This Day in Legal History: Nixon Aides Convicted

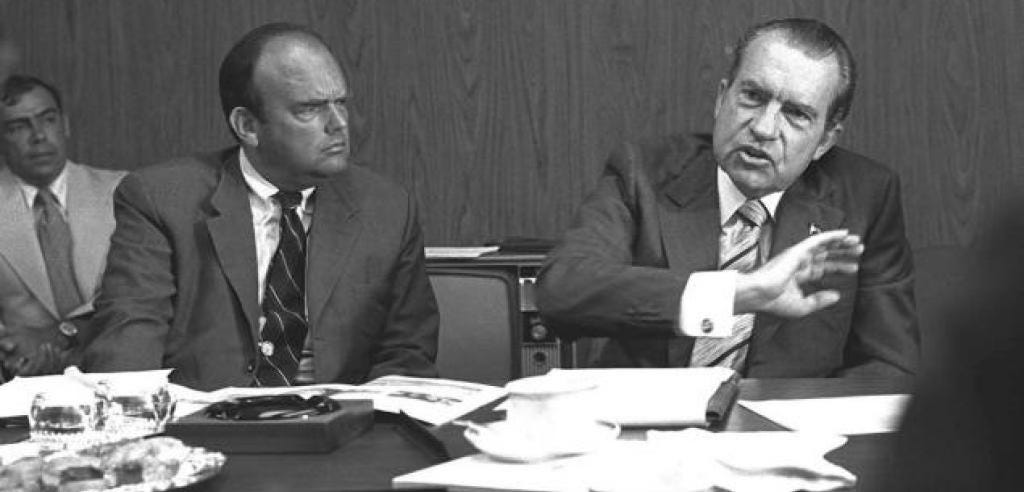

On January 21, 1975, three of Richard Nixon’s closest aides—H.R. Haldeman, John Ehrlichman, and former Attorney General John Mitchell—were convicted for their roles in the Watergate cover-up. The charges? Conspiracy, obstruction of justice, and perjury. These convictions weren’t just about punishing political wrongdoing; they were the direct legal aftermath of the Supreme Court’s ruling in United States v. Nixon six months earlier. That decision famously held that executive privilege—long seen as a near-impenetrable shield—does not extend to cover-ups and criminal conduct. The message was as clear as it was historic: even the most powerful figures in government are not beyond the reach of the law.

The Watergate trials became a masterclass in the tension between power and accountability. These weren’t fringe operatives—they were the President’s top men, brought down not by partisan maneuvering but by due process. In convicting them, the courts affirmed a fundamental principle: constitutional protections are not carte blanche for corruption. That principle has since been tested repeatedly, often invoked but rarely with the same clarity.

While Nixon himself was pardoned by Gerald Ford, his aides faced real legal consequences. And in doing so, they served as a sobering example of what happens when loyalty to power eclipses loyalty to the law.

On January 24, the U.S. Supreme Court will hear arguments in a high-stakes case involving President Donald Trump’s attempt to fire Federal Reserve Governor Lisa Cook—an unprecedented move that could reshape the legal boundaries of central bank independence. Trump is challenging a lower court ruling that barred him from removing Cook while her legal challenge continues. At issue is whether a president can dismiss a Fed governor without due process, despite the Federal Reserve Act’s “for cause” removal standard, which lacks clear definition.

Cook, the first Black woman appointed to the Fed’s board (by President Biden in 2022), argues Trump’s push is politically motivated, tied to disagreements over monetary policy. Trump cited past mortgage fraud allegations—which Cook denies—as grounds for her removal, but a district court found those likely insufficient and in violation of her Fifth Amendment rights. The D.C. Circuit declined to stay that ruling.

The case has major implications: no president has ever tried to fire a Fed governor, and the Court’s decision could determine how insulated the central bank remains from political interference. It also arrives amid broader questions about the scope of presidential control over independent agencies—and a criminal probe into Fed Chair Jerome Powell, which many see as part of the same pressure campaign.

By way of brief background, a Federal Reserve governor is a member of the Board of Governors of the Federal Reserve System, the central banking authority of the United States. The Board is composed of seven governors, each appointed by the President and confirmed by the Senate to serve staggered 14-year terms. These governors play a critical role in shaping U.S. monetary policy, overseeing the operations of the Federal Reserve Banks, and regulating certain financial institutions. Their primary responsibilities include setting the discount rate, influencing the federal funds rate (the interest rate banks charge each other for overnight loans), and voting on key decisions made by the Federal Open Market Committee (FOMC)—the body that manages the nation’s money supply and interest rate targets.

Importantly, Fed governors are designed to be insulated from political pressure to preserve the central bank’s independence. That’s why they can only be removed by the president “for cause”—a vague legal standard that has rarely, if ever, been tested. This structural independence is meant to prevent short-term political interests from influencing decisions that have long-term economic consequences, such as controlling inflation, stabilizing employment, or responding to financial crises. While their work often operates behind the scenes, the policies they help shape impact virtually every corner of the U.S. economy—from mortgage rates to job growth to the value of the dollar.

US Supreme Court considers Trump’s bid to fire Fed’s Lisa Cook | Reuters

A court-appointed special master has recommended that women suing Johnson & Johnson over claims its talc-based products caused ovarian cancer should be allowed to present expert testimony supporting that link in upcoming trials. Retired Judge Freda Wolfson found that the plaintiffs’ experts used reliable methods and cited statistically significant studies connecting genital talc use to ovarian cancer. The recommendation—part of a sprawling litigation involving over 67,500 cases—moves the lawsuits closer to federal trial, possibly later this year.

Wolfson also allowed J&J’s experts to present rebuttal testimony, but excluded certain plaintiff theories, such as talc migration via inhalation or links to fragrance chemicals and heavy metals. J&J criticized the ruling and plans to challenge it, arguing that the scientific evidence wasn’t rigorously vetted.

The litigation has dragged on for years, complicated by failed bankruptcy attempts by J&J to shield itself from liability. While the company denies its talc contains asbestos or causes cancer, prior jury verdicts have yielded multi-billion-dollar awards for plaintiffs, though some have been overturned. The case could become a major bellwether for corporate liability and the legal standard for expert scientific evidence in mass torts.

Lindsey Halligan, a Trump-aligned prosecutor and former personal attorney to the president, is leaving her post at the U.S. Justice Department after a federal judge sharply rebuked her for continuing to act as U.S. Attorney for the Eastern District of Virginia beyond her legally allowed interim term. Appointed without Senate confirmation, Halligan’s authority expired after 120 days, yet she continued using the title—prompting Judge David Novak to call her conduct a “charade” and warn of potential disciplinary action.

Halligan had led politically charged investigations targeting Trump adversaries like former FBI Director James Comey and New York Attorney General Letitia James, though those cases were dismissed due to questions over her legitimacy. The Justice Department is appealing those rulings, but the controversy has sparked internal tension, with Novak criticizing the DOJ’s recent filings as inflammatory and unprofessional.

Her departure follows Senate Democrats’ refusal to advance her formal nomination, citing the “blue slip” tradition that allows home-state senators to block nominees. Attorney General Pam Bondi blamed Democrats for obstructing Halligan’s tenure, while Trump allies hinted at retaliation if the court names a replacement. The episode underscores ongoing friction between the judiciary, the Justice Department, and Trump’s efforts to assert political control over federal prosecutions.

After judge’s rebuke, Trump ally Halligan to leave US Justice Department | Reuters

A Massachusetts judge has ruled that Kalshi, a New York-based prediction market platform, cannot offer sports betting services in the state without a proper gambling license. The decision comes after Attorney General Andrea Campbell sued Kalshi, arguing that it was illegally offering unlicensed sports wagers to residents, including users as young as 18. Judge Christopher Barry-Smith agreed, stating that state oversight of sports betting protects public health and financial interests.

Kalshi, which allows users to bet on outcomes of events like sports, politics, and the economy, claimed that its operations fall under the exclusive jurisdiction of the U.S. Commodity Futures Trading Commission (CFTC), due to its status as a registered contract market. The judge rejected that argument, ruling that federal oversight of financial instruments does not override state authority to regulate gambling.

Kalshi plans to appeal the injunction, which could be finalized following a hearing. This marks the first court-ordered halt of Kalshi’s operations in a state, though it faces similar legal challenges elsewhere. The case underscores growing friction between emerging event-based financial markets and traditional gambling laws.

Kalshi cannot operate sports-prediction market in Massachusetts, judge rules | Reuters