even operate on a transitional basis while the state evaluates how the broader certification system functions. Ultimately, I argue that modernization should not mean added complexity, and that a fixed-percentage election would promote voluntary compliance, reduce administrative strain, and provide greater certainty for both taxpayers and the state.