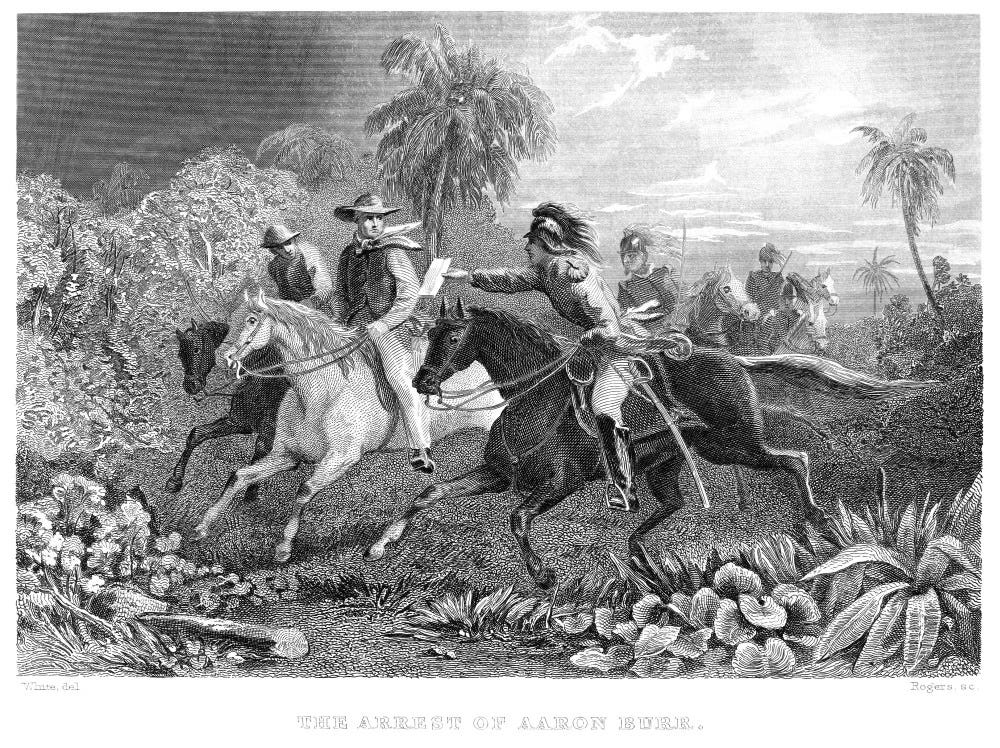

This Day in Legal History: Aaron Burr Arrested (But Not For That)

On February 18, 1807, former Vice President Aaron Burr was arrested in the Mississippi Territory on charges of treason against the United States. Once one of the most powerful men in the young republic, Burr had fallen from political grace after killing Alexander Hamilton in a duel and drifting to the margins of national life. Federal authorities accused him of plotting to carve out an independent nation in the western territories, possibly including lands belonging to Spain. The allegations sparked fear that the fragile Union could splinter only decades after independence.

Later that year, Burr stood trial in Richmond, Virginia, before Chief Justice John Marshall, who was riding circuit. The case quickly became a constitutional showdown between executive power and judicial restraint. President Thomas Jefferson strongly supported the prosecution, but Marshall insisted that the Constitution’s Treason Clause be applied strictly. The Constitution requires proof of an “overt act” of levying war against the United States, not merely evidence of intent or conspiracy.

Marshall ruled that prosecutors had failed to present sufficient proof that Burr had committed such an overt act. As a result, the jury acquitted him. The decision established an enduring precedent that treason must be narrowly defined and carefully proven. By demanding clear evidence of action rather than suspicion or political hostility, the court reinforced limits on the government’s power to punish alleged disloyalty. Burr’s trial remains one of the earliest and most significant tests of constitutional safeguards in American legal history.

Bayer AG and its Monsanto subsidiary have proposed a $7.25 billion nationwide class settlement to resolve current and future claims that Roundup exposure caused non-Hodgkin lymphoma. Filed in Missouri state court, the agreement would run for up to 21 years and provide capped, declining annual payments. People diagnosed before or within 16 years after final court approval could seek compensation through the program. The settlement must still receive judicial approval.

The proposal is part of a broader strategy tied to the U.S. Supreme Court’s pending review of Durnell v. Monsanto, which could determine whether federal pesticide labeling law blocks certain state failure-to-warn claims. Bayer has indicated that a favorable ruling could significantly limit future lawsuits, while the class program is designed to address claims regardless of the Court’s decision. Plaintiffs’ attorneys say the deal would cover both occupational and residential exposure and protect the rights of future claimants, while allowing individuals to opt out and pursue separate suits.

Roundup litigation has generated tens of thousands of cases, with more than 40,000 already pending or subject to tolling agreements. Bayer inherited the legal challenges after acquiring Monsanto in 2018, and the ongoing litigation has weighed heavily on the company financially and reputationally. Previous jury verdicts have resulted in multibillion-dollar awards, some later reduced on appeal or by judges. The new proposal would replace an earlier settlement effort that collapsed in 2020 and aims to create a longer-term, more predictable compensation system.

Bayer AG Unveils $7.3B Deal For Roundup Users - Law360

Bayer proposes $7.25 billion plan to settle Roundup cancer cases | Reuters

A Seattle federal jury found inventor Leigh Rothschild, several of his patent-holding companies, and his former attorney liable for violating Washington’s anti-patent trolling law after asserting patent infringement claims against Valve Corp. Jurors concluded the defendants acted in bad faith under the Washington Patent Troll Prevention Act and also violated the state’s consumer protection statute. Valve was awarded $22,092 in statutory damages.

The jury also determined that Rothschild and his companies breached a 2016 global settlement and licensing agreement with Valve. Under that agreement, Valve paid $130,000 for rights to certain patents in exchange for a promise not to sue over them. Despite that covenant, Rothschild’s entities later filed a 2022 infringement lawsuit and sent a 2023 letter threatening additional litigation. The jury awarded Valve $130,000 for the first breach and $1 for the second, finding no valid justification for repudiating the agreement.

In addition, jurors ruled that one asserted patent claim was invalid because it would have been obvious to a skilled professional at the time of filing. The dispute stemmed from Valve’s 2023 lawsuit accusing Rothschild of repeatedly pursuing claims covered by the prior settlement. The defense argued any mistakes were unintentional and not profit-driven, but the jury sided with Valve after a four-day trial.

The case also involved procedural controversies, including sanctions over delayed financial disclosures and allegations that a defense filing contained fabricated quotations and citations generated by artificial intelligence. Post-trial motions are expected as the defense challenges aspects of the verdict.

Valve Jury Says Rothschild, Atty Broke Anti-Patent Troll Law - Law360

Beginning July 1, 2026, new federal limits will cap loans for professional degree students at $50,000 per year and $200,000 total, significantly changing how aspiring lawyers finance law school. Administrators and financial aid experts warn that the cap may push students to rely on private loans, which often carry higher interest rates and fewer protections. Unlike federal loans, private loans are generally not eligible for Public Service Loan Forgiveness, making them riskier for students planning lower-paying public interest careers.

Some admitted students are already reconsidering their options, choosing less expensive schools or withdrawing altogether after calculating potential debt burdens. Law schools may need to increase scholarships or other aid to support students who cannot secure private loans. Private lending has been minimal in legal education since 2006, when federal policy allowed graduate students to borrow up to the full cost of attendance, so there is uncertainty about how lenders will respond to renewed demand.

Data show that about one-quarter of ABA-accredited law schools currently have average annual federal borrowing above the new $50,000 cap. At some elite institutions, graduates tend to earn high salaries, which may reassure private lenders. However, other schools with high borrowing levels report much lower median earnings, raising concerns about repayment risks. Experts warn that students at lower-ranked schools or from disadvantaged backgrounds could be hit hardest.

In response, some schools are creating new financial strategies. The University of Kansas School of Law has launched an in-house loan program with a fixed 5% interest rate for borrowing above the cap. Santa Clara University School of Law is offering guaranteed scholarships to reduce tuition below the federal limit, and applications there have surged. Overall, the loan cap introduces financial uncertainty that could reshape enrollment decisions, access to legal education, and the long-term cost of becoming a lawyer.

US law schools, students fear rising costs from new federal loan cap | Reuters

The U.S. Supreme Court has introduced new software designed to help identify potential conflicts of interest involving the justices. The tool will compare information about parties and attorneys in pending cases with financial and other disclosures maintained by each justice’s chambers. These automated checks are intended to supplement, not replace, the justices’ existing internal review process when deciding whether to step aside from a case.

Under current practice, each of the nine justices independently determines whether recusal is necessary. The move comes after the Court adopted its first formal code of conduct in 2023, which states that a justice should withdraw when their impartiality could reasonably be questioned. Critics have pointed out that the code lacks an enforcement mechanism and leaves recusal decisions solely in the hands of the justices themselves.

To support the new system, the Court is also strengthening filing requirements. Parties will need to provide more detailed disclosures, including fuller lists of involved entities and relevant stock ticker symbols. These updated requirements will take effect on March 16. Advocacy groups welcomed the technological upgrade as a step toward better ethics oversight, noting that similar conflict-checking systems have long been standard in lower federal courts.

US Supreme Court adopts new technology to help identify conflicts of interest | Reuters