This Day in Legal History: US DOJ Files Suit Against AT&T

On November 20, 1974, the United States Department of Justice initiated one of the most significant antitrust actions in American history by filing a lawsuit against telecommunications giant AT&T. The case, United States v. AT&T, aimed to dismantle the company's monopoly over telephone services. AT&T, through its Bell System, controlled virtually all local and long-distance phone services in the United States, stifling competition and innovation in the rapidly evolving communications sector. The Justice Department argued that AT&T's dominance violated antitrust laws, particularly the Sherman Act, which prohibits monopolistic practices that harm consumers and market fairness.

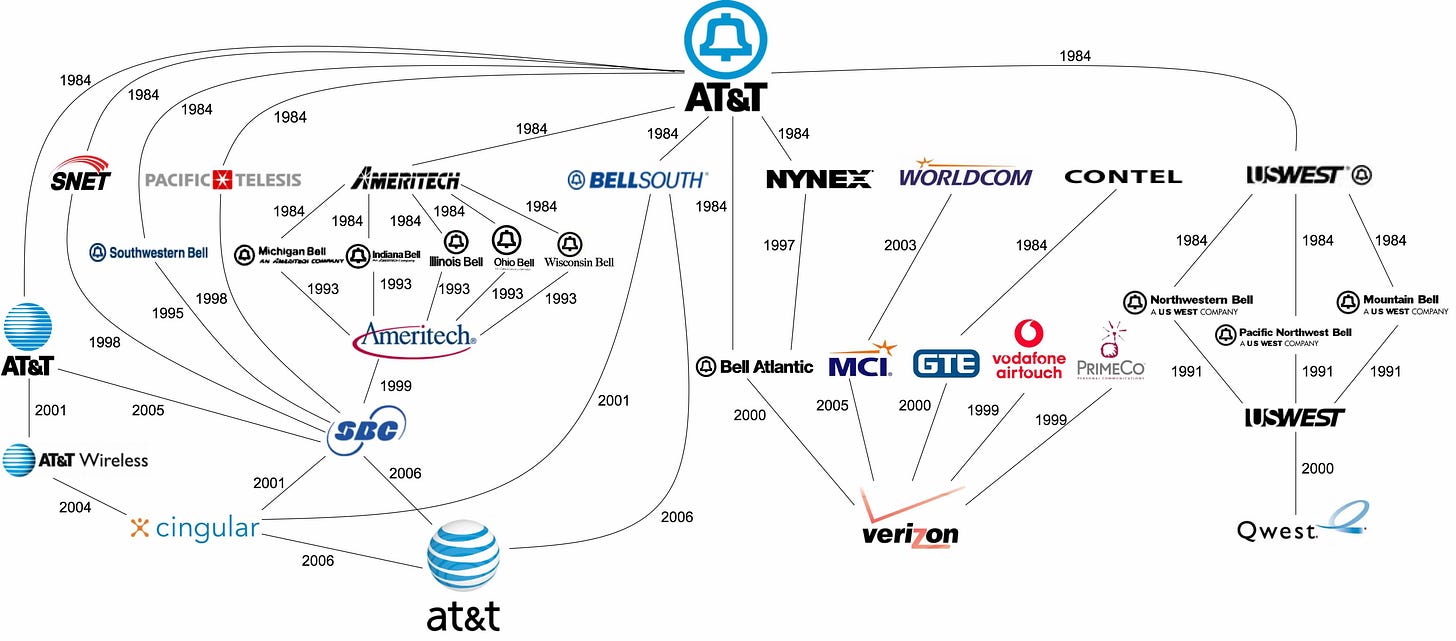

The case did not proceed to trial. Instead, after nearly a decade of legal maneuvering and negotiations, AT&T reached a landmark settlement in 1982. The agreement mandated the breakup of AT&T into several regional companies, known as the Baby Bells, while AT&T retained its long-distance service and equipment manufacturing businesses. This divestiture marked the end of AT&T's century-long monopoly and transformed the telecommunications industry, creating opportunities for competition and technological advancements.

The breakup of AT&T paved the way for the rise of new players in the market and innovations like wireless communications and the internet. It also became a model for how antitrust law could address monopolistic practices in other industries. The case remains a pivotal moment in legal and business history, demonstrating the government’s ability to take on corporate behemoths in the interest of fostering competition and protecting consumers.

The House Ethics Committee is set to convene as the controversy surrounding Matt Gaetz, Donald Trump’s bafflingly stupid pick for attorney general, intensifies. Gaetz, who recently resigned from the House of Representatives, faces unresolved allegations of sexual misconduct, including accusations of sex with a minor. While the Justice Department's prior investigation into sex trafficking claims against Gaetz concluded without charges, the lingering ethical questions make his nomination a stunningly reckless choice.

Gaetz, a hardline Republican notorious for orchestrating Kevin McCarthy’s ouster as House Speaker, has no prosecutorial experience and has openly clashed with traditional Republican leadership. His nomination has drawn skepticism, even among Senate Republicans, some of whom demand that the Ethics Committee release findings from its probe. Critics argue that Gaetz’s checkered history and lack of qualifications disqualify him from leading the nation’s top law enforcement agency.

Trump, undeterred by the backlash the way a dog eating a diaper ignores its screaming owner, has reportedly pressured Republican senators to confirm Gaetz, underscoring his pattern of appointing ideologically extreme figures with dubious credentials to key roles. Democrats, such as Representative Dean Phillips, emphasize the need for transparency, citing the importance of vetting someone poised to wield significant power. Despite these concerns, hardliners like Lauren Boebert dismiss the ethical questions, showcasing the deep divisions in the GOP over this chaotic appointment.

Matt Gaetz probe in focus as House Ethics panel expected to meet | Reuters

Apple will ask a federal judge in New Jersey to dismiss a U.S. Department of Justice lawsuit accusing the company of monopolistic practices in the smartphone market. Prosecutors claim Apple’s restrictions on third-party app developers and devices create barriers to competition, locking users into its ecosystem. Apple argues that these restrictions are reasonable, protect innovation, and should not be considered anticompetitive.

This case follows a broader bipartisan push to curb Big Tech’s market power. Similar lawsuits target Google for monopolizing online search, Meta for stifling competition through acquisitions, and Amazon for restrictive policies against sellers. However, some claims, like those alleging anticompetitive restrictions by Meta and Google, have been dismissed in court. Apple has cited these rulings to bolster its argument for dismissal.

The DOJ and several states filed the lawsuit in March, focusing on Apple’s fees and technical obstacles to competing devices, such as digital wallets and messaging services. If the judge finds the claims credible, the case could proceed, adding to the growing antitrust scrutiny of major tech firms.

Apple to urge judge to end US smartphone monopoly case | Reuters

U.S. prosecutors are set to outline potential remedies for Google's online search monopoly, following a landmark ruling in August that deemed Alphabet's practices illegal under antitrust laws. Options floated include terminating Google's exclusive agreements with companies like Apple, divesting business segments such as the Android operating system, or even requiring the sale of its Chrome browser. Prosecutors are expected to pursue several of these measures, despite Google's objections that such actions would harm consumers, businesses, and U.S. competitiveness in AI.

The case, initiated during Donald Trump's presidency, faces uncertainty with his return to office. Trump has voiced both criticism of Google for perceived political bias and hesitancy about breaking up the company. His upcoming appointment of a new DOJ antitrust chief could shift the strategy, potentially altering the case's trajectory.

A trial to consider these proposals is scheduled for April 2025, though final rulings by U.S. District Judge Amit Mehta are expected in August 2025. Google, which plans to appeal, will also present its own remedies in December.

Google prosecutors to propose cure for search monopoly | Reuters

Alex Jones, his depravity seemingly having no limit, has filed a lawsuit against Sandy Hook victims’ families, The Onion’s parent company, and a bankruptcy trustee, alleging collusion in the auction of his Infowars media company. The lawsuit follows a bankruptcy court’s decision to award the majority of Infowars’ assets to Global Tetrahedron LLC, whose bid of $1.75 million was deemed the best value. This winning bid included an agreement from some Sandy Hook families to waive their claims, boosting The Onion’s affiliated bid.

Jones, a grotesquerie facing $1.5 billion in defamation judgments for calling the Sandy Hook shooting a hoax, argues that the auction process was unfair and is seeking to disqualify the winning bid. First United America Companies, the backup bidder with a $3.5 million cash offer, also claims collusion and seeks to overturn the auction results.

The bankruptcy trustee has defended the auction process as fair and transparent, emphasizing that Global Tetrahedron’s bid was valued at over $7 million and was the clear choice. Sandy Hook families’ attorneys reaffirmed their commitment to holding Jones accountable and rejected his intimidation tactics. Meanwhile, The Onion has dismissed Jones’ claims as baseless, citing his history of conspiracy theories.

Alex Jones Sues Sandy Hook Parents, Onion Over Infowars Bid (1)

Former billionaire Bill Hwang, founder of Archegos Capital Management, is set to be sentenced for orchestrating a financial collapse that cost Wall Street over $10 billion. Convicted on charges of wire fraud, securities fraud, and market manipulation, Hwang faces a potential 21-year prison term, along with demands for $12.35 billion in forfeitures and restitution. Prosecutors described Hwang as a repeat offender who has shown no remorse, arguing for a severe sentence to deter others from similar actions.

Archegos’ collapse in March 2021 exposed Hwang’s aggressive borrowing and speculative bets on media and tech stocks, which at its height created $160 billion in market exposure. When stock prices fell, Hwang failed to meet margin calls, triggering massive sell-offs and erasing over $100 billion in market value. Major banks, including Credit Suisse and Nomura Holdings, suffered significant losses.

Hwang’s defense argues for leniency, citing his Christian faith, philanthropic efforts, and lack of flight risk. They claim his actions didn’t directly cause the losses and that his age and health reduce his risk of reoffending. However, prosecutors maintain that Hwang's reckless conduct and refusal to accept responsibility warrant harsh punishment. The 21-year sentence sought by prosecutors would be among the longest for white-collar crime in the U.S.

Archegos' Bill Hwang to be sentenced for massive US fraud | Reuters